Stablecoins extend winning streak in December

- The stablecoin market cap was well on track to rise further in December.

- USDT’s market cap stormed past $90 billion in December, setting a new ATH.

Stablecoins are the backbone of the digital asset market, and they are often seen as having the best chance of replicating or even replacing traditional currencies.

An increase in stablecoin supply typically suggests increasing capital inflows into the crypto market. This is because most traders from traditional markets would use stablecoins to enter and exit trades on crypto exchanges.

To put it simply, stablecoins help in assessing how bullish the sentiment is for cryptos in general.

Stablecoins continue to ascend

According to the latest report by digital assets market data provider CCData, the total stablecoin marketcap rose 0.9% to $129 billion as of the 18th of December, the highest in seven months.

The market cap was well on track to rise further in December as demand for other top cryptos continued to soar.

Bitcoin [BTC] pushed to the north of $43,000 while the altcoin rally was led by Solana [SOL] and Avalanche [AVAX], both of which recorded double-digit gains in the last 24 hours, AMBCrypto spotted using CoinMarketCap’s data.

However, due to the surge in the market value of other cryptos, the stablecoin market share fell to 8.32% in December, compared to 8.92% in November.

The demand for stablecoins was also reflected in the surge in trading volumes on centralized exchanges.

As of the 18th of December, $557 billion in stablecoins had been exchanged throughout the month, with the figure anticipated to surpass November’s total of $782 billion.

How did the big boys perform?

Being the largest stablecoin, Tether [USDT] is considered a bellwether for stablecoin sentiment in the market.

USDT’s market cap stormed past $90 billion in December, setting a new all-time high (ATH). With the latest move up, the king of the stablecoins recorded its fourth straight month of market value growth.

AMBCrypto’s further scrutiny of the data revealed a 16% growth in USDT’s market cap year-to-date (YTD). In predominantly bear market conditions, this was a significant achievement.

USDT solidified its position with more than 70% market share, the highest since January 2021.

Meanwhile, the second-largest stablecoin, USD Coin [USDC], stagnated. Its market cap has hovered just above the $20 billion mark in December.

The past year has turned out to be a forgettable one for the asset. Events like the March banking crisis caused severe downsides. Since the beginning of the year, USDC lost 45% of its market capitalization as of this writing.

USDC’s woes triggered a domino effect on the algorithmic stablecoin DAI. This was because USDC formed the majority of its collateral reserves.

As a result, DAI has been trapped in a similar rut, averaging a market cap of a little over $5 billion for the last three months.

BUSD makes way for FDUSD

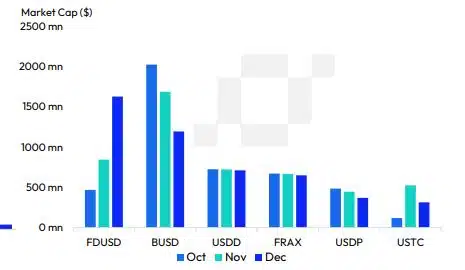

The report also drew attention to the emergence of First Digital USD [FDUSD]. The Binance [BNB]-backed stablecoin has taken giant strides since its debut on the exchange in July.

As shown below, the market capitalization of the FDUSD has nearly tripled in the last three months, reaching well over a billion at the time the report was issued.

A big credit to the rise goes to Binance’s popular zero fee trading program, which slashed maker and taker fees for practically all spot trading pairs.

Interestingly, FDUSD scooped a big portion of the market share from another Binance-related stablecoin, Binance USD [BUSD]. BUSD’s growth trajectory resembled a perfect mirror image of FDUSD, falling sharply in the last quarter.

Note that BUSD was in a phasing-out stage, with Binance dissociating from the asset since regulatory concerns surfaced earlier in the year.

Is it too early to celebrate?

All said and done, the overall value of stablecoins has failed to increase appreciably despite the market pump. The $129 billion market cap as highlighted earlier was still low in comparison to $139 billion in December 2022.

Moreover, in one of the recent articles, AMBCrypto highlighted a rather slow flight of stablecoins towards exchanges lately. This gave rise to theories that the ongoing rally was not powered by capital from the traditional market.