Surmising Bitcoin’s price movement in coming days, as it surpasses $50,000

Bitcoin crossing $50k has been the most anticipated moment this month, since recovery from there on would be the only sign of a positive rally going into 2022. However, investors still remain slightly cautious, since a bullish rally has not been declared yet.

Bitcoin back to $50k

The news of Senator Lummis’ intentions of introducing a new comprehensive bill next year, which would provide a rundown of how digital assets can be taxed and categorized, had a significant impact on the king coin yesterday.

As prices went up by 5%, BTC finally reclaimed its critical support of $50k. Interestingly this event, for the first time in a while, invoked optimism in the investors.

Bitcoin price action | Source: TradingView – AMBCrypto

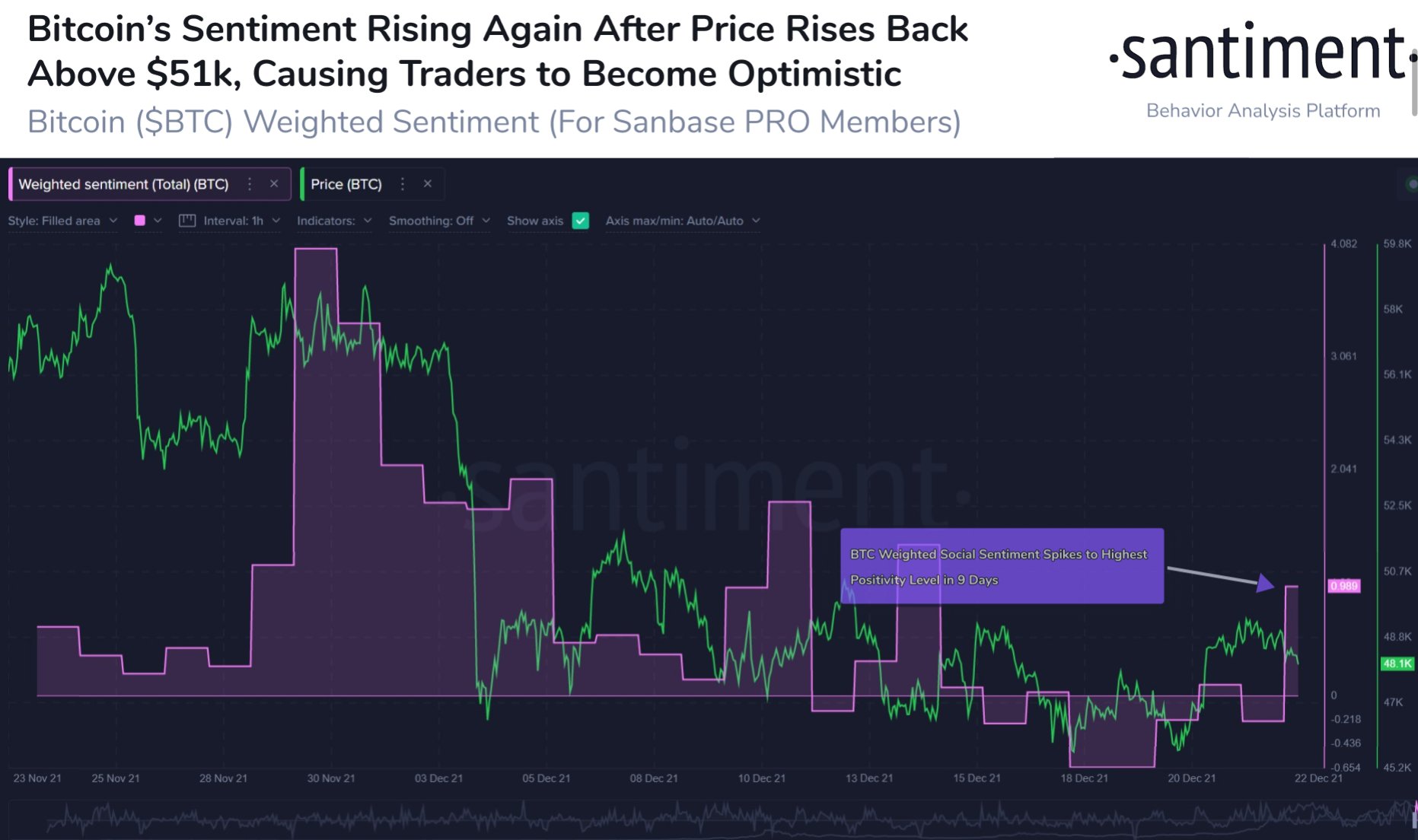

The falling prices over the last couple of days had created an atmosphere of concern but after yesterday, for the first time in 9 days, investors’ sentiment actually turned positive.

Bitcoin investor sentiment | Source: Santiment

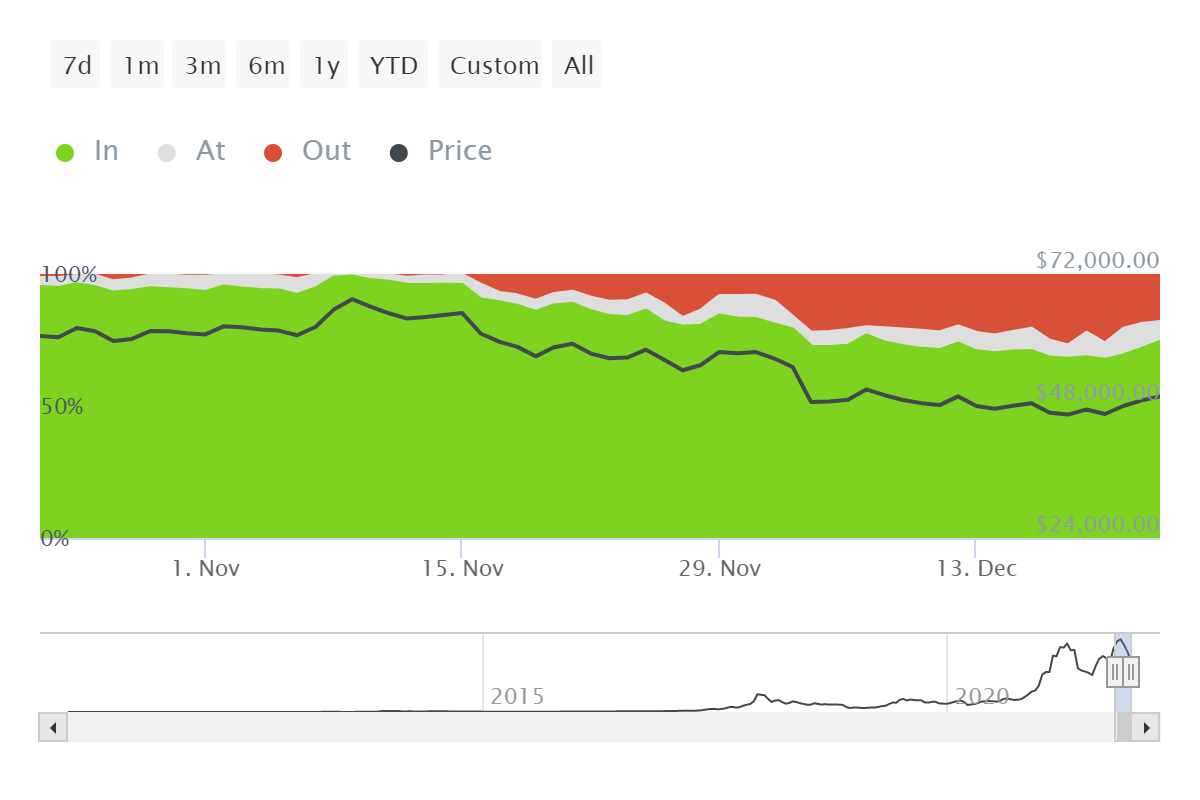

Coincidentally, the 9% price rise over the last 3 days also pushed the network into realizing relatively higher profits than it had in more than 2 weeks.

This comes as a relief for the 7.77 million Bitcoin investors who have been a victim of the losses that ensued owing to the 18.26% dip in price over the month of December (ref. Bitcoin price action).

Bitcoin investors in loss | Source: Intotheblock – AMBCrypto

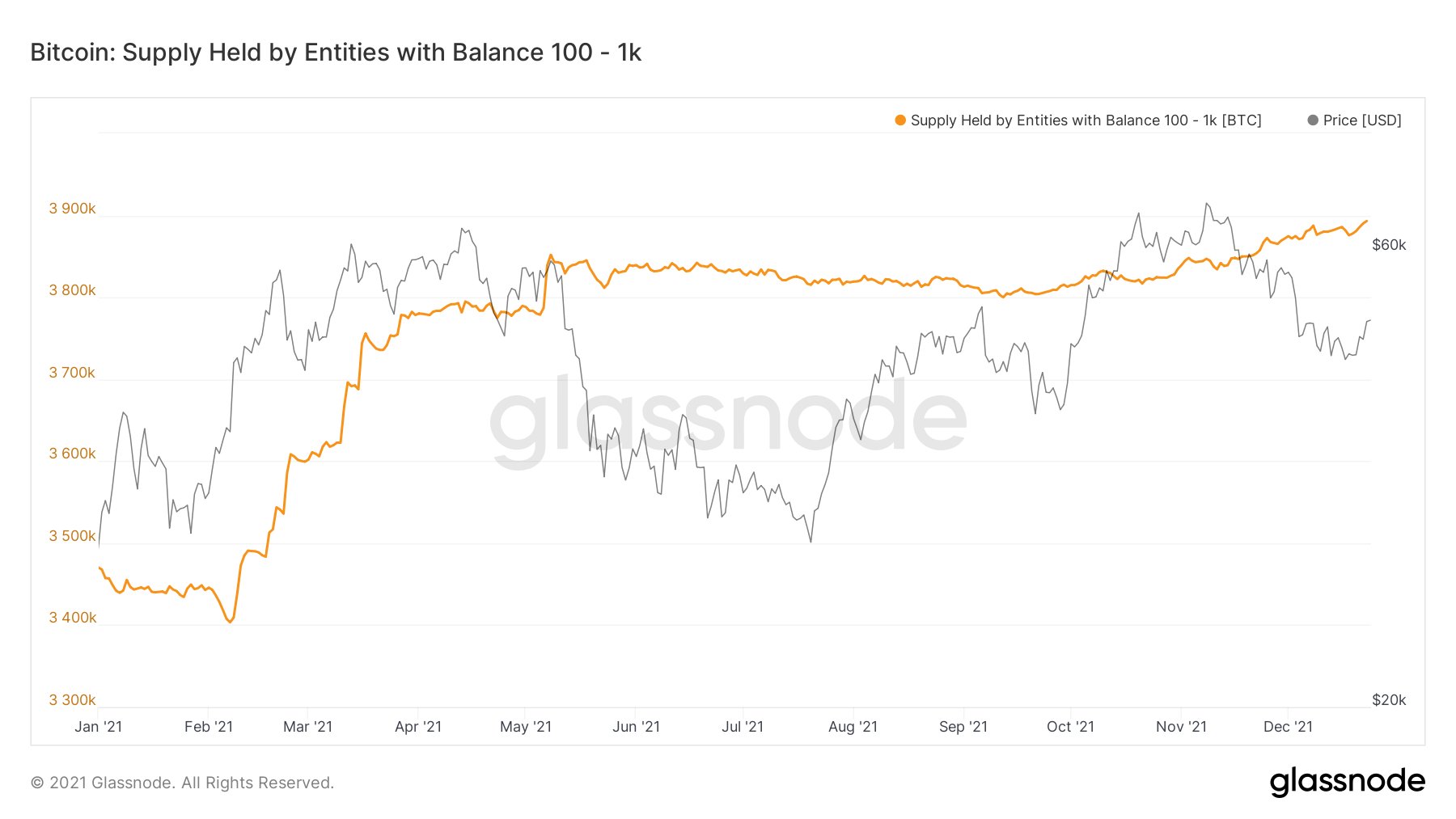

Should Bitcoin keep going higher, it would only serve as a payoff to the resilience of long-term holders and large wallet investors as they did not lose their footing in months, regardless of the events that ensued in November.

HODLing still alive

This is verified by the consistently falling level of liveliness which indicates that LTHs are not liquidating their positions but are simply accumulating to HODL.

Secondly, the supply held by large wallets consisting of BTC between 100-1k touched its all-time high. The 3.85 million BTC held by them worth over $196.2 billion represents almost 18% of all BTC supply.

Bitcoin supply held by 100-1k BTC holders | Source: Glassnode – AMBCrypto

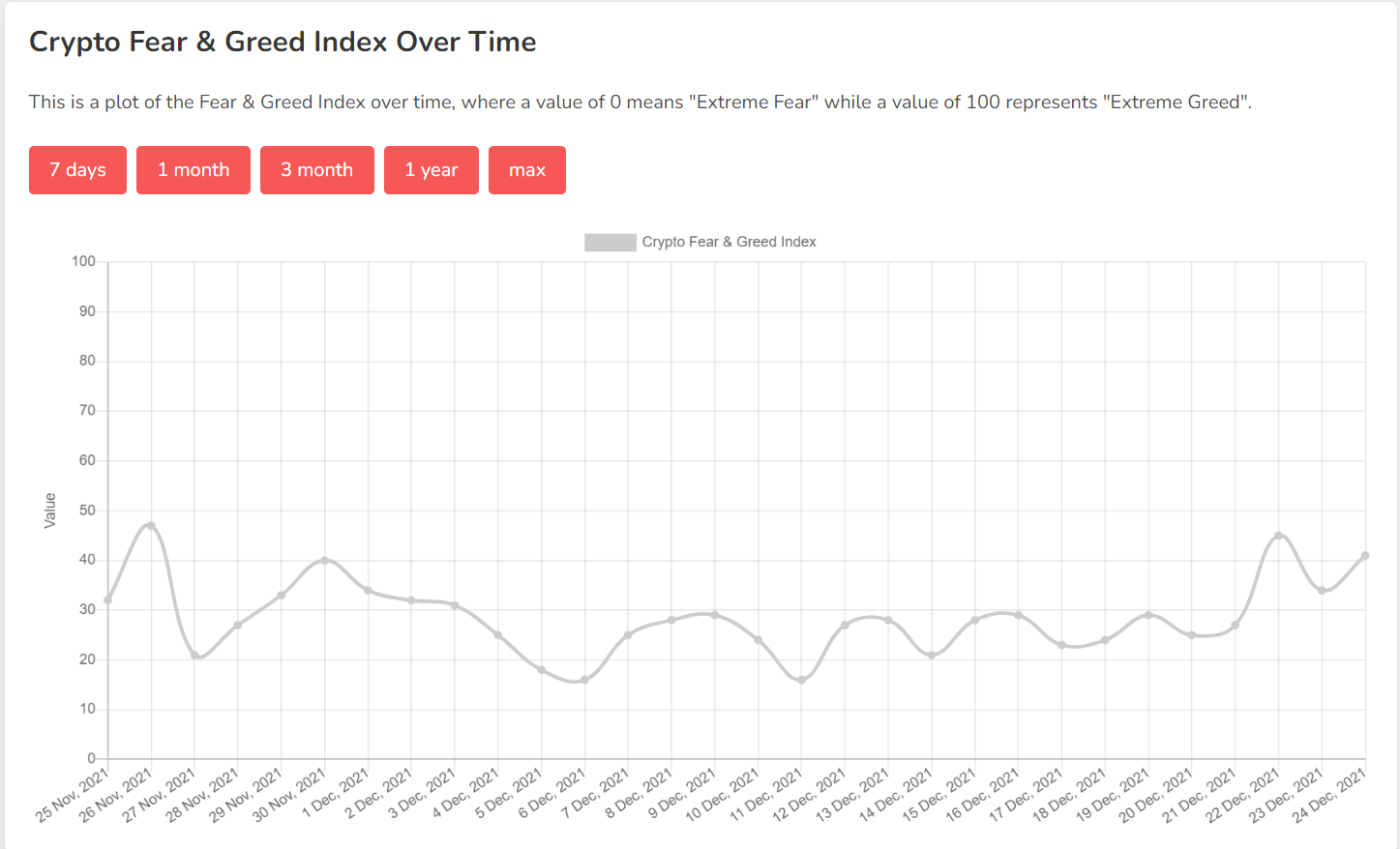

Moreover, while it may look like the market is rising back towards greed but as per the fear and greed index, it still lies closer to the sentiment of fear so one should not expect any radical moves from either the investors or the market.

Fear and Greed Index | Source: Alternative

Thus, while reclaiming $50k is a huge deal, investors can wait and watch for a while, since the uptrend has only begun and how long it could last cannot be ascertained at this point.