SUSHI may be on a slippery slope, but should it bother HODLers

The DeFi market, by and large, has remained resilient to major corrections lately. In fact, over the past week, DeFi tokens have been trading higher, managing to return to their respective early July levels.

However, SUSHI, one of the market’s most prominent DeFi tokens, has been on a slippery slope of late. While most tokens have had a green week, SUSHI’s price dropped by 2.5% over the same timeframe. Before decrypting the reasons, however, let’s analyze the state of a few key metrics.

Retention v. New users

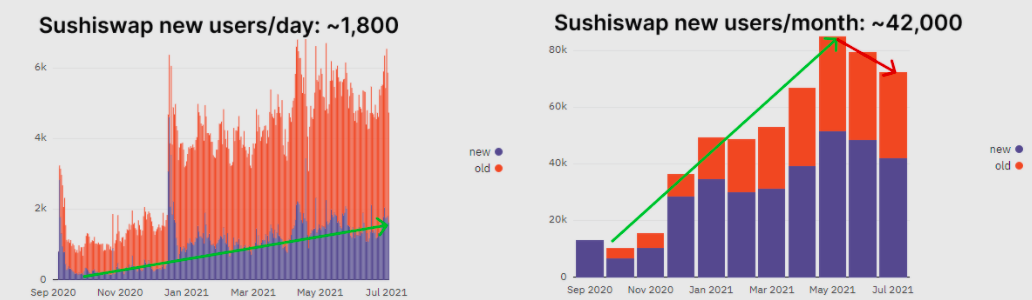

With respect to user penetration, the project is fairly behind its other DeFi counterparts. On average, close to 1800 new users get associated with the protocol on a daily basis. The aforementioned metric has, undoubtedly, witnessed a spike since September last year. However, the monthly count narrates a slightly different tale.

1800 daily users should account for approximately 54,000 monthly users. But, as evidenced by the chart attached, the same stood at merely 42,000. What this means is that the hike is not uniform. In fact, over the last couple of months, the number of users (both old and new) has been falling.

What’s more, whenever new users join the network, SUSHI’s price rallies. Now, since the number of active addresses is not really surging, SUSHI’s price has been dwindling too.

Additionally, the protocol has not been able to retain its existing users for longer durations. The macro-level spurt in the number of new addresses is fine, but the inability to retain users might prove to be a hindrance in the long term.

Balance on Exchanges

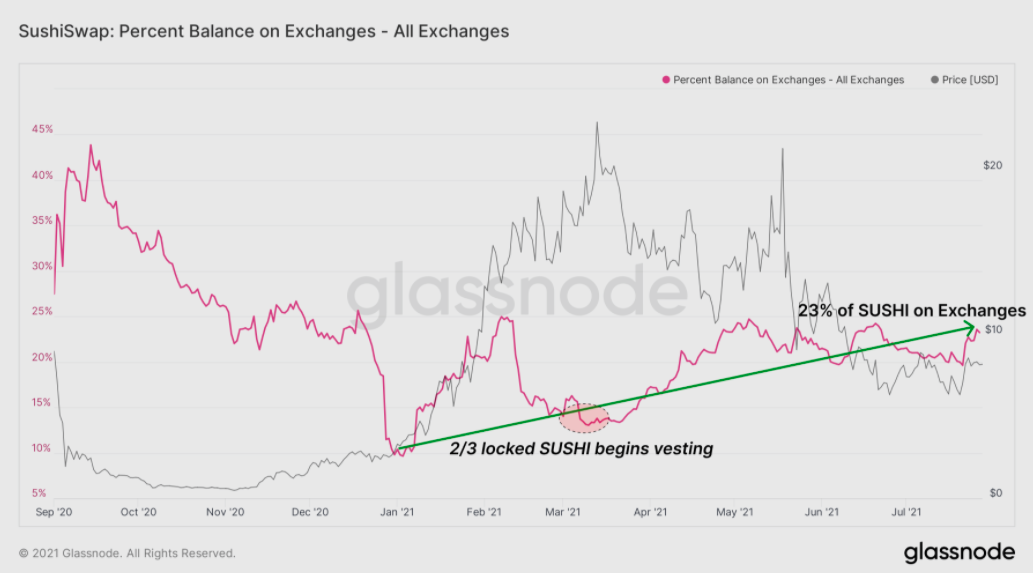

SUSHI’s balance on exchanges has risen by 23% since the beginning of this year. This ultimately means that HODLers have been parting with their holdings. This is clearly not a pleasant sign either.

At this stage, it should be noted that SUSHI tokens are awarded to liquidity providers in vesting periods. However, earlier in April this year, the vesting schedule was modified. All exchanges witnessed an intensified uptick in their balances since the beginning of that phase. In fact, a recent Glassnode report highlighted,

“High percentage of vesting SUSHI rewards continue to be sent to exchanges over time, potentially increasing the sell-side pressure on the token through to October.”

Nonetheless, out of SUSHI’s total circulating supply, roughly 40% was staked as SUSHI and HODLers made earnings from the staking rewards. The same also talks a lot about the token’s recent adoption. The remaining supply is either held in wallets (37%) or on centralized exchanges (23%).

Positive takeaways

Amidst the not-so-captivating state of the aforementioned metrics, SUSHI’s liquidity has remained strong since its launch in August last year. Glassnode’s report also highlighted that for every $1 of liquidity on either Ethereum or Polygon, SUSHI has witnessed $2 in trading volume on the respective chains. Additionally, SushiSwap’s year-over-year growth and product momentum remain strong too.

SUSHI’s appetite for risk is well-known to people from the community. The protocol’s ecosystem-centric developments have the ability to pull the token out of its sluggish phase. When SUSHI forced its way into the DeFi space last year, people expected the token to remain a footnote. However, SUSHI has managed its way up and keeping in mind its bold approach to innovation and experimentation, the token’s long-term prospects seem to be in safe hands.