Tenth time’s the charm for Ethereum after this dry spell comes to an end

ETH, the world’s second-largest cryptocurrency, finally started to move north earlier today. In fact, it broke past the strong resistance it was facing at $3000 by gaining by over 6% in 24 hours.

While it was hovering near the resistance at press time, bullish momentum for the coin might have already set in. Especially in light of the reversal in investment product flows this week.

Light at the end of the tunnel?

After a nine-week long spell of noting outflows from its investment products, Ethereum‘s native token saw inflows totaling $21 million during the week ending on 11 February. According to the latest report by CoinShares, this was after investors remained bearish over the nine weeks prior to the latest one. These nine weeks saw outflows totalling around $280 million, representing 2.2% of the AuM.

During this time, the crypto’s price also remained volatile, much like most other assets from its class. ETH actually has lost around 35% of its valuation since the beginning of December.

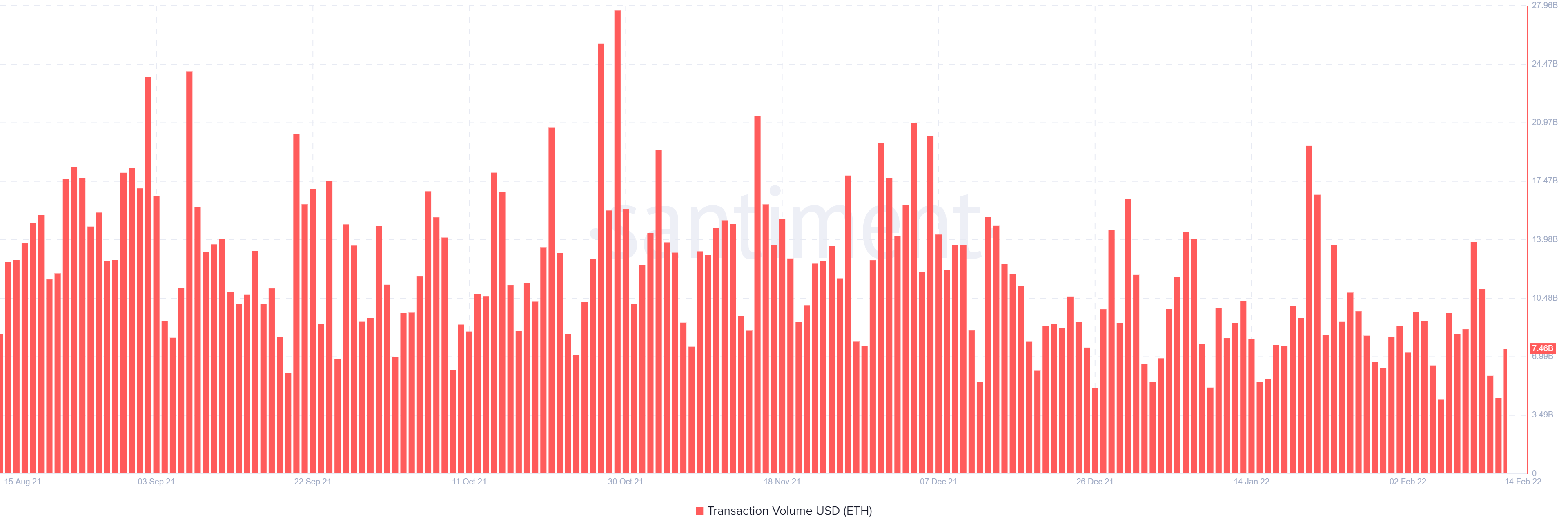

This price drop also contributed to a fall in ETH’s demand and transactions, resulting in a 71% cut in transaction fees over the last 4 months.

However, things might be looking up for the virtual currency. Especially since positive sentiment can be seen returning to the network.

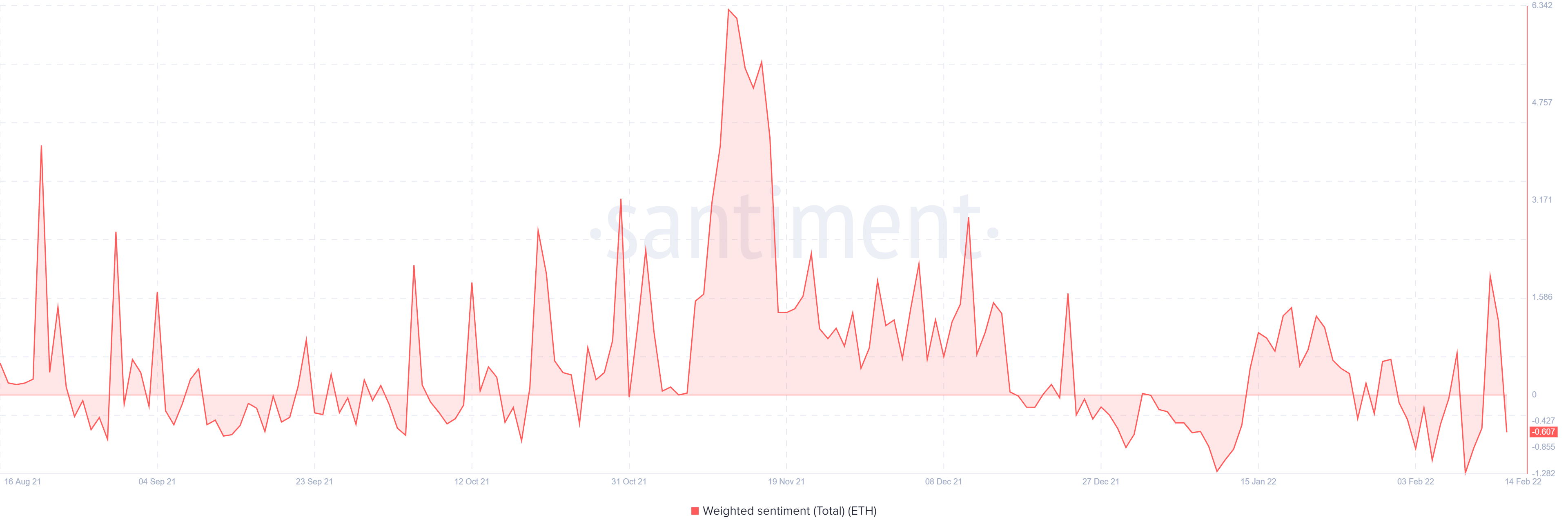

Ethereum’s weighted social sentiment, which had remained in the negative since the price depreciation first began in December, spiked over the past week. This is a sign that bullishness might be returning to the network.

Optimism all around

More importantly though, this has also been accompanied by a resurgence in transaction volume as Ethereum settled around $4.3 million on 10 February, up from $2.7 million the previous day.

A continuation of this trajectory would help the network recover its price loss going forward.

In addition to this, whale transactions above both $100,000 and $1 million have also been declining. This indicated that the whale dumping trend from the end of 2021 might be coming to an end. Especially as they once again begin to accumulate the asset.

Another factor that might have aided the inflows might be geographical as the institutional inflows over the previous week originated from Europe. On the contrary, the American industry registered a lot of outflows. This could be due to the boom in exchange-traded products backed by cryptocurrencies in Europe. According to reports, a new ETP is releasing practically every week on its various digital bourses.

For instance, the average monthly trading turnover in crypto-ETFs trading on Germany’s Deutsche Börse increased to over 1 billion Euros or $1.133 billion – A 922% increase from 2020.