Terra Classic [LUNC] investors may have some sleepless nights thanks to Binance

Terra Classic [LUNC] is once again in the news. The token was recently in the limelight for registering an unprecedented hike over the last week. However, hell broke loose much recently.

Binance posted an update that it will suspend deposits and withdrawals of LUNC (Shuttle) via Ethereum network (ERC20) and USTC (Shuttle). It will also suspend transactions via BNB Smart Chain (BEP20), Ethereum network (ERC20), and Polygon network. The withdrawals and deposits will be suspended indefinitely effective from 7 September 2022.

After the news was revealed, LUNC’s price action also showed some negative growth by registering a 6% decline in its 24-hour performance. At press time, LUNC was trading at $0.00024169.

What’s cooking?

Though LUNC’s seven-day performance was commendable as its price grew more than 100%, the Binance episode might have hindered its growth. The primary reason for a potential decline is that Binance is one of only a few exchanges that has supported and listed LUNC.

Therefore, the lack of support from the exchange might adversely affect LUNC’s price in the days to come. However, users will still be able to deposit and withdraw their LUNC and USTC tokens via the Terra Classic network.

The crypto exchange mentioned, “Binance will handle all technical requirements involved for all users holding LUNC (Shuttle) and USTC (Shuttle) in their Binance accounts.”

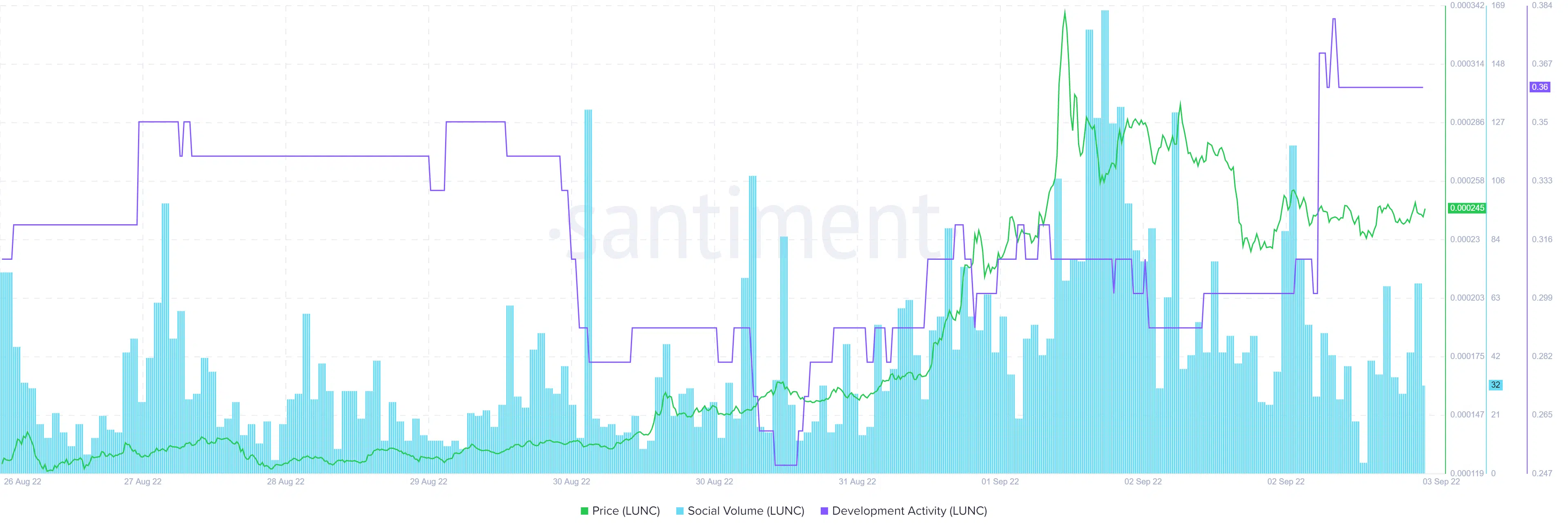

Interestingly, LUNC’s social volume also went down along with the price, which indicated that the community was losing interest in the token.

However, the development activity provided some relief to the investors. Despite the price decline, this metric showed some rise as compared to the historic data. This is a positive sign as it depicts the efforts of developers in improving the network.

Moreover, LUNC’s trump card, the 1.2% burn protocol, is yet to be launched. This may help LUNC maintain its uptrend in the days to come. As the burn would reduce LUNC’s total supply over years, this process would increase its price.

What to expect?

While LUNA registered a downtrend, its four-hour chart suggested otherwise. At the time of writing, LUNC showed resistance at the $0.000279 mark as it failed to breakout.

The Exponential Moving Average (EMA) Ribbon clearly displayed a massive buyer advantage in the market, giving hope for a further surge. The Chaikin Money Flow (CMF) also told the same story as it too registered an uptick.

Furthermore, a bearish crossover happened on 2 September in the Moving Average Convergence Divergence (MACD)’s readings. The blue line was steadily approaching the red line, increasing the possibility of a bull-run in the short-term.