Terra Classic [LUNC] surges by 25% in a day, but should you buy the pullback

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- Gains of <100% in a week

- Pullback likely, but how deep would it be?

- Bitcoin situation meant early profit-taking could prove valuable

Terra Classic [LUNC] registered gains of nearly 100% from its swing low to swing high over the past seven days. The strong buying pressure continued at the time of writing, and any dip to a support zone would likely present a low-risk, high-reward buying opportunity. And yet, deep retracements can also occur with such strong pumps. Therefore, traders can consider relatively tight stop-losses on their LUNC positions.

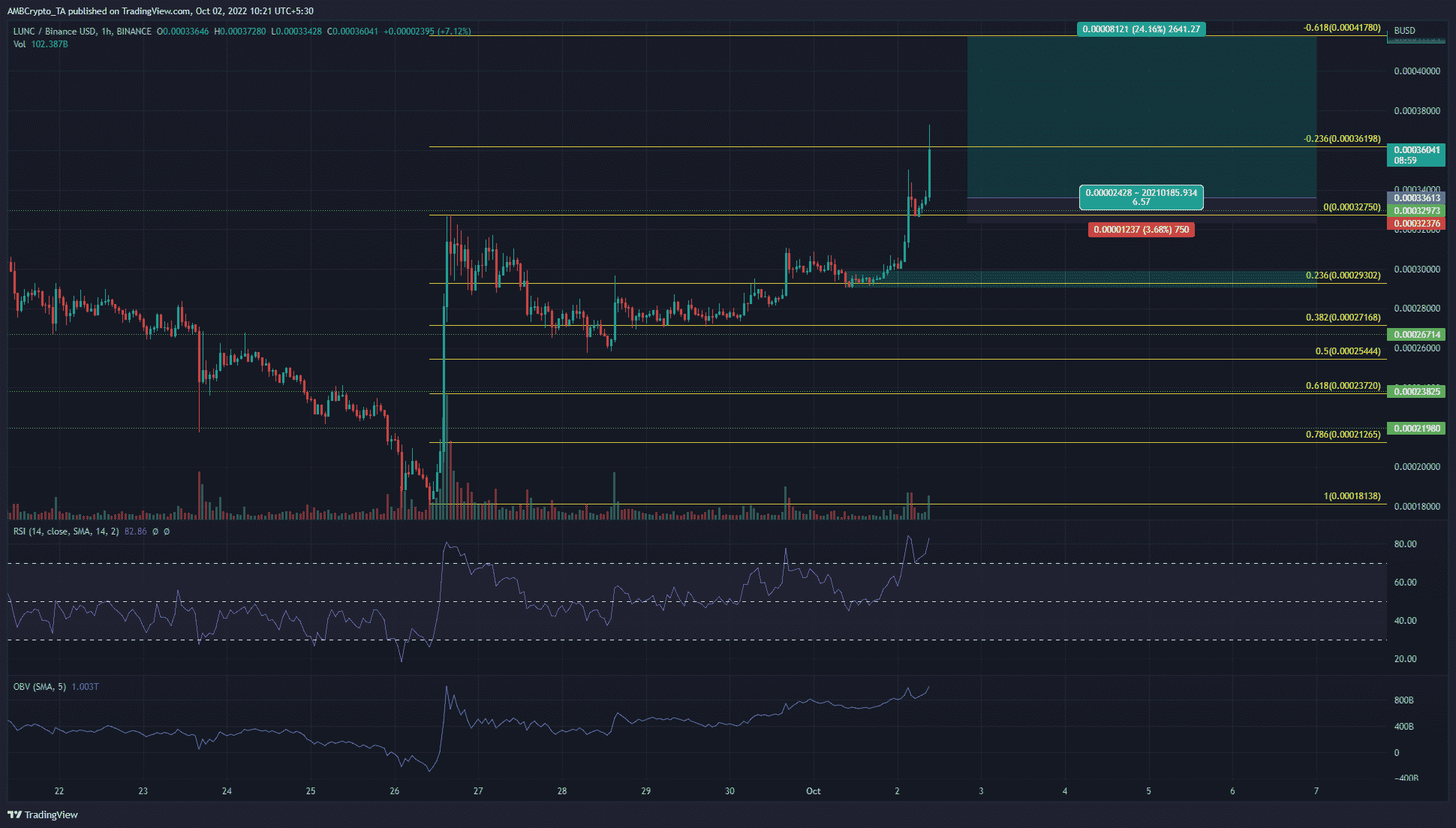

Fibonacci levels shed light on possible LUNC course

A look at a higher timeframe chart such as the 4-hour showed a bullish market structure. Hence, a lower timeframe trader can be bullishly biased and look for buying opportunities. The Fibonacci levels (white) showed that $0.00036 could be a short-term resistance, while the $0.00033-level could act as support.

A deeper pullback to the $0.0003-level (23.6% retracement) seemed possible as well. The RSI was strongly bullish, and in the overbought territory too. The OBV also rose swiftly over the past few days. In terms of risk-to-reward, it would be more sensible to wait for a pullback to the aforementioned support zones before buying Terra Classic.

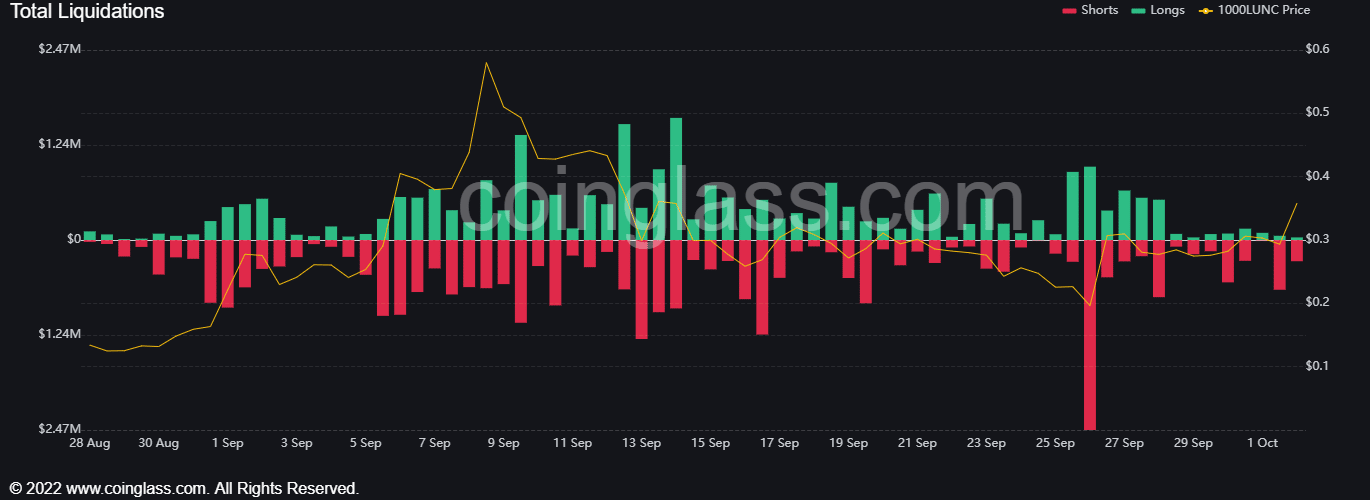

Short positions have been blown out of the water

LUNC has gained by nearly 100% on the price chart over the past week. This, after Binance announced a burn mechanism that would burn all trading fees paid to it on LUNC spot and margin trading pairs. The liquidations chart from Coinglass showed that a huge volume of short positions was caught offside over the past week. This has fueled the rally upward as well. Therefore, a pullback could be likely. It could extend deeper than $0.00029.

A revisit to $0.00033 and $0.0003 can be used to enter long positions on LUNC. The strong uptrend could continue over the next few days. To the north, the 61.8% extension level at $0.00042 can be another bullish target.