Tether [USDT] on shaky grounds: Will these new developments reinforce fear

- FUD around Tether continued to grow as it didn’t provide audited financial reports

- Tether’s transaction count declined while active addresses witnessed a rise

According to a recent report by the Wall Street Journal, Tether [USDT] issued massive loans of around $6.1 billion as of 30 September 2022. Additionally, Tether did not publish audited financial documents or a complete balance sheet documenting the same. This lack of transparency by Tether could stir up more FUD against the stablecoin, as the community may perceive these loans in a negative light.

USDT is the largest stablecoin by market capitalization in the crypto industry. If its parent company, Tether, were to face a financial scandal, it would have a negative ripple effect on the entire crypto market.

At the time of writing, the supply of small contracts on USDT had fallen and reached a 21-month low of 11.64%, according to Glassnode. Regardless, large addresses continued to show their interest, as the supply held by the top 1% addresses reached a five-month high of 95.32%.

? $USDT Percent Supply in Smart Contracts just reached a 21-month low of 11.646%

Previous 21-month low of 11.976% was observed on 28 November 2022

View metric:https://t.co/FXRb731sNE pic.twitter.com/cXbdiopPqP

— glassnode alerts (@glassnodealerts) December 2, 2022

USDT FUD setting in?

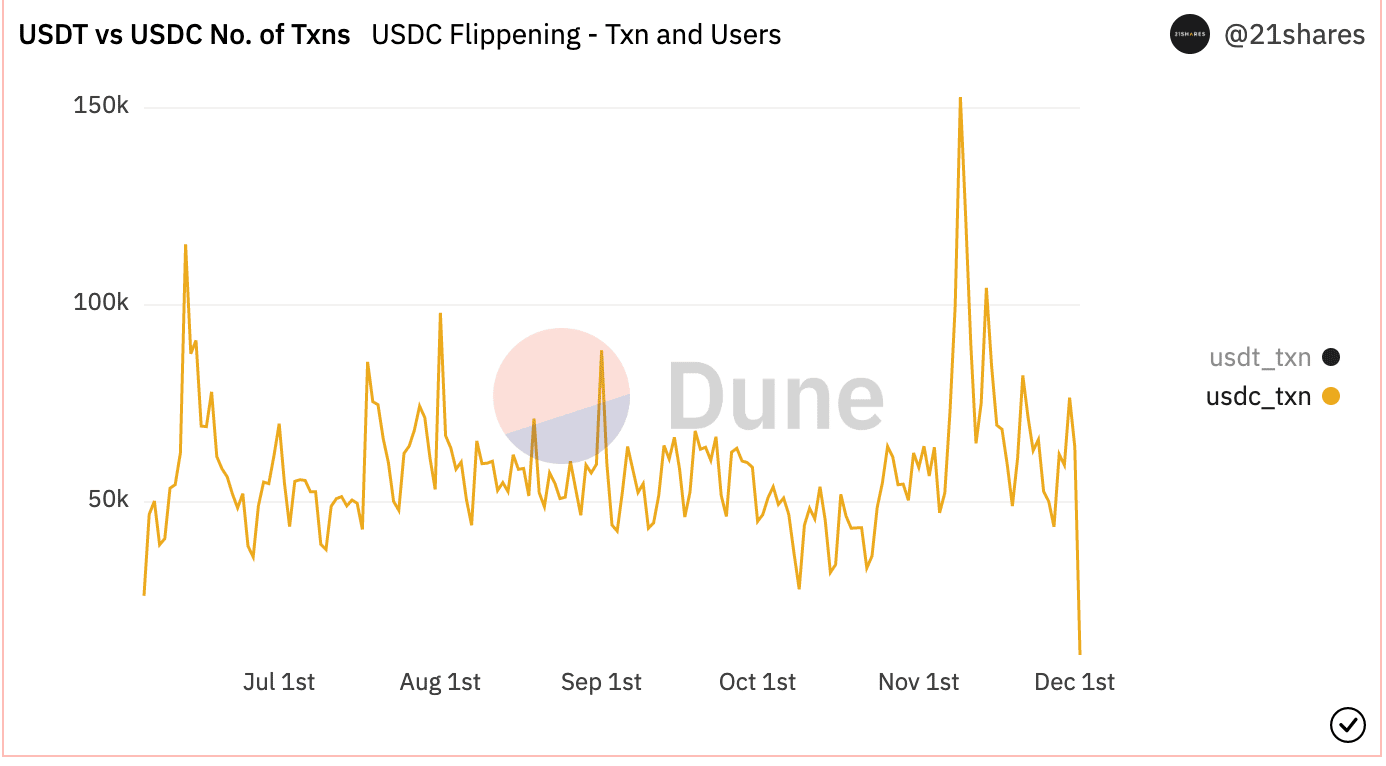

USDT showed no improvements throughout the board as the number of USDT transactions continued to decline over the past few days. The value of the transactions plummeted as well, according to data provided by Dune Analytics.

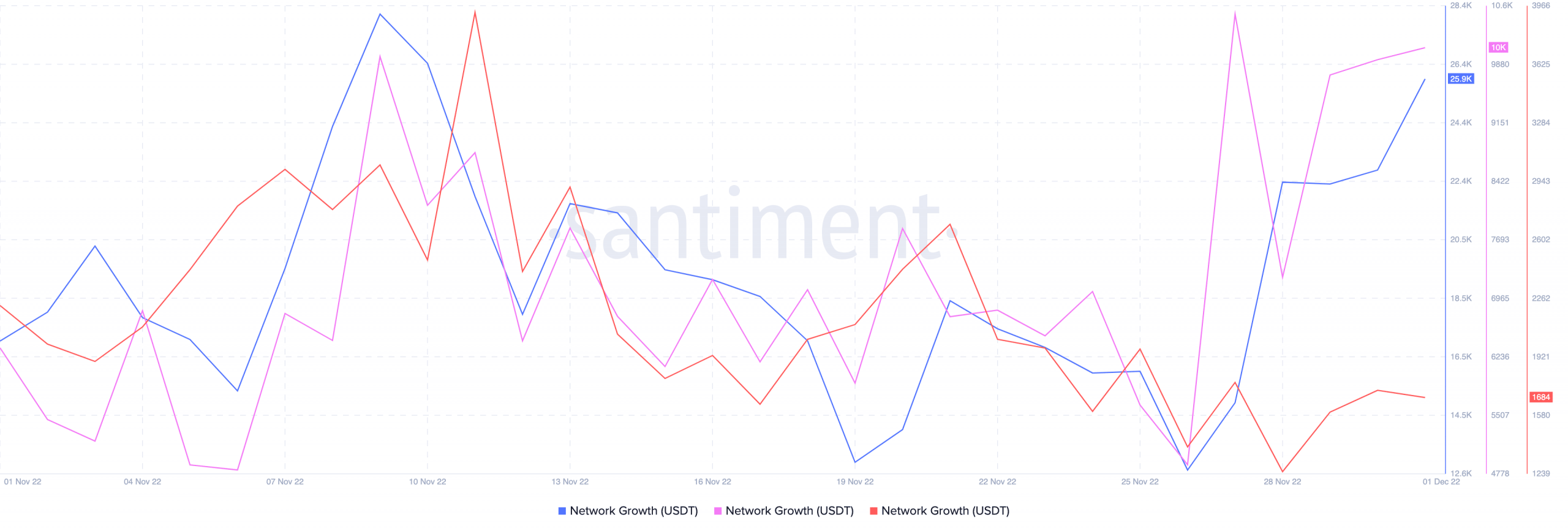

In terms of network growth, USDT grew on Polygon (Purple) and Ethereum (Blue) over the last month, as per the image below. A spike in network growth showed that the number of addresses transferring USDT for the first time had increased. This implied that adoption was increasing for USDT on Ethereum and Polygon.

However, Arbitrum’s network growth declined during the same period.

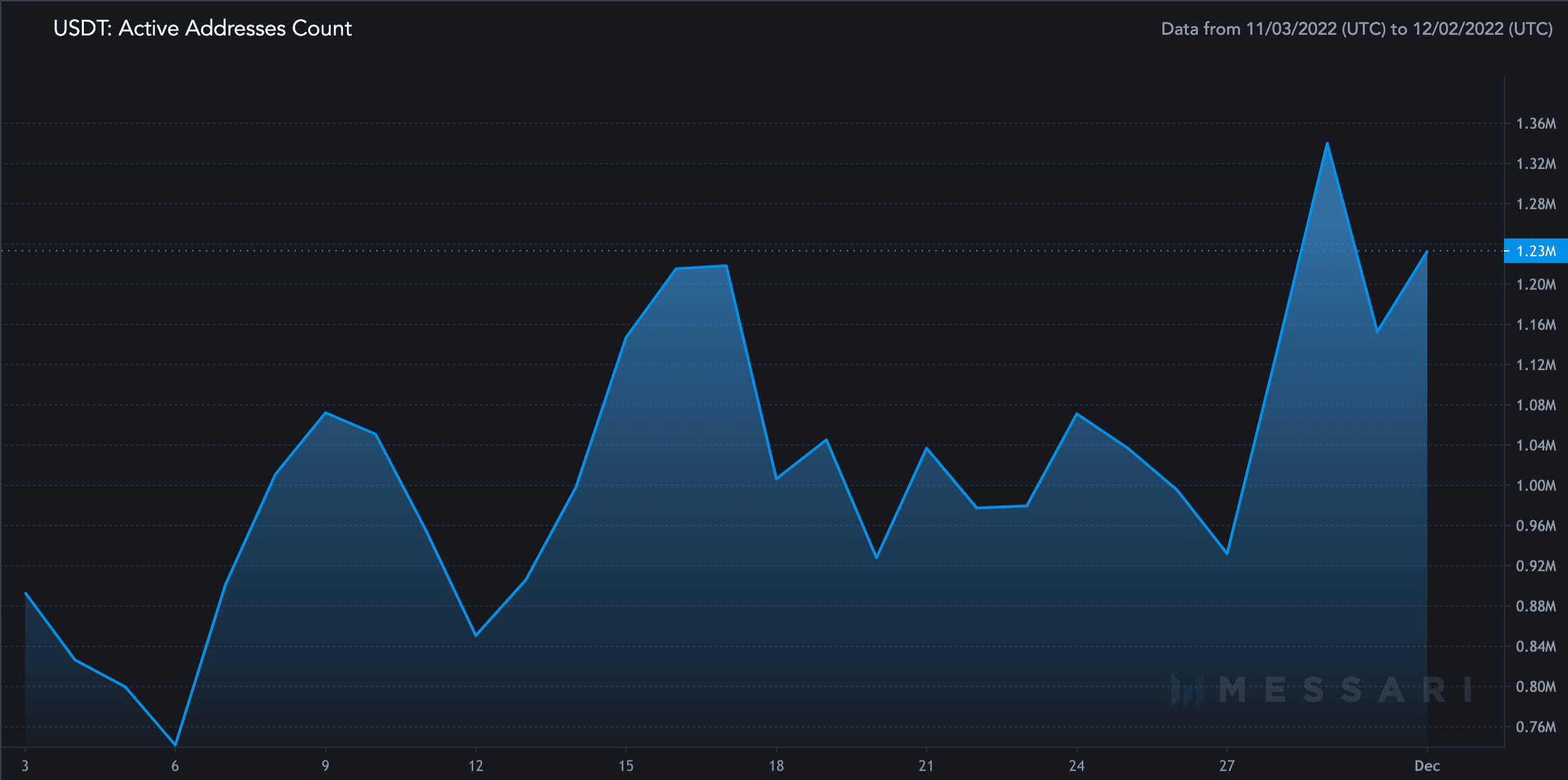

The number of USDT active addresses increased by 18.83% over the last month. Additionally, its market capitalization declined by 10.52% as well. As of 2 December, USDT had captured 7.82% of the overall crypto market, according to data provided by Messari.