Is USDT exposed to FTX? Read what this Tether exec has to say

- Tether’s CTO addressed concerns over USDT’s exposure to FTT

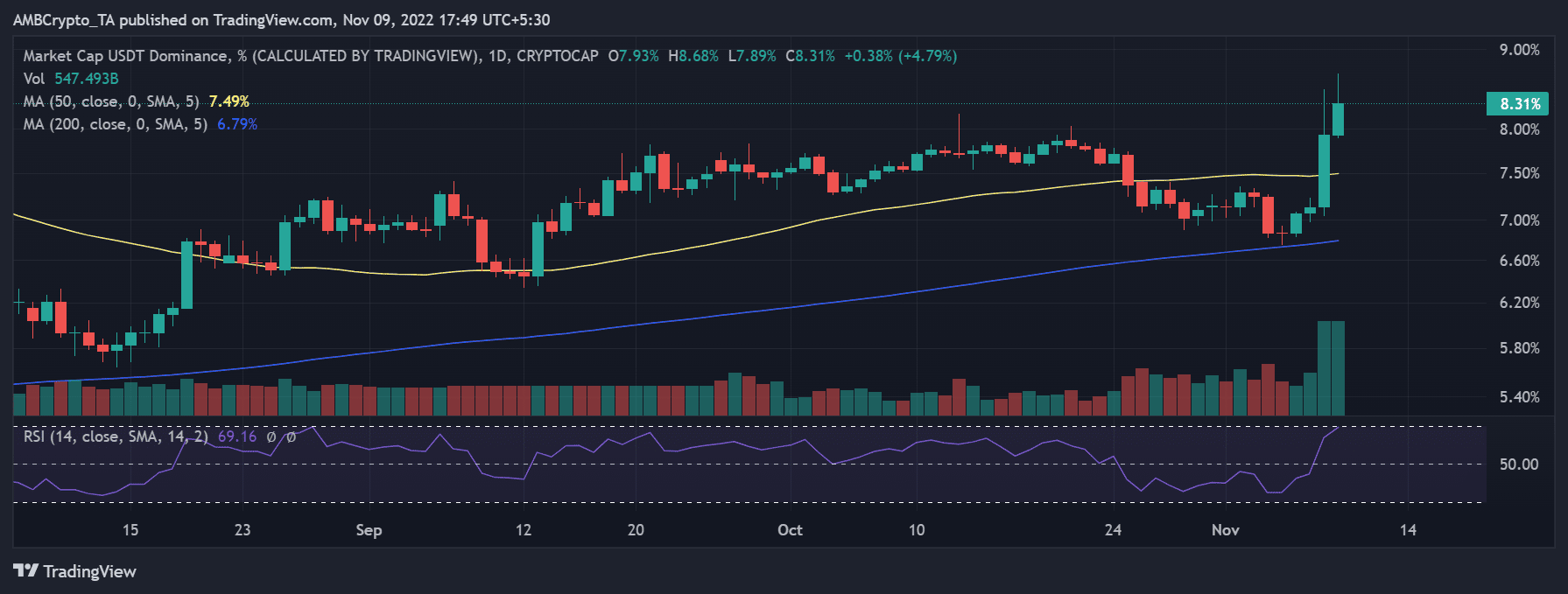

- USDT daily volume sees a spike

Members of the cryptocurrency community have been questioning prominent stablecoin companies about their engagements with FTX and FTT. Perhaps, out of worry that a repeat of the Terra scenario might transpire. Paolo Ardoino, the CTO of Tether, was recently asked about the cryptocurrency’s potential risk from FTT as well.

So, how serious is USDT’s exposure to this failing asset and company?

Is USDT exposed?

Questions regarding the stablecoin’s vulnerability to FTX and FTT were raised in a tweet addressed to both Tether’s CTO and Circle’s CEO. According to the tweet, Alameda, FTX’s trading subsidiary, has been rumoured to be the biggest issuer of USDT.

If USDT, the largest stablecoin by market cap, were to suddenly and unexpectedly collapse owing to excessive exposure, the repercussions might be disastrous. Perhaps, potentially exceeding those of the Terra crash.

Circle and Tether should disclose more of their financial relationship with FTX Alameda to let users know if it's a risk. @jerallaire @paoloardoino We are seeing a lot of assets move from Circle to FTX; there are also reports that Alameda is the second largest issuer of Tether.

— Wu Blockchain (@WuBlockchain) November 9, 2022

After members of the community voiced their concerns, Tether’s Chief Technology Officer Paolo Ardoino tweeted that the stablecoin issuer is not afflicted by either FTX or Alameda.

The Tether executive said that Alameda had redeemed a large quantity of USDT in the past. Despite this, however, no credit exposure had reached maturity.

To be clear: #Tether does not have any exposure to FTX or Alameda. 0. Null.

Maybe is time to look elsewhere.

Sorry guys. Try again. https://t.co/1bRNUGrttr— Paolo Ardoino ? (@paoloardoino) November 9, 2022

Likewise, Circle CEO Jeremy Allaire refuted speculations that his company is exposed to FTX or Alameda. According to him, although FTX and Alameda have been Circle customers, the stablecoin issuer never issued loans to FTX, received FTT as security, or took any holdings in FTT.

2/ Circle has no material exposure to FTX and Alameda. FTX has been a customer of Circle Payment APIs for the past 18 months, providing card and ACH services for customer transactions. Circle's crypto payments beta product uses FTX and other exchanges, for BTC/ETH liquidity.

— Jeremy Allaire (@jerallaire) November 9, 2022

USDT trading volume spikes

While the doubts and rumours have been put to rest, for the time being, the actual status of Tether will remain unknown until the dust settles. USDT is still the most popular stablecoin in the market globally. In fact, data also showed that trading volume grew by over 70% in the last 24 hours.

More information can be gleaned from USDT’s daily chart.

A rise in USDT trade was evident, as was a preponderance of buying pressure, which was measured by the volume indicator.

In other news, the CEO of Binance announced that the exchange would soon launch a Proof-of-Reserves audit mechanism to allow verification of its digital asset holdings. This, in the wake of the liquidity problem and the acquisition of FTX.

He further promised to develop a Proof-of-Reserve mechanism using Merkle Trees – A data structure designed to encapsulate blockchain data more effectively and securely in order to guarantee “complete transparency.”

All crypto exchanges should do merkle-tree proof-of-reserves.

Banks run on fractional reserves.

Crypto exchanges should not.@Binance will start to do proof-of-reserves soon. Full transparency.— CZ ? Binance (@cz_binance) November 8, 2022

Several other exchanges have also shown their desire to follow suit. This is critical as it would allow people to understand the financial state of different markets.