Uniswap NFTs take the crypto world by storm, but what about…

- Hype around Uniswap increased as social contributions soared, however, sentiment declined

- TVL and revenue continued to decline even though new users flocked to the DEX

DEXes like Uniswap [UNI] have witnessed a significant hype since the collapse of FTX. Soon thereafter, the exchange capitalized on this attention and launched their NFT collection. This development helped Uniswap reach new highs in social contributions.

Read Uniswap’s [UNI] Price Prediction 2022-2023

All the attention on Uniswap

According to data provided by social analytics firm LunarCrush, the number of social contributions on Uniswap grew by 878% over the last seven days. Its social mentions increased by 8.8% as well.

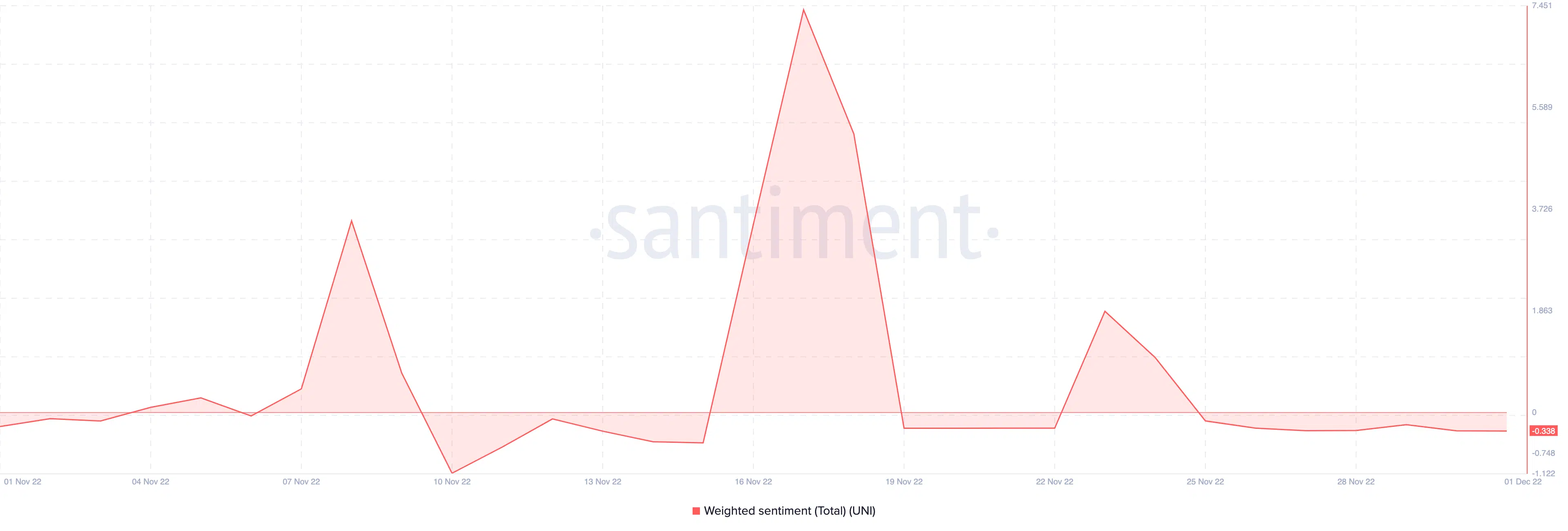

However, despite the increasing social mentions and contributions, it appeared that the crypto community was unable to agree on a definite stance. As can be seen from the image below, the weighted sentiment for Uniswap witnessed massive volatility over the last week, with massive spikes being observed from 16 – 19 November.

At the time of writing, the weighted sentiment was negative for Uniswap, suggesting that the crypto community had a negative outlook toward UNI.

Having a closer look

Uniswap underperformed in other areas as well. For instance, in the DeFi space, Uniswap’s TVL depreciated from $4.25 billion to $3.48 billion over the last 30 days, according to DeFiLlama.

Along with that, the fees generated by Uniswap depreciated by 16.7% in the last seven days as well, according to token terminal.

Even though the hype around Uniswap’s NFT wasn’t able to generate fees or impact its TVL, it did attract more unique users to the DEX.

According to Messari, a crypto analytics firm, the number of unique users on Uniswap grew by 42.45% in the last 30 days. The number of liquidity pool transactions grew by 42.94% during the same time period.

The spike in unique addresses led to the spike in UNI’s network growth as well, which increased tremendously in the last few days. This implied that the number of new addresses that transferred UNI for the first time had increased. The number of daily active addresses on the network grew in congruence with the network growth as well.

However, both these indicators declined as of 1 December, indicating that the spike could have been caused by the excitement around Uniswap’s NFTs, and the trend could change in the coming future.