Tezos Price Analysis: 13 January

Disclaimer: The findings of the following article are the sole opinions of the writer and should not be taken as investment advice

Tezos, at the time of writing, was trading at $2.40, with XTZ having a market cap of $1.8 billion, making it the 22nd largest cryptocurrency in the world. With XTZ up by 2.1% in the last 24 hours, the digital asset seemed to be poised for another leg up on the price charts.

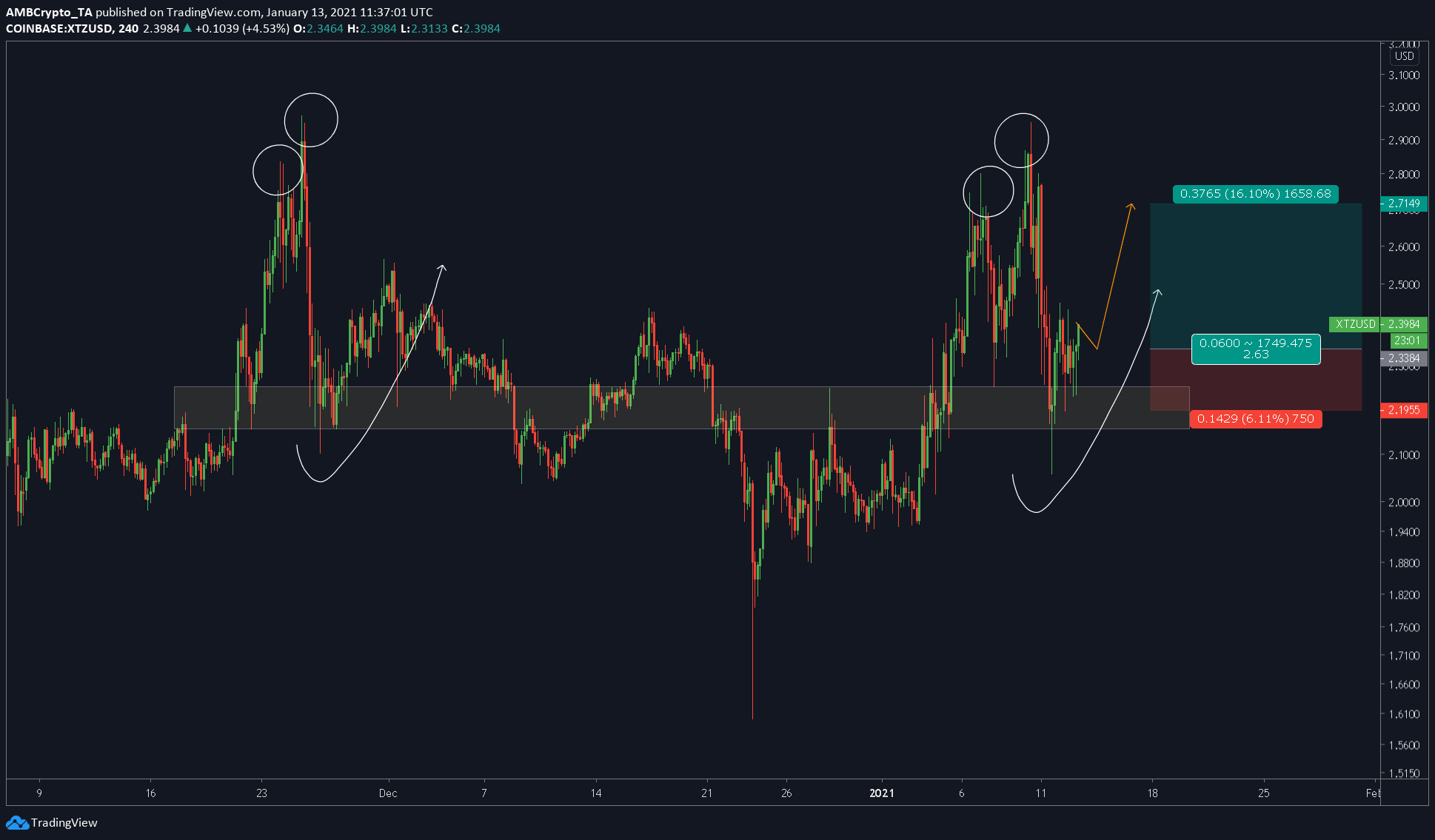

Tezos 4-hour chart

Source: XTZUSD on TradingView

The 4-hour chart for XTZ highlighted the formation of a fractal first seen in December 2020. This fractal has two distinct peaks, followed by a steep crash. The crash bounces off a support range, following which the crypto surges by 10-15%. At press time, while this fractal had repeated itself, XTZ was yet to experience the surge from the support range. Hence, XTZ appeared to be bullish in the short-to-mid-term scenario.

Market Rationale

Apart from the fractal, the RSI indicator pointed to a slow, but steady rise above the neutral zone, highlighting a surge in buyers’ momentum. Additionally, the Stochastic RSI underlined a surge from the oversold zone, one depicting the said buyers’ momentum.

Last but not the least, the MACD indicator also showed a decline in the red histogram and pointed to a decline in selling pressure. Moreover, the MACD also showed signs of a potential bullish crossover waiting to happen, further highlighting the rise in buying pressure.

Overall, XTZ looked ready for a surge, especially considering it was sitting on a support range from $2.15 to $2.25

Levels to look out for

The current surge is expected to head lower to $2.338, which will be a good point to start. All-in-all, a 10 to 15% surge can be expected from Tezos during this leg up with little downside risk.

Entry: $2.3384

Stop-Loss: $2.1955

Take-Profit: $2.7149

Risk-to-Reward: 2.63

However, it should be noted that altcoins tend to follow the king coin, and due to obvious reasons. Hence, a Bitcoin crash might render this fractal and the long position moot. Hence, a close eye on Bitcoin’s trend will help identify the credibility of XTZ’s fractal.