Tezos, UNI, Dogecoin Price Analysis: 13 February

Tezos retraced from record levels after the market’s sellers intervened and dragged the price towards its $4.6-support level. UNI’s on-chain metrics backed the sellers in the short-term, but a fall below the $20-mark seemed unlikely. Finally, DOGE was little changed over the last 24 hours and was projected to trade within a fixed channel moving forward.

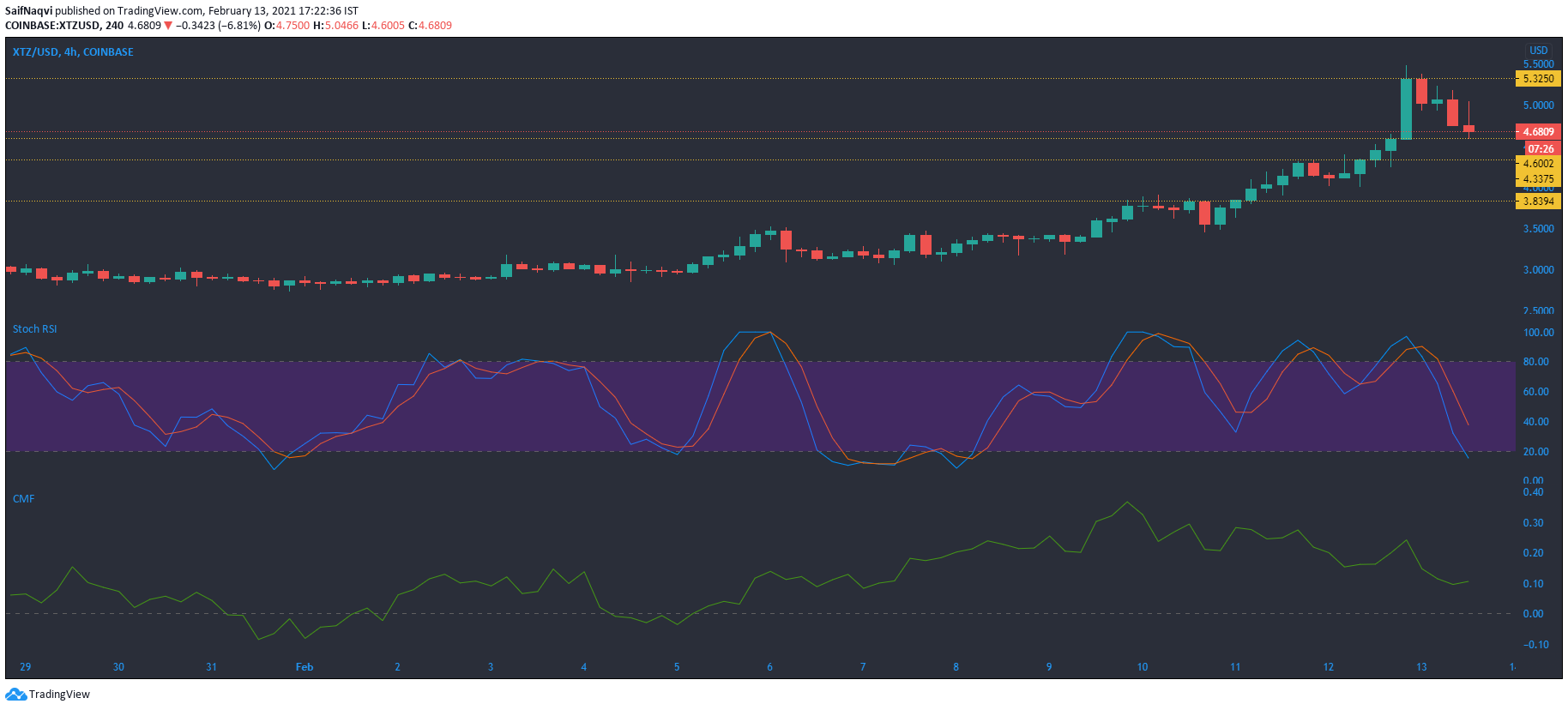

Tezos [XTZ]

Source: XTZ/USD, TradingView

Strong buying activity over the last few sessions saw Tezos climb to an all-time high of $5.5, before the price cooled off on the charts. Even though the market still belonged to the buyers, some selling pressure was seen over the last few sessions as the price moved closer to the $4.6-support.

In fact, the Stochastic RSI backed the sellers as the index moved towards the oversold zone. At the time of writing, healthy capital inflows, according to the CMF, and an uptick in trading volumes, kept XTZ above the press time support level but that could change rapidly if the sellers assume control of the market.

Uniswap [UNI]

Source: UNI/USD, TradingView

Uniswap flashed red, at press time, as the market’s bears attempted to flip the $21.5-support level after the price climbed to its all-time high just yesterday. The Awesome Oscillator registered red bars on its histogram while the MACD closed in on a bearish crossover as sellers took control of the crypto’s price.

The lack of healthy trading volumes worked against a bullish outcome for UNI. Despite bearish predictions, the cryptocurrency could hold itself above the $20-level, in light of the strong uptrend over the last 30 days.

Dogecoin [DOGE]

Source: DOGE/USD, TradingView

The Bollinger Bands on Dogecoin converged as the cryptocurrency entered a phase of consolidation and found itself drop out of the top 10 in the crypto-rankings. The 24-hour trading volumes contracted by over 30% while buying activity remained subdued as attention shifted towards surging markers leaders BTC and ETH.

The RSI registered a figure of around 50 as momentum balanced out between the buying and selling side. Expect DOGE to trade sideways between its immediate support and resistance levels in the coming sessions, before a clear trend emerges. In case DOGE falls below the 50-SMA (yellow), some sell signals could be presented for short to medium-term traders.