The anatomy of CRV’s recent DeFi exploit: What you need to know

- Curve Finance was the victim of a recent exploit and the malicious entity deposited 400 ETH and withdrew millions.

- CRV attempts recovery but whale demand remains low.

The last couple of days have been quite the roller coaster for Curve Finance and its native token CRV. The network recently experienced an exploit that sent ripples of FUD across the enter Curve Finance ecosystem.

Is your portfolio green? Check out the CRV Profit Calculator

Kaiko Data analyst Riyad Carey broke down the series of events that led to CRV’s recent crash. The network’s CRV-ETH pool reportedly experienced an exploit. The malicious actors behind the exploit reportedly deposited 400 ETH and somehow managed to withdraw tokens worth millions of dollars.

1/ There have been a lot of threads on $CRV/Curve/Aave/Fraxlend so I’ll try to aggregate all the information and add some charts I made, covering:

off-chain bids

OI and volume weighted funding rate

L&B protocol outflows

and moreLet’s get into it pic.twitter.com/0EokBZwtyw

— Riyad Carey (@riyad_carey) August 3, 2023

The exploit took place on 30 July. This was around the same time that CRV’s price embarked on a steep selloff. According to the analysis, Curve’s limited liquidity contributed to the price drop.

For perspective, the token crashed by as much as 33% between 30 July and 1 August. This was because CRV holders were spoofed into selling their tokens. The network’s low liquidity did not help either.

CRV enters recovery mode after the exploit

Some saw the sharp price drop as an opportunity to buy CRV at discounted prices. As such, the token bulled off an impressive bounce back. This was supported by a surge in open interest as noted in the analysis.

CRV exchanged hands at $0.62 at press time, which represents a 24% bounce back from its lowest price point in the last seven days.

A closer look at the CRV price chart revealed that the crash sent the price into oversold territory. This may have further supported the accumulation at discounted prices. CRV’s Money Flow Index (MFI) also confirmed that there had been a bit of a buying frenzy in the last two days.

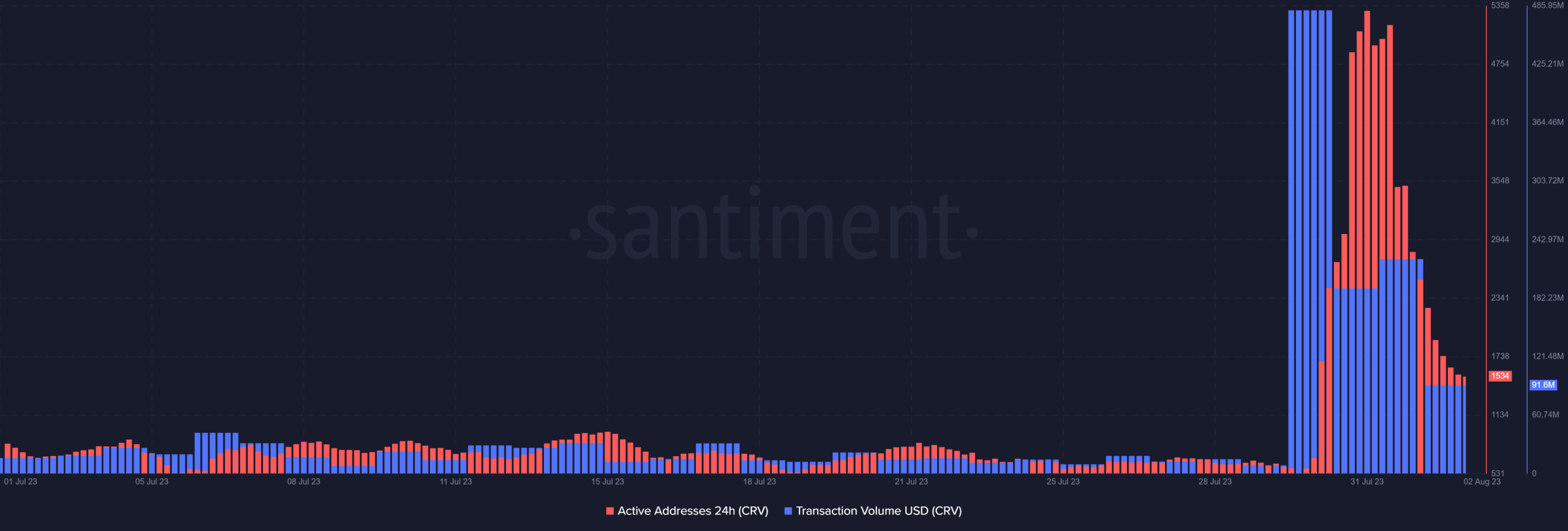

The entire situation certainly made a statement regarding Curve Finance’s activity. For example, the network’s on-chain volume was relatively docile for most of July. The transaction volume metric registered its highest level of activity at the end of June, at around the same time as the exploit.

Curve Finance also registered the highest level of address activity between 31 July and 1 August. However, the biggest concern for the Curve Finance community was how the event impacted investor confidence.

Read Curve’s [CRV] price prediction 2023-24

There was no doubt that traders were taken aback by the situation. Although we have observed some accumulation at discounted prices so far, it is worth noting that there were significant whale outflows that have yet to recover. The supply held by top addresses dipped considerably since the end of July.

Consequently, CRV’s mean coin age also took a dive for the last few days, indicating a loss of confidence among long-term hodlers.

But will there be more recovery? Well, that remains in the realm of speculation but it will be more difficult without support from whales.