Curve Finance [CRV] loses its market share for these reasons

- Curve Finance’s TVL reflects the dwindling confidence in its liquidity pools.

- CRV’s recent bounce signifies hope for the project’s future.

You may have heard that not all cryptocurrency projects that performed in the previous bull run will thrive in the next major rally. Curve Finance might be at risk of being sidelined based on recent observations.

Is your portfolio green? Check out the CRV Profit Calculator

Not so long ago, Curve Finance was one of the best platforms through which crypto holders could provide liquidity. Of course, it requires incentives such as passive earnings to entice crypto holders to contribute to liquidity pools. Those incentives made Curve Finance very appealing in its early days. Fast forward to today and the platform is losing its grip.

A recent Messari analysis looks into how Curve Finance has been losing its momentum in the DeFi race. As a result, upcoming decentralized exchanges have easier capital requirements and better incentives.

Liquid staking protocols use DEX liquidity pools for fast LST/ETH swaps.@Curvefinance lost momentum with reduced incentives and lower yields despite having high TVL.

To fill the void, specialized DEXs with lower capital requirements are becoming more popular. pic.twitter.com/MKWX6XtITu

— Messari (@MessariCrypto) July 5, 2023

Just how much of an impact can this loss of market share cause? Perhaps the first major concern for users and CRV holders is whether it can survive and perhaps even recover in the future. A look at actual data might offer better insights into the state of Curve Finance.

What can TVL outflows tell us about Curve Finance?

Curve Finance’s total value locked (TVL) is likely the easiest metric that underscores Curve Finance’s current situation. Its TVL peaked at just above $24 billion in January 2022. It has been on a downward spiral since then, and its TVL was at $3.74 billion at press time.

One could argue that the current level is miles better than most liquidity protocols. However, the massive TVL dip reinforces the fact that Curve Finance has been losing a lot of liquidity. Some DeFi protocols and their TVL have achieved significant recovery so far this year. That is not the case for Curve Finance. But what about the demand for its native token CRV?

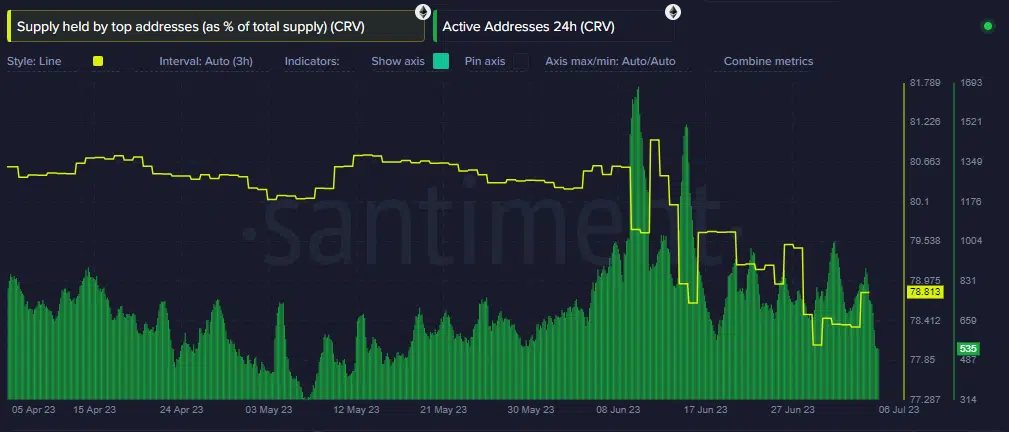

The number of CRV’s active addresses registered its largest spike in June. That spike was its largest in the last three months. It has since cooled down slightly but current levels do not necessarily inspire confidence. Also, whales have been offloading their CRV judging by the downward trajectory in the supply held by top addresses.

Read CRV’s price prediction for 2023/2024

Outflows from the top addresses confirm that CRV was a victim of eroding investor confidence. Despite these findings, CRV has maintained some level of demand, especially in the last two weeks of June. It bounced back by almost 50% from its lowest point in June to its recent peak during the 4 July trading session. A potential sign that it still has a strong community of believers.