The Balaji Bitcoin bet needed a 3500% rally – but was it just about the money

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Balaji’s Bitcoin bet was never about just the prices.

- Bitcoin to $1.2 million by 2029, according to our bold predictions (take it with a bucket of salt).

In March, Balaji Srinivasan, former Coinbase CTO, and cryptocurrency advocate, made a bet that Bitcoin [BTC] would reach $1 million in mid-June. When the bet was made, he insisted that the US economy would enter hyperinflation soon. Later in March, he warned that hyperbitcoinization could arrive faster than anticipated if the government continued to print currency and “lie about how much there is in banks.”

Read Bitcoin’s [BTC] Price Prediction 2023-24

The bet was closed out on 2 May by mutual agreement. Mr. Srinivasan made three $500,000 donations provable on-chain to Bitcoin Core Development, GiveDirectly, and Medlock, the person he made the original bet. But why did he burn his own money making an impossible bet?

Burning personal money for a public cause

Balaji claimed that the reason behind the bet was to force a public discourse by sending a “costly signal” that something is wrong with the economy. Balaji says that we cannot rely on public figures to inform us when something is wrong, citing Janet Ellen and Ben Bernanke’s actions in 2008. The 2008 crisis was far larger than Bernanke had anticipated, as he had only called it a “minor recession” five months before the crash.

This time around, Balaji is convinced that we will not have the “soft landing” that the Chair of the Federal Reserve, Jerome Powell, promised in late March. According to Balaji, the vast amounts of money injected by the US Reserve were leading to rampant inflation, and the outcome will be far worse than what Powell stated. He believes the only haven is Bitcoin, and that he “burned a million to tell you they’re printing trillions“.

Must be nice to have a million dollars to burn like that. Balaji says he did this for the public good and citizens cannot rely on public figures to call out the truth. The rapidly depreciating dollar could see investors rush to Bitcoin, leading to hyperbitcoinization.

The market cap of Bitcoin stands at $517.8 million at the time of writing. The amount of BTC in circulation was 19,385,012, with more mined roughly every ten minutes. With a price of 1 million, the market cap of BTC would stand at $19.38 trillion, close to the GDP of China in 2022 ($18.1 trillion).

The cycles of rallies and retracements

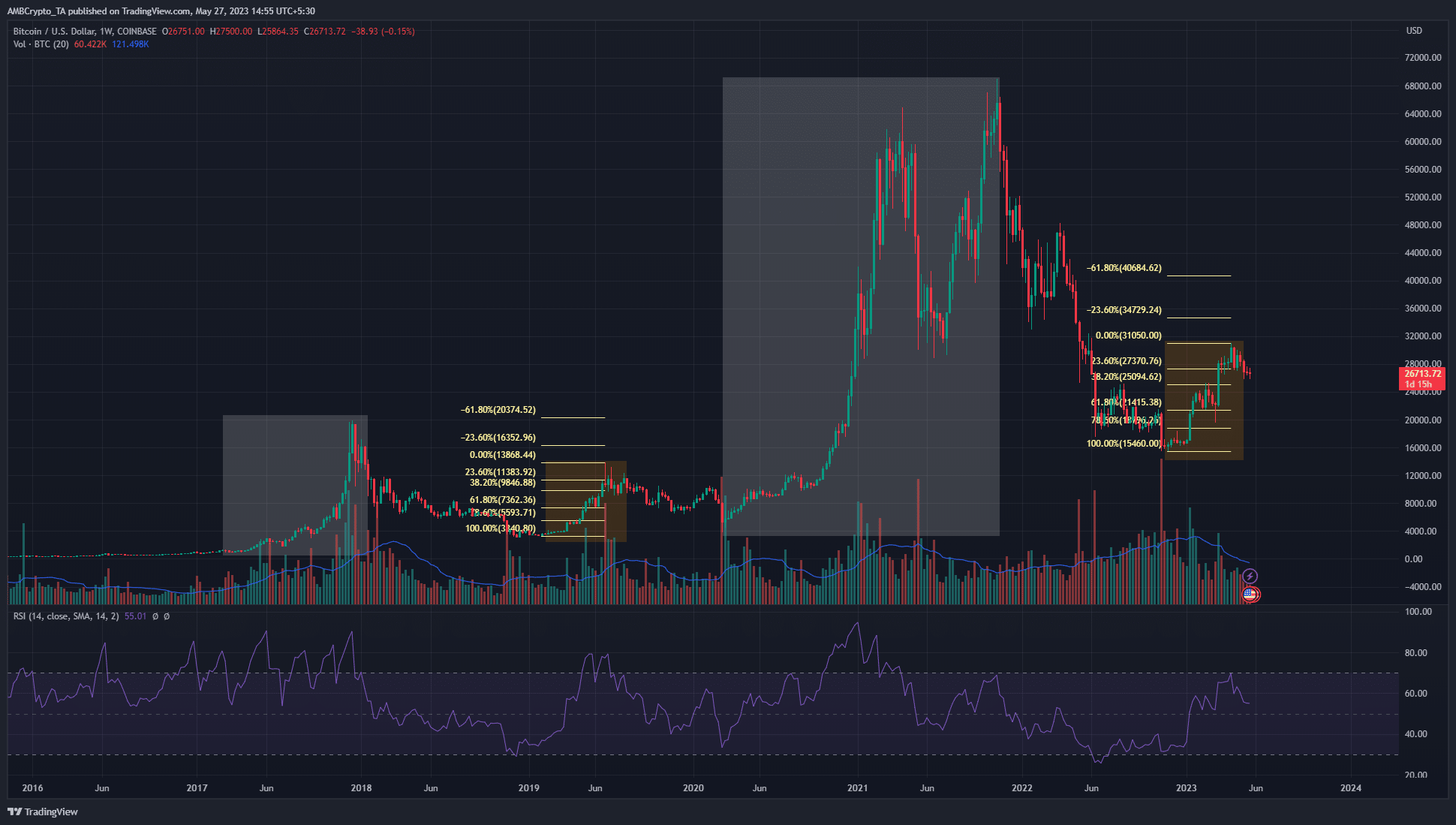

The chart above shows the bull rallies (white) in 2017 and 2021, and the bear market rallies (orange) in 2019 and 2023. The bull rallies measured 2135% and 1688% respectively, although the second rally took much longer. Almost twice as long, as it took 430 days after prices stabilized around the $10k mark before BTC reached the ATH at $69k on Coinbase.

From the highs of the bear market rally, BTC pulled back to the 78.6% Fibonacci retracement level 280 days later, during the Covid crash. If history were to repeat, we would expect BTC to fall to $18.8k in January 2024 before rallying higher once more.

Estimating conservatively, if the price made another 1680% rally from $18.8k, it would reach $315,840 after about 400-450 days, which would mean June 2025. An 80% pullback 380 days thereafter would take Bitcoin to $63,168 in July 2026.

Assuming the same pattern were to repeat, that is, a bear market rally measuring 100% within five months, BTC would trade at $126k in December 2026. Since we are only comparing the 2017 and 2021 cycles, let’s estimate BTC undergoes another 78.6% retracement of the bear market rally over the following 280 days.

Mark the dates in your calendar, buy BTC, and go on a multi-year world tour

That would mean Bitcoin reaches $76.5k sometime in August or September 2027. Another 1680% rally after close to 500 days would take BTC to $1.28 million in February 2029. This would be an insane journey for BTC long-term hodlers. Even more so for people who held BTC through thick and thin for more than a decade.

Is your portfolio green? Check the Bitcoin Profit Calculator

Of course, the above conjecture is just a guessing game, assuming BTC does something like the 2021 cycle again and again. As we have already seen, the bull market rallies do not extend as far north and the time to rally was longer in 2021 than in 2017. If this were the case for the next decade, it could take much longer for BTC to reach $1 million than another six paltry years. If ever Bitcoin reaches $1 million.

Balaji’s bet was ludicrous if we believe that his sole intention was a BTC price prediction like the one John McAfee made years ago. However, he has clarified that he gave away his money to shed light on something far bigger occurring in the economic background.