The curious case of stablecoins amid slumping crypto market

- Stablecoin sharks and whales have not converted to other assets despite downtrend.

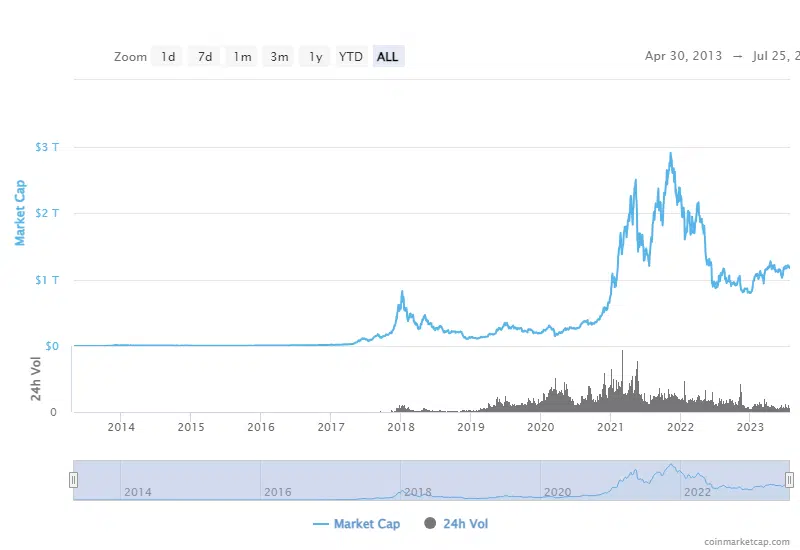

- The crypto market cap remained above $1 trillion.

Amidst the recent slump in the crypto market, a curious phenomenon has emerged: addresses bulging with substantial reserves of stablecoins such as Tether [USDT] and USDCoin [USDC] have remained quiet. But what does this unusual hush signify for the crypto market?

Stablecoins remaining stable

In a recent Santiment post, an intriguing analysis of specific wallet holders dubbed “dolphins” or “sharks” came to light. These individuals maintain a balance of $10,000 to $100,000 in stablecoins. What caught the attention of researchers was the conspicuous absence of conversion attempts from these stablecoins to other assets over the past week.

? Among active dolphin and shark #Tether and #USDCoin wallets currently, there is a notable lack of conversion into other various #crypto assets. Our quick insight looks at whether this retrace opportunity is enough to make #stablecoin #buythedip. https://t.co/YdiNqvSkxq pic.twitter.com/6fYPeJwh69

— Santiment (@santimentfeed) July 24, 2023

One possible explanation for this lack of movement is that investors and traders are finding solace in the perceived stability of these chosen stablecoins. As the crypto market experienced turbulence, these assets served as a safe haven.

Alternatively, this dormancy might signify profound confidence in the current market trend. Before the recent slump, the crypto market enjoyed a remarkable surge, with Bitcoin [BTC] claiming impressive highs like breaking the $30,000 price range.

Crypto market cap maintains the 1 trillion-dollar mark

In the face of a widespread price decline in the crypto market, data from Coin Market Cap has revealed that the overall impact hasn’t been as devastating as expected. As of this writing, the crypto market cap remains impressively high at around $1.1 trillion, holding its ground in the trillion-dollar territory.

In the last 24 hours, it experienced a relatively modest drop of less than 1%.

Source: CoinMarketCap

However, it’s worth noting that the trading volume tells a slightly different story. Over the same timeframe, the volume witnessed a more notable decrease, dipping by over 9%. This suggests that while the market cap retained its strength, trading activity has seen a more substantial decline.

Liquidation declines

As of the latest available data from Coinglass, the total liquidation in the crypto market stands at over $43 million. While this amount may appear significant, it pales in comparison to the $130 million recorded in the previous 24 hours.

This substantial reduction in liquidation could potentially ease the market’s selling pressure, at least in the short term.

The liquidation heatmap offers further insights, revealing that Bitcoin, Ripple [XRP], and Dogecoin [DOGE] have experienced the highest liquidation levels during observation. This suggests that these specific cryptocurrencies were subject to higher selling activity and may have experienced more pronounced price drops than others.

One noteworthy point is that when major stablecoins begin converting their holdings into other crypto assets, it could trigger a cascade effect, leading to further price drops for those assets.