The how and why of TUSD’s influence on BTC rally

- TUSD’s significant supply increases have coincided with Bitcoin rallies on multiple occasions.

- The dominance of TUSD in BTC trading volume has surpassed that of USDT.

The recent surge in Bitcoin[BTC]’s price has sparked curiosity and debate within the crypto community. While some have attributed the rally to factors like Blackrock’s ETF or a short squeeze, emerging data suggests that TUSD, a stablecoin, may have played a significant role in contributing to Bitcoin’s upward momentum.

Read Bitcoin’s Price Prediction 2023-2024

Impact of TUSD

Data from CryptoViz revealed that the circulating supply of TUSD has witnessed substantial increases of over $1 billion on just three distinct occasions since 2018. These occurrences took place in May 2021, February 2023, and June 2023.

Interestingly, following each surge, Bitcoin embarked on a rally within a relatively short period.

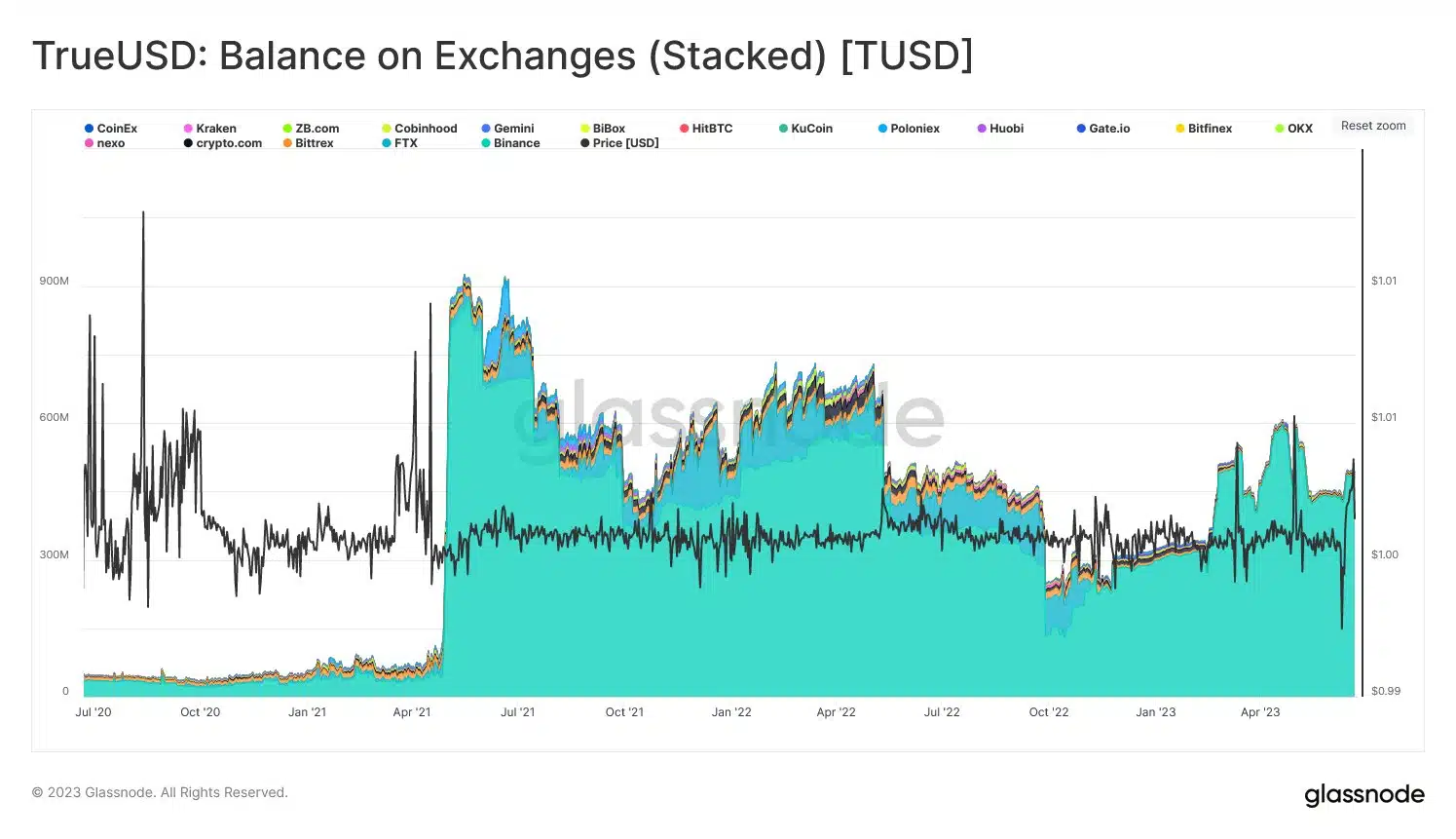

At present, Tron accounts for 76.45% of the total TUSD supply, followed by Ethereum with a 22.5% share. A closer look at the distribution of TUSD supply among different exchanges highlights the overwhelming dominance of Binance.

When analyzing the trading volumes of the top three BTC spot trading pairs, an intriguing trend emerged. BTC/TUSD trading volume surpassed that of BTC/USDT, which showed the growing dominance of TUSD as a trading pair.

CEO of CryptoQuant, Ki Young Ju, suggested that TUSD is following a trajectory similar to that of USDT. TUSD appears to no longer function as a direct off-ramp for converting cryptocurrencies to fiat. However, it remains possible to off-ramp TUSD to other cryptocurrencies across various exchanges.

Comparing the growth of TUSD and USDT, it becomes evident that both stablecoins have the potential to benefit BTC in the future. While the issuance of new USDT has slowed compared to the redemption rate, the expanding supply of TUSD may continue to impact the market.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Traders turn bullish

Traders are currently facing the impending expiration of 31,000 BTC options, characterized by a Put Call Ratio of 0.73, a max pain point set at $27,000, and a substantial notional value of $930 million, as reported by GreeksLive. This data suggests a relatively higher demand for calls, indicating bullish sentiment among traders.

The max pain point serves as an area of interest for market participants, potentially influencing their trading decisions. With such significant notional value involved, the expiration of these BTC could result in increased market volatility and potential price fluctuations.