The impact of Ethereum L2 solution, Optimism’s upgrade, on Arbitrum

Ethereum has a bunch of different protocols and L2 solutions operating for different purposes. So there is always some sort of competition going on within the network. This one-on-one competition was shattered with the arrival of Arbitrum as it skyrocketed within a few days. But now it looks like its old competition Optimism is back and definitely intends to dethrone it.

Arbitrum vs Optimisim

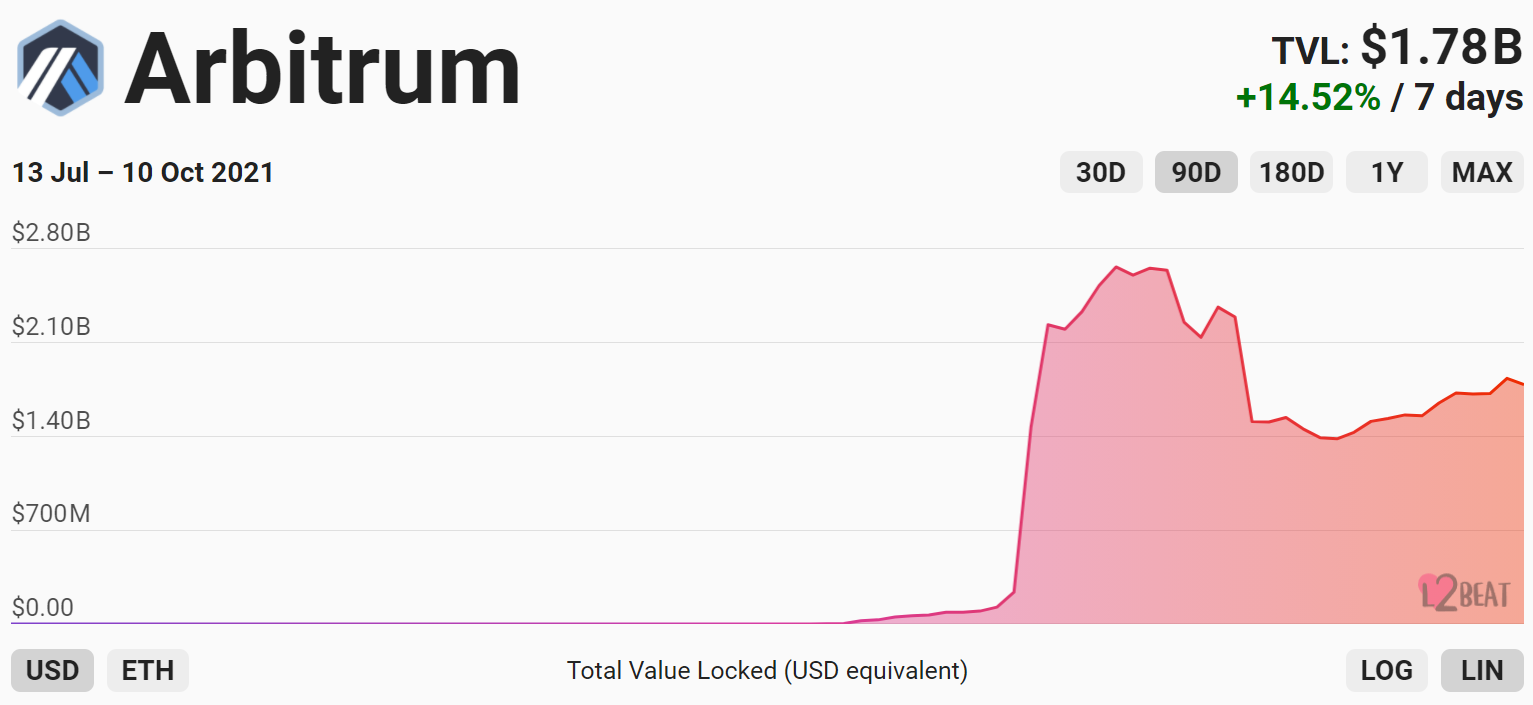

Arbitrum noted phenomenal growth last month. The rally that began on 31 August, 2021 rose from nothing to becoming the most successful rally on Ethereum. As of today, the total-value-locked on Arbitrum is just shy of $1.8 billion. But as October came, that growth began to slow down and its top spot is now being threatened by Optimism.

Arbitrum’s TVL | Source: L2beat

Over the last week, Optimism saw a flurry of new investors, participating on the network. The rapid rise has been adding over 4700 wallets a day. That is 135% more than Arbitrum’s current average of 2k wallets per day.

As a result of which, Optimism came very close to closing the gap of 19k wallets to take over Arbitrum’s 200k+ wallet top spot.

Optimism’s rising number of addresses | Source: Coin98

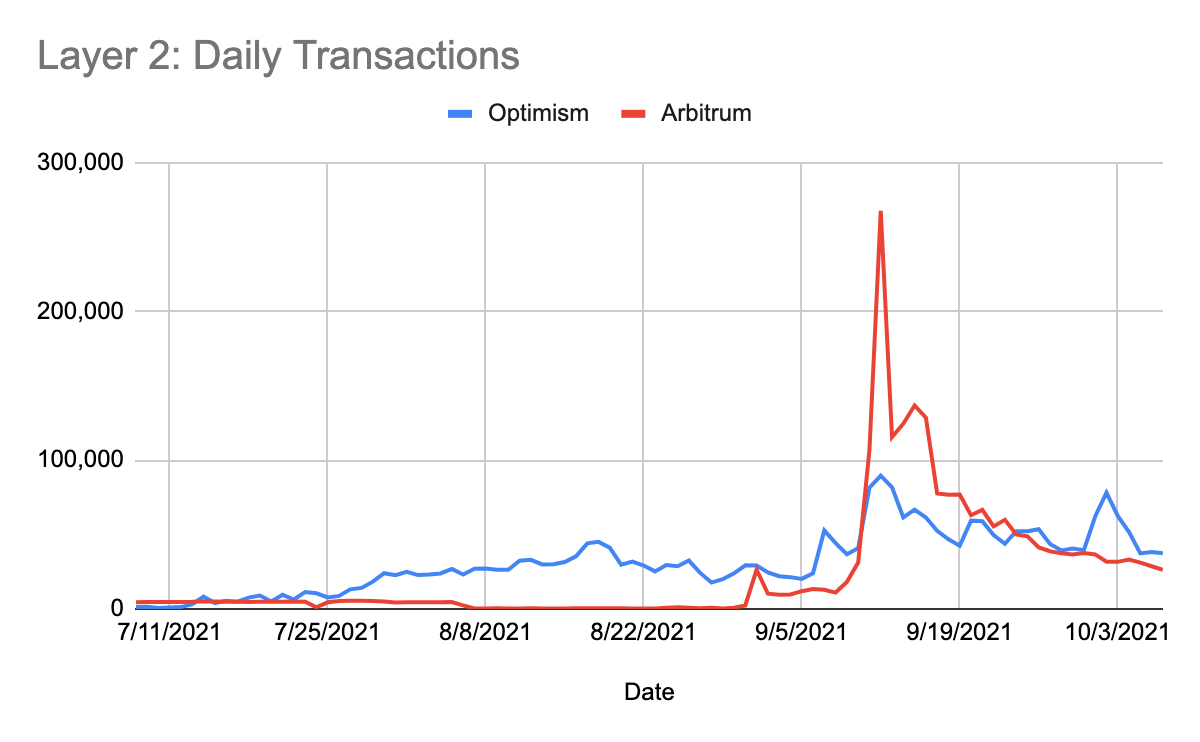

However, Arbitrum not only observed a decline in participation but also in terms of network utility. Arbitrum’s transaction count fell from 270k at its peak in August to less than around 15k. This was less than Optimism itself.

Optimism’s higher daily transactions | Source: Coin98

Will Ethereum benefit from it?

As a matter of fact, it will. The growth witnessed on Optimism will make things easier for both investors and developers alike, attracting more of them, which will, in turn, benefit Ethereum as a whole.

With the OVM 2.0 Optimism will be making some changes that have been in demand for a while now.

The most important change although is the need for reduced gas fees. At the moment operating on OVM (Optimistic Virtual Machine) can cost up to 10x the gas cost on L1 Ethereum due to compiled OVM opcodes. This will now be toned down to the pre-London hardfork costs of transactions on Ethereum.

Developers too won’t have to deal with the code size constructor issue when it comes to Optimistic Ethereum (OE). Even though the size limit remains 24kb, the deployment will become as smooth as on Ethereum itself.

So as the network prepares for an 14 October testnet release and 28 October mainnet release, investors are also realizing the capabilities and pitching in with the bullishness. This is the time for Optimism to make strides.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)