The only thing that Bitcoin needs as it inches closer to an all time high

Bitcoin has maintained above the $55K level for over a week now. As the king coin traded at $57,936 at press time its price was closer to a new all-time high than to the price on 1 October, 2021. This, in turn, fueled the market with high expectations that BTC will soon hit its ATH on the charts.

However, the top coin has been testing the $57,750 mark for the last three days. Its over 1% fall at the time of writing presented a similar “hit and fall” scenario wherein the asset hits a high price level and falls after facing considerable resistance.

But with the asset making considerable leaps on a longer time frame these minor drops hardly seemed to concern the larger market. In fact, looking at the long-term rally in perspective, there were a bunch of bullish signs that confirmed BTC’s momentum this time.

Metrics favoring a run to ATH?

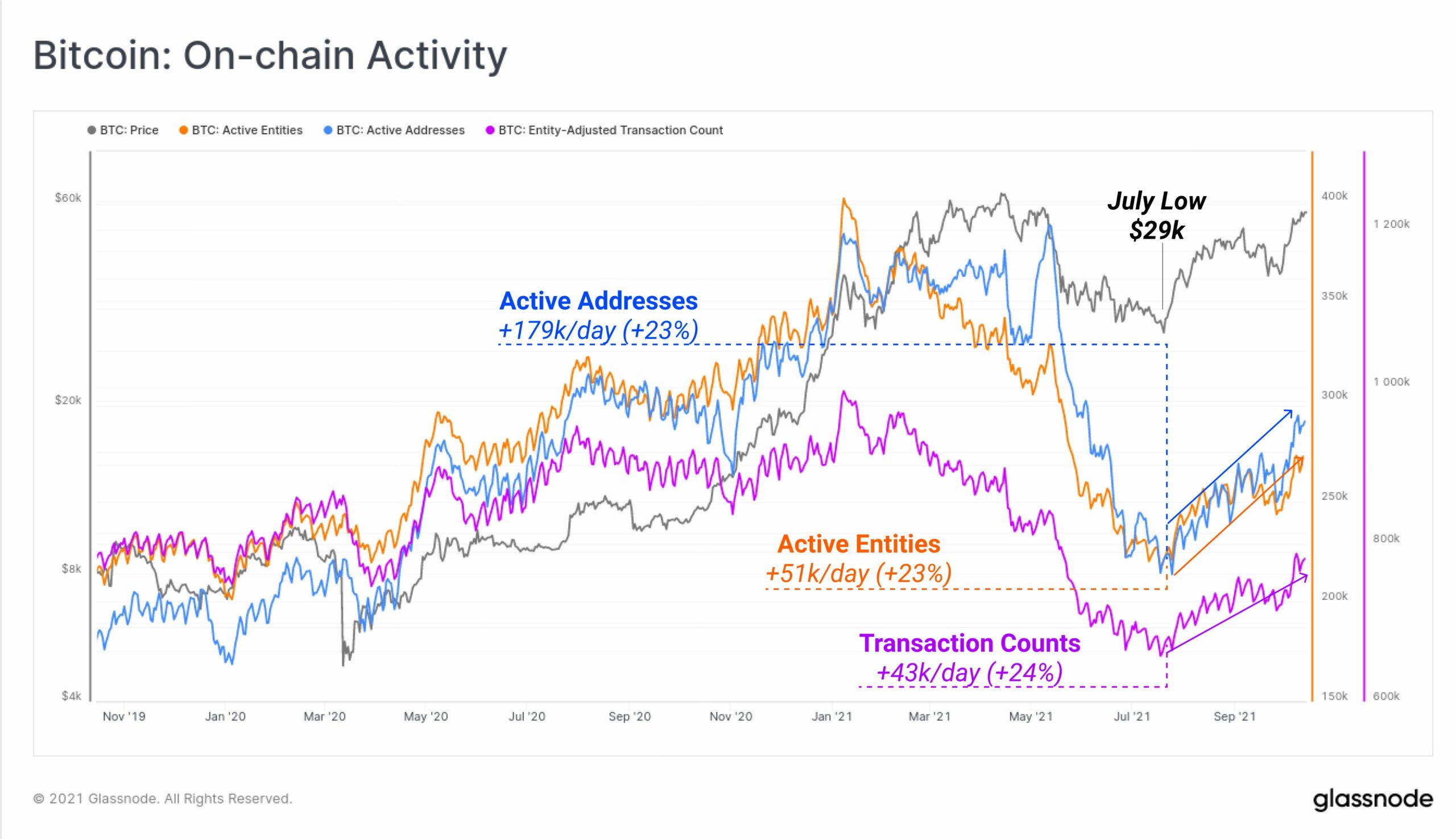

Bitcoin finally broke over the $58K level on October 14 after consolidation between key Fibonacci levels. The price rise was supported by growth in key metrics noting consistently high on-chain activity from August till October.

As per Glassnode, many activity metrics were up by approximately 24% since the $29K low. Bitcoin’s Active Addresses were growing at the rate of 179K per day while Active Entities saw a 51K rise per day. While BTC’s Entities Adjusted Transaction Counts saw a 43K growth per day.

BTC on-chain activity growth | Source: Glassnode

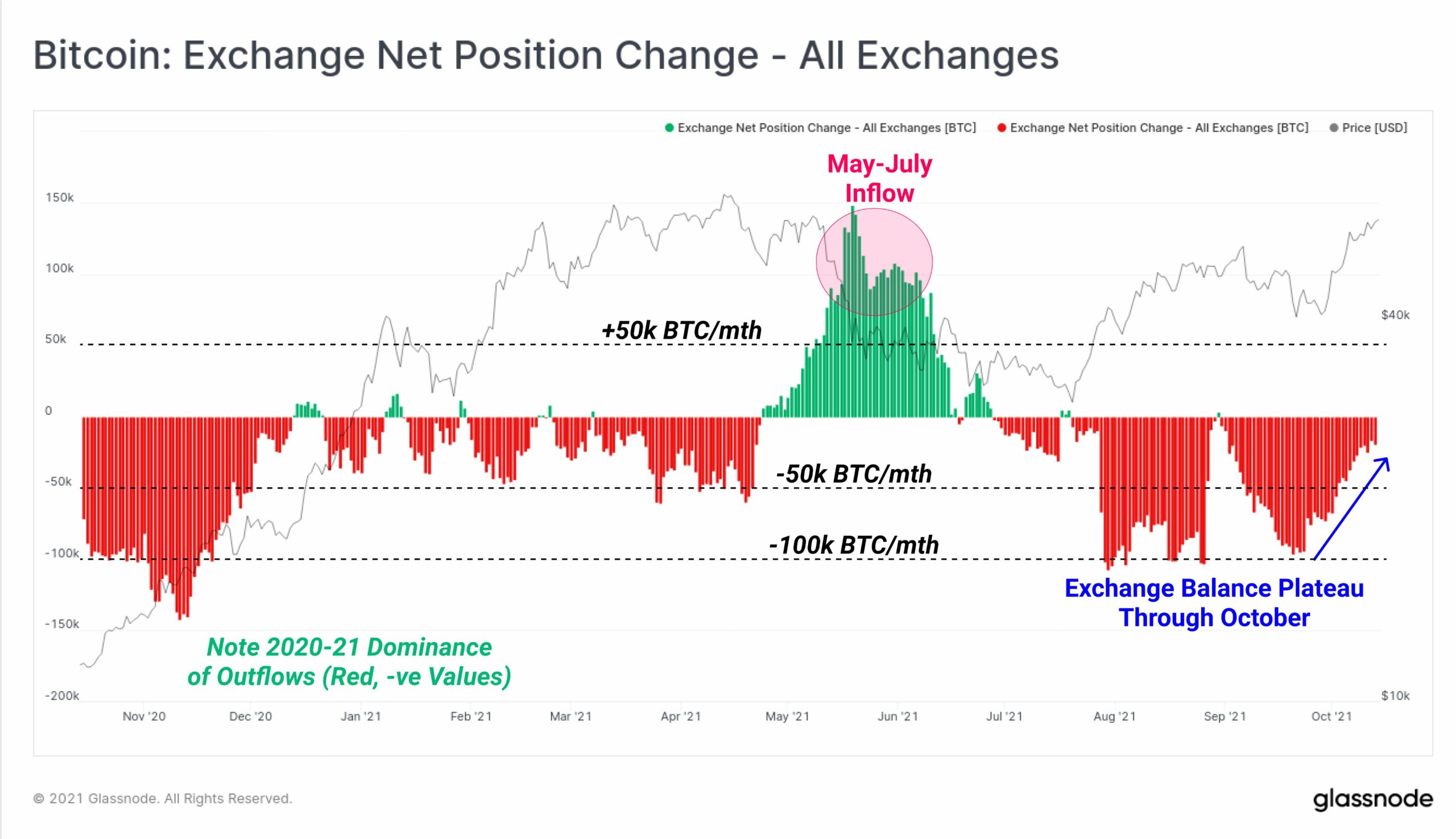

Further, Bitcoin balances on exchanges have plateaued throughout October. The total exchange balance till October 14 is around 2.45 million BTC, which is roughly equivalent to the August 2018 levels. From the 3.11 million BTC ATH in March 2020, a total of 657K BTC have flowed out, equal to 21% of the ATH balance.

The aforementioned trend is also noticed in the Exchange net position change metric which has been in a net outflow regime since March 2020. May-July was the primary period of net inflows, however, that has been fully reversed. Exchanges are currently seeing modest outflows of around 20K BTC per month.

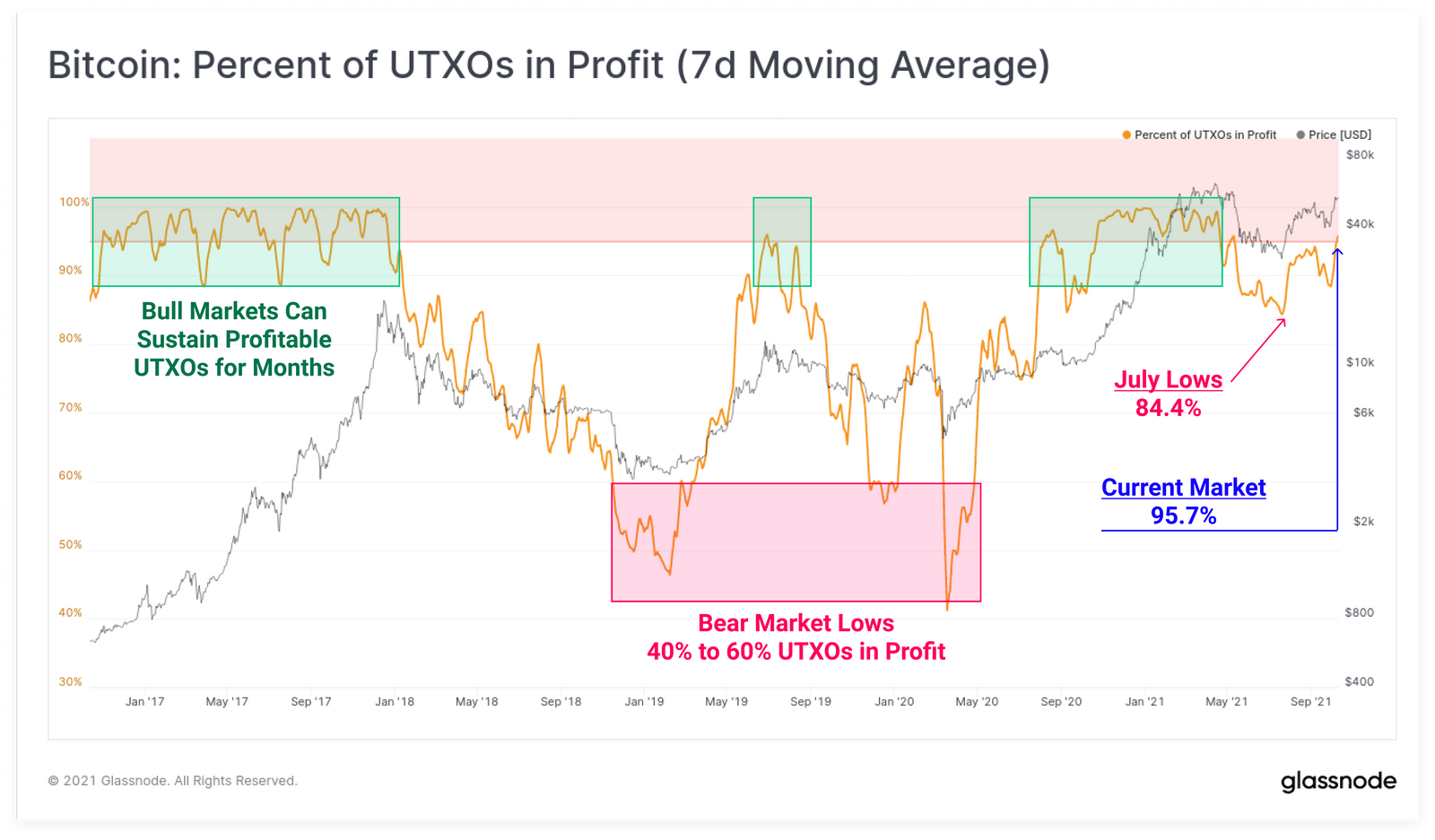

Additionally, a very large portion of the UTXO set has also returned to profit, reaching 95.7% of all UTXOs. This is an uplift of around 11.3% since the September lows. Notably, in strong bull markets, UTXOs in profit can maintain values above 90% for many months at a time.

Calm before the storm?

Data suggests that over the past few weeks, long-term HODLers have pushed the price above $42K and eventually above $50K. But one ingredient that seemed to be missing from this rally was FOMO sentiment which might be required from new retail investors.

Even though the current consolidation under the $58K level seems like the calm before the storm, BTC’s close to 40% rally in October will need proper demand volume that can put BTC in a wild place. That being said, if at all BTC sees a small correction it would be a good time to buy the dip. This could also trigger a FOMO sentiment ahead of the ATH thereby pumping a stronger move ahead.