The simple answer to what could go wrong for CRV’s bullish thesis

Curve DAO token has a future that is painted green, according to technical and on-chain metrics. In fact, different standpoints agree that CRV is ready to explode higher and revisit the $4 psychological level.

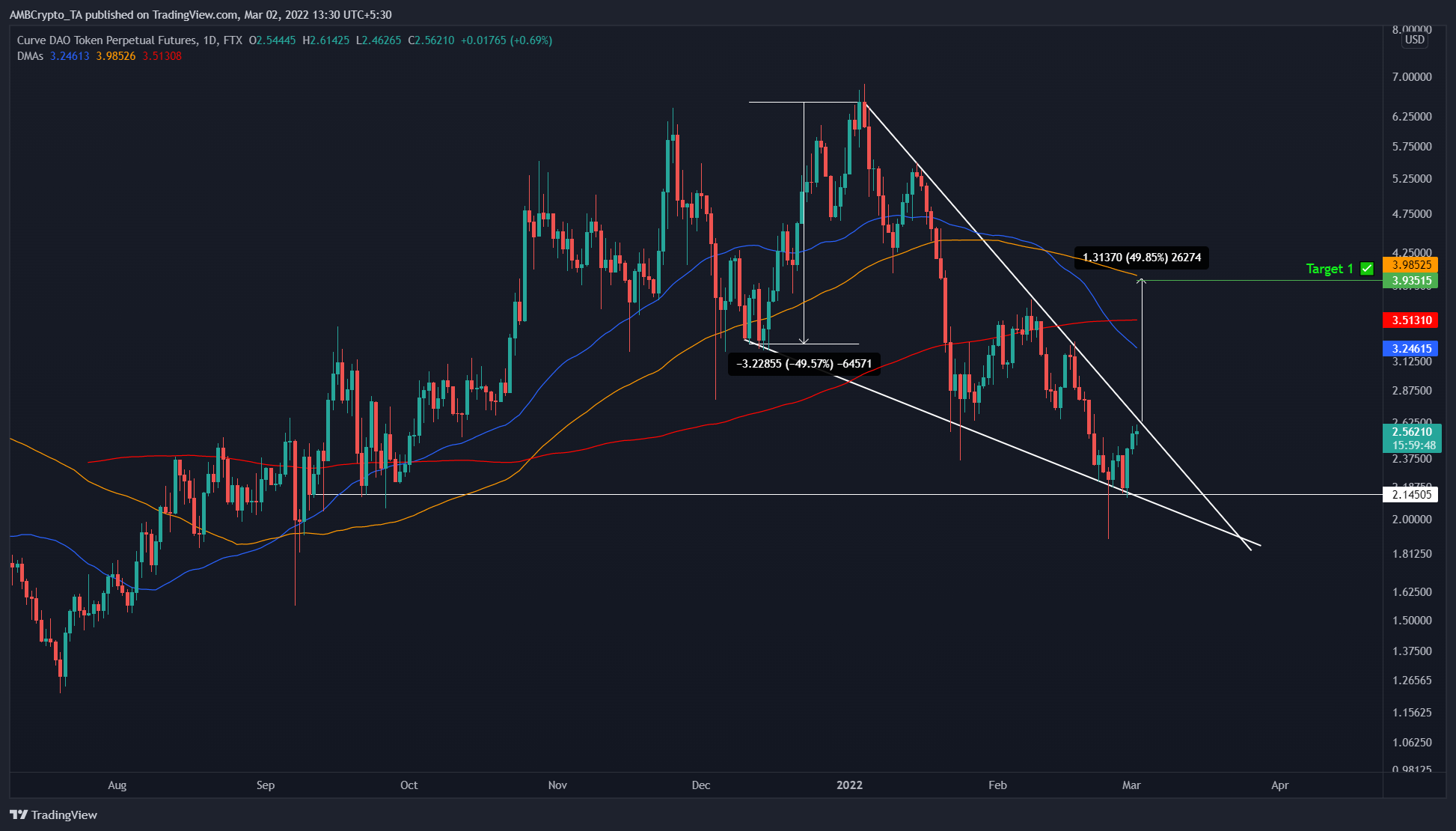

Technicals point to a 50% gain

Curve DAO token is forming a falling wedge pattern, one suggesting that a breakout could result in a bullish move. The theoretical projections seemed to indicate that CRV should rally by 50% and tag the $4-level.

The Market Value to Realized Value (MVRV) model is an essential technical indicator used to assess the average profit/loss of investors who purchased assets over a particular time frame.

In this case, we will be assessing the average profit/loss of investors who purchased CRV over the past month and year.

Readers should note that any value below-10% indicates that short-term holders are at a loss and is typically where long-term holders tend to accumulate. Therefore, a value below -10% is often referred to as an “opportunity zone.”

The 30-day and 365-day MVRV models are hovering at -12.7% and -13.52%, respectively, indicating that they are in a place where long-term investors accumulate. Hence, this index lends credence to the bullish thesis explained above.

Further supporting the optimistic narrative around the Curve DAO token is the steady decline in the supply of CRV tokens held on exchanges from 110 million to 100 million. The outflow of 10 million CRV tokens suggests that investors are optimistic about the altcoin’s performance in the near future.

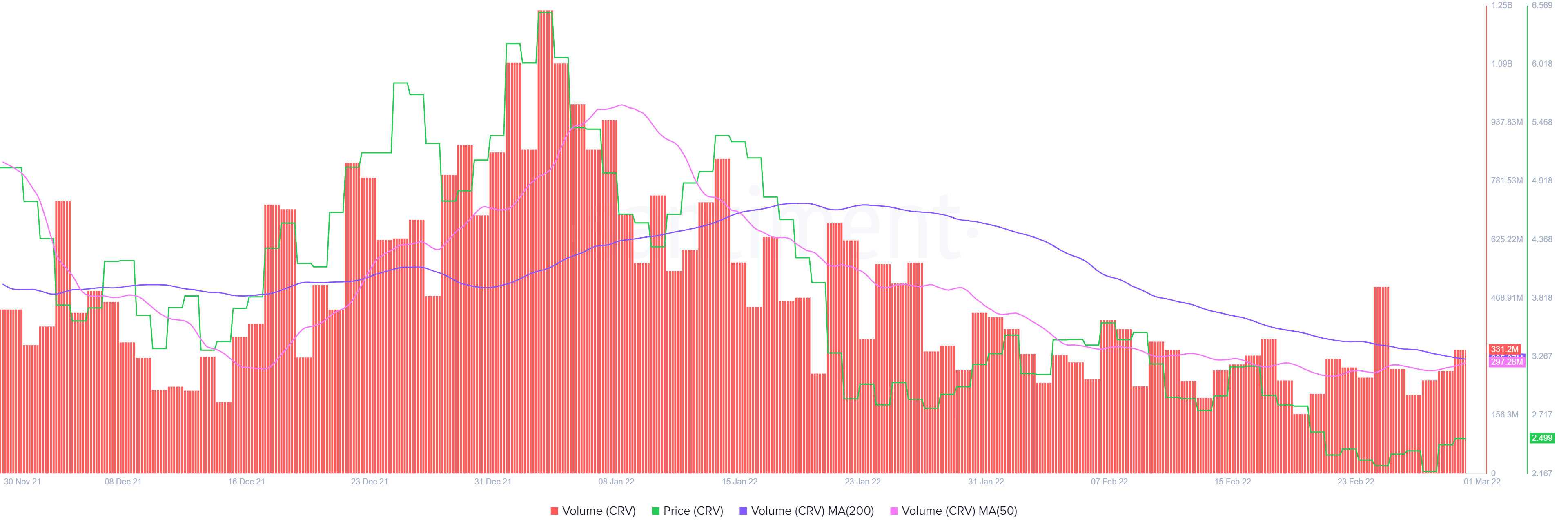

To add a tailwind to this already perfect concoction is the recent yet steady uptick in on-chain volume for Curve DAO token. This index has increased to 350.42 million CRV, just above the 200-day moving average at 304 million.

Interestingly, the 50-day moving average is creeping higher and approaching the 200-day moving average, hinting at a bullish crossover.

While all signs point to a bullish outlook for the Curve DAO token, investors should consider a wildcard scenario that knocks this scenario on its head.

If Bitcoin’s price crashes, all altcoins, including CRV, will follow its lead. In such a case, if CRV produces a daily candlestick close below $2.14, it will create a lower low and invalidate the falling wedge’s bullish thesis.