The true scope of APE & MANA’s correlation with Bitcoin for investors

With bullish momentum starting to wane across the cryptocurrency market, analysts hold varying views on whether the bear run in June brought in the bottom or not.

With the total cryptocurrency market capitalization pegged at $1.064 trillion at the time of writing, a mere 1% growth has been logged by all crypto-assets this week. On the contrary, the figure for the same was 6% in July’s first trading week.

At press time, Bitcoin (BTC) had declined by 17% over the past week to be spotted at $22,994.74. With most crypto-assets sharing a correlation with the king coin, their prices are mostly impacted by how BTC fares.

According to data from CryptoWatch, leading metaverse tokens, Apecoin (APE) and Decentraland (MANA), share a positive correlation with BTC. Hence, they have also not seen much traction over the week.

Wherever BTC goes, APE & MANA follow

Over the last 7 days, key stakeholders holding the king coin have shed part of their holdings. This category of whales holds between 10,000 to 10,000,000 BTCs in their portfolios. With a total of 2.95 million BTCs held by these addresses, a 1% decline was recorded over the aforementioned period.

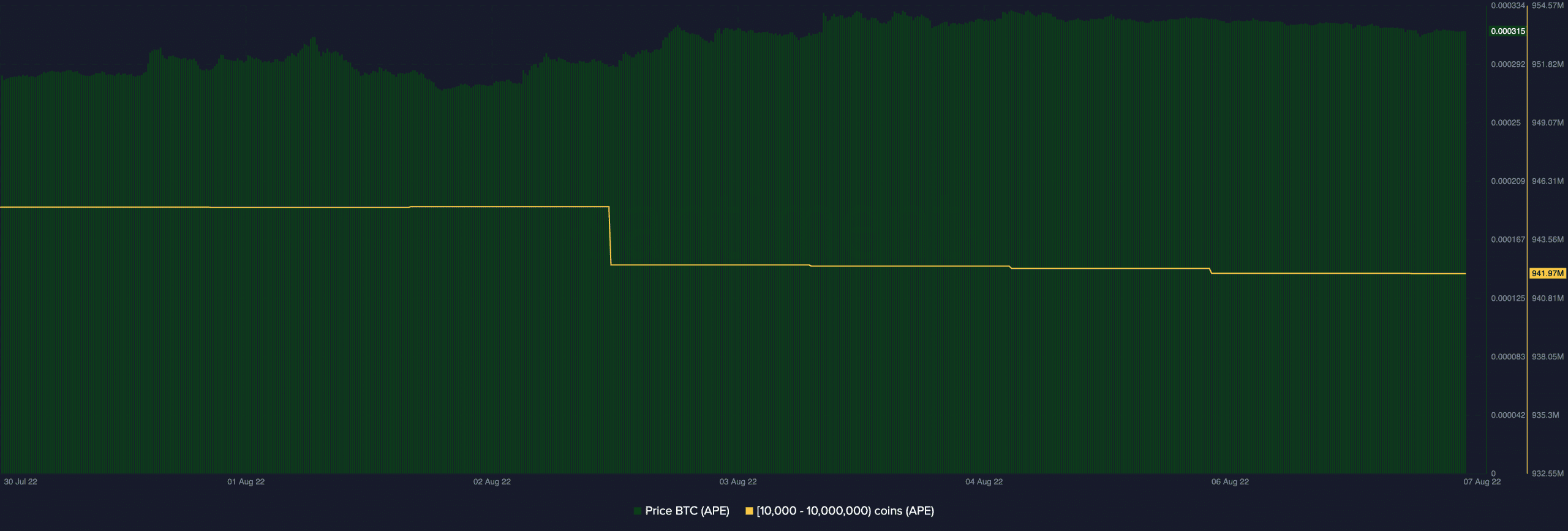

For APE, addresses holding between 10,000 to 10,000,000 APEs held 941.97 million APE tokens, as of this writing. Seven days ago, this stood at 945.09 million – Representing a 0.33% decline in whale APE holdings.

After key stakeholder holdings rose to a high of 814.02 million MANA tokens on 1 August, this soon dropped by 0.5%. In fact, the same was pegged at 810.3 million at press time.

Over a 30-day window, the price per BTC rose by 9%. Taking advantage of the price rally, some investors made a profit as the coin’s 30-day MVRV hiked to +2.364%.

Treading a similar path and registering a 41% price uptick in the last 30 days, APE’s 30-day MVRV rose to 10.04%, showing that a sizeable number of holders took profits.

MANA was no different as its price rallied by 14% in the last 30 days. Its 30-day MVRV was spotted at a positive 8.109%, at press time.

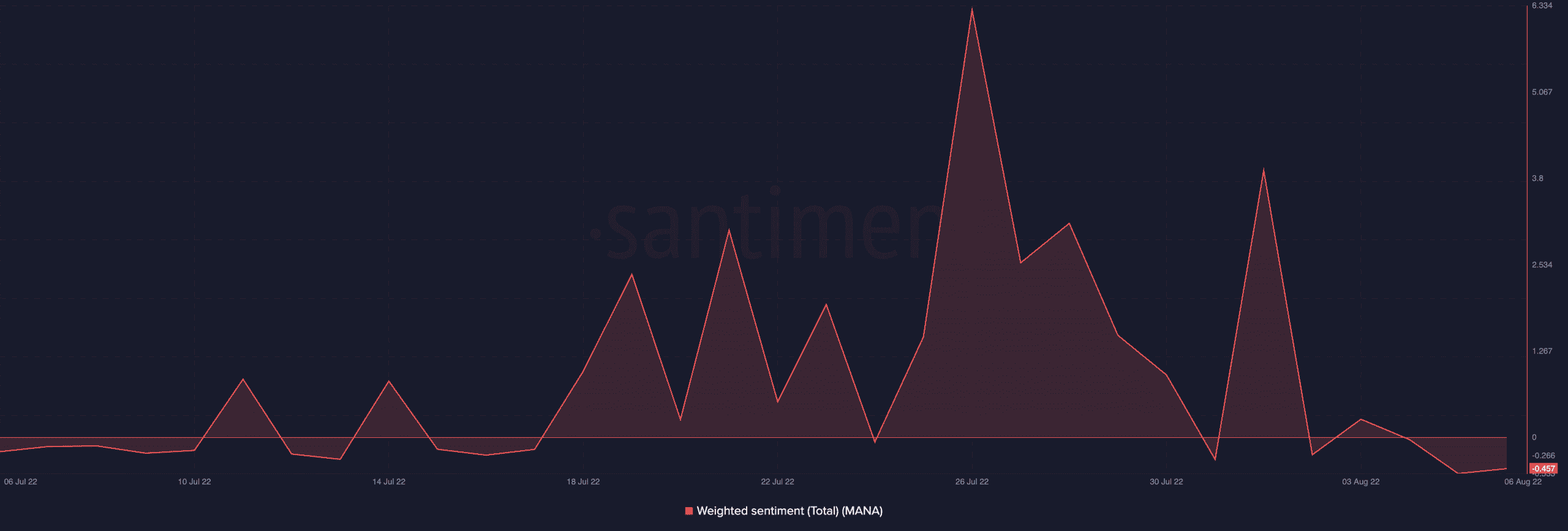

Furthermore, on the social front, BTC and MANA recorded negative weighted sentiments at press time.

With a figure of -0.52 on 5 August, MANA logged the lowest weighted sentiment it has seen in the last 30 days.

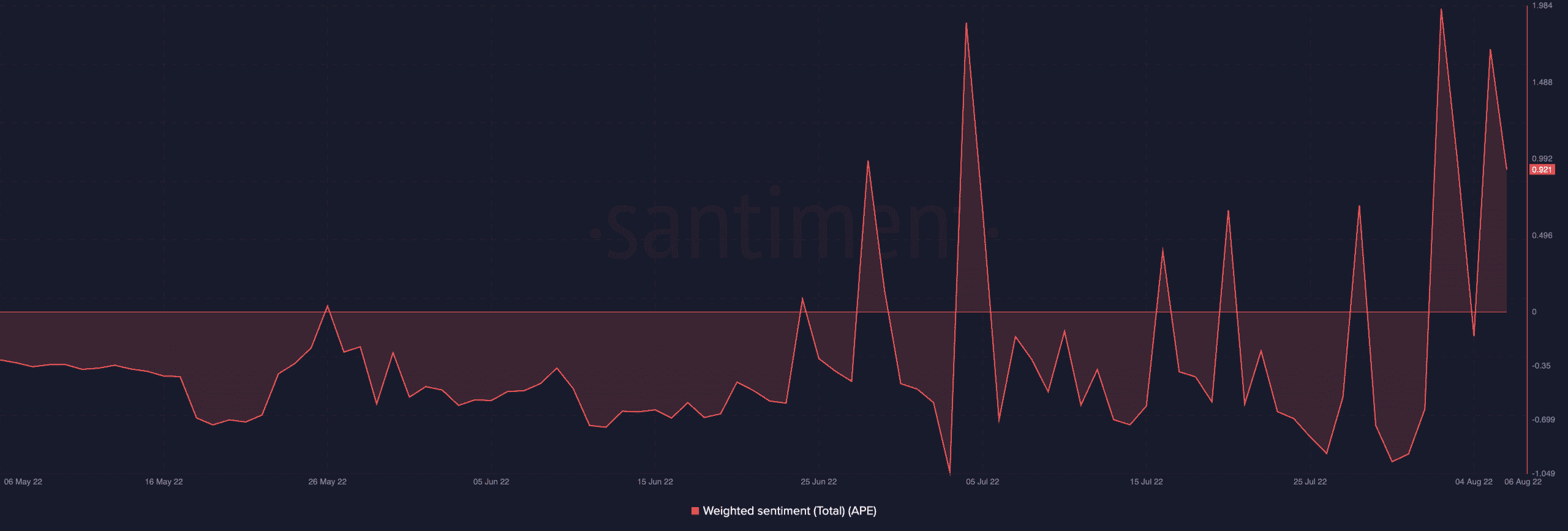

On the other hand, APE registered a positive weighted sentiment of 0.921. Additionally, the token recorded a weighted sentiment of 1.96 on 2 August, the highest value the token has seen in the last three months.