The truth about Ethereum’s status and why this is ‘definitely on the table’

From an ATH of $4,356 over two months ago, ETH, the world’s largest altcoin, was down by over 55% on the price charts until a few days ago when the crypto touched the $1,810-mark. Since then, the crypto has recovered, hiking by 15% in a matter of days to consolidate between $2,000 and $2,500. However, the question remains – Where does Ethereum go from here, and is this decline likely to continue?

As always, there is no easy answer. After all, the altcoin’s charts seemed to have a mix of bullish, bearish, and neutral signals, with on-chain metrics pointing to the same as well. In fact, the same was recently highlighted by Santiment’s latest report on Ethereum.

At the time of writing, on the back of the aforementioned hike, recovery was in order, with indicators such as the Parabolic SAR pointing to the initiation of an uptrend. However, such an uptrend had only just begun and it’s probably too soon to say whether it is sustainable. What can be observed though is selling pressure has fallen of late too.

How did that come to pass? Well, simply because Ethereum’s fall under $1,850 precipitated a hike in buying pressure, something fueled by the altcoin’s on-chain metrics.

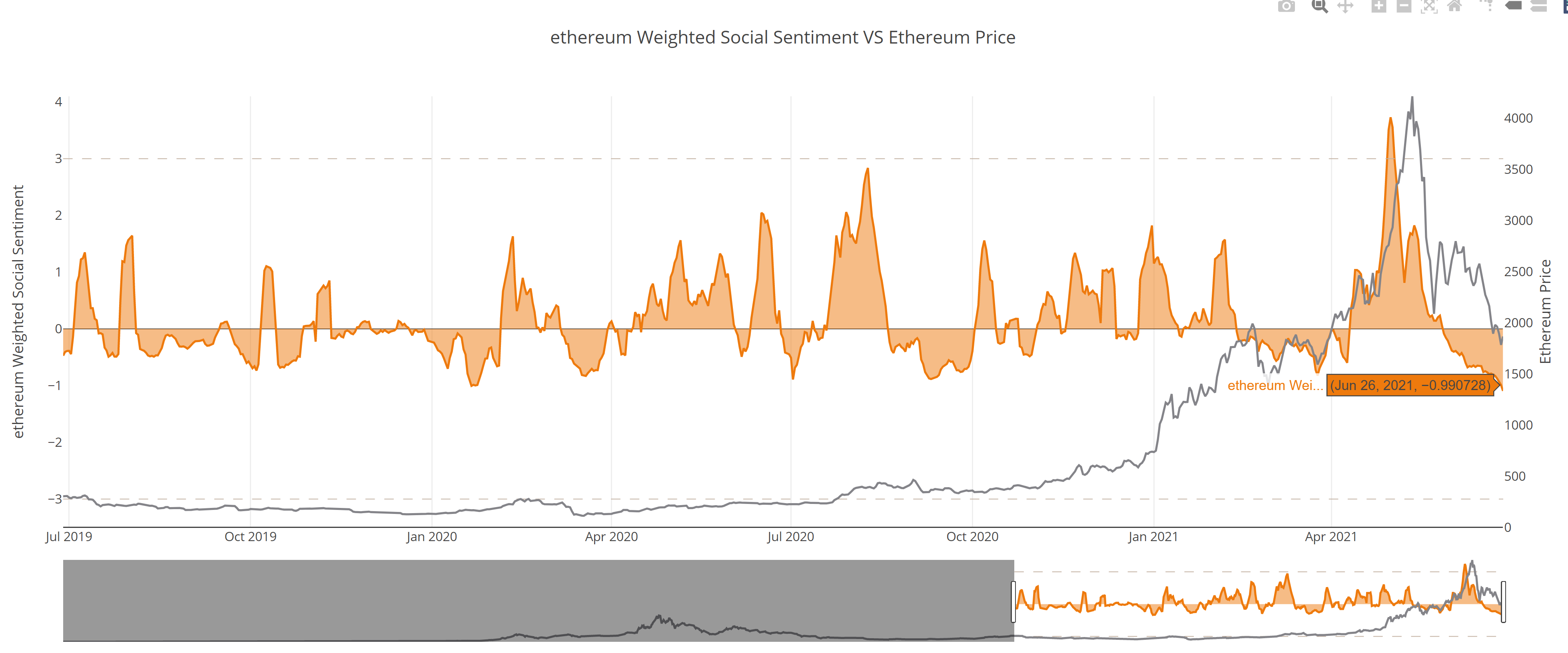

Consider something as basic as Weighted Social Sentiment. When ETH hit the said level, it was at a “historical low.” Speaking of history, however, this low was seen by the market’s traders as a great potential buying opportunity. Needless to say, they soon bought in.

Source: Santiment

The 30-day MVRV came to a similar conclusion as well, with Santiment’s report finding,

“An average MVRV (30d) of -16.9% implies a less risky opportunity to buy than normal.”

The report in question also found that,

“ETH fees are at their lowest point since December 2020, clearly allowing more flexibility for users to move assets.”

Source: Santiment

What’s more, at the time of writing, Ethereum had also touched a historical milestone, with the altcoin’s unique address activity surging above Bitcoin’s for the first time ever. While talks of Ethereum “flippening” Bitcoin have died down of late, the world’s largest cryptocurrency is still struggling somewhat to recoup its old market dominance.

The fact that ETH’s address activity has finally sustained a lead over BTC’s could be a sign of more and more people moving into altcoins like Ethereum at the moment, despite its recent price performances and thanks to the notion of being undervalued attached to it.

That being said, there have been a few bearish signs, however.

For instance, the supply of ETH on exchanges has risen considerably of late – A possible sign of ETH being moved for the purpose of selling. Also, as per the NVT ratio, “Token circulation has dried up heavily compared to market cap.”

Source: Santiment

In conclusion, it’s probably too soon to say whether Ethereum has finally halted its slide down the price charts, especially since the aforementioned metrics still had shades of red.

Then again, the aforementioned are meant for the short-term alone. The world’s largest altcoin, in the long-term, thanks to a host of expected developments, remains as bullish as ever. In fact, some believe the community is “not bullish enough” on ETH.

During a recent appearance on Bankless, for instance, DC Investor gave his take on where he sees the altcoin by the end of this market cycle.

“Through the end of this cycle, we’ll probably see a 10k to 30k Ether. And, I know those are big numbers, but there can be real speculative mania in this market and it can exceed what we’ve seen already.”

Anthony Sassano agreed with the said projections, with Ethhub’s co-founder adding, “Within 5 years, a 100k Ether is definitely on the table,” especially since “the fundamentals for Ethereum haven’t changed at all during this downturn.”

Ergo, it would seem that for most, the only direction for ETH to go is Up.