This Chainlink trend can affect its price movement

In the current market crash, with a drop in the price of several altcoins, LINK’s price was at the $18.91 level. Based on the price trend and charts, LINK does an 18-month cycle and repeats again but within a new price discovery range. This has been observed on the price chart and on-chain metrics like increase in the number of active addresses and demand across exchanges have exhibited the same trend.

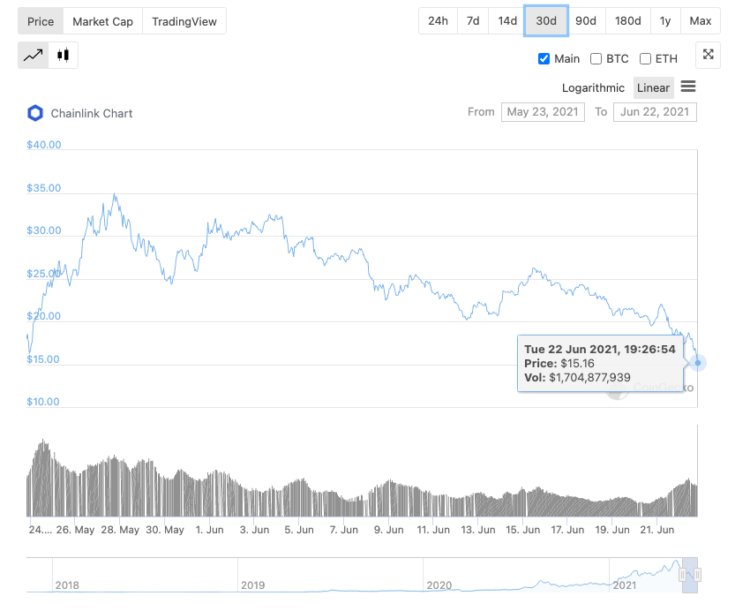

LINK Price Chart | Source: CoinGecko

Based on the above price chart, the price is headed towards the 30-day low if the consolidation were to continue. At this price level, there are more traders both retail and institutional who bought LINK in the past week. Besides, after hitting 0.5 Million in total wallets and $2.62 Billion in investment inflow in the past week, LINK’s price was more likely to recover from the drop.

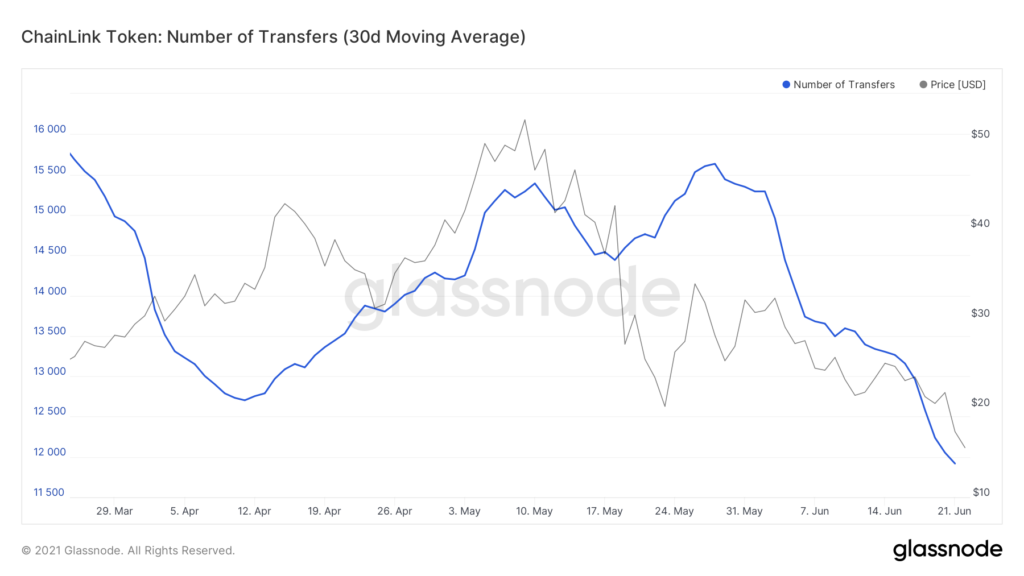

Additionally, at the $15.91 level, LINK maybe somewhere in the middle of the current recovery, and the crash may not have yet set in. The number of transfers per second noted a cyclical trend with the biggest spike being in September 2021 at the end of DeFi Summer.

LINK total number of transfers || Source: Glassnode

The cyclicality seems to mainly revolve around two important zones: accumulation and expansion. We are in the accumulation zone based on the number of transfers and the trends seen before in the chart. When the velocity of LINK token on-chain dropped in the expansion zone, the price rallies. Based on this and other metrics, traders are bullish for LINK in the following 4-6 weeks.

Additionally, LINK’s popularity has increased since the beginning of 2021. As there aren’t many smart contracts using predefined conditions with widely needed capability across Defi and other hybrid smart contracts. Chainlink Keepers provide a decentralized and reliable way to make sure that critical smart contract functions are executed effectively. This is another reason why analysts are bullish on LINK in the long term and so are the HODLers, based on the fundamental analysis and the on-chain metrics.