This could pave Ethereum’s path to $4300

Top altcoin, Ethereum was trading at $3800 after an exponential rally amid which it tested the $4,000 psychological level on September 3. It has managed to stay strong, keeping well above $3750. It it manages to recover above $3,860, a retest of the all-time high would be next on ETH’s cards.

So, how far can the Ethereum rally go? The answer to that can be found in the following metrics.

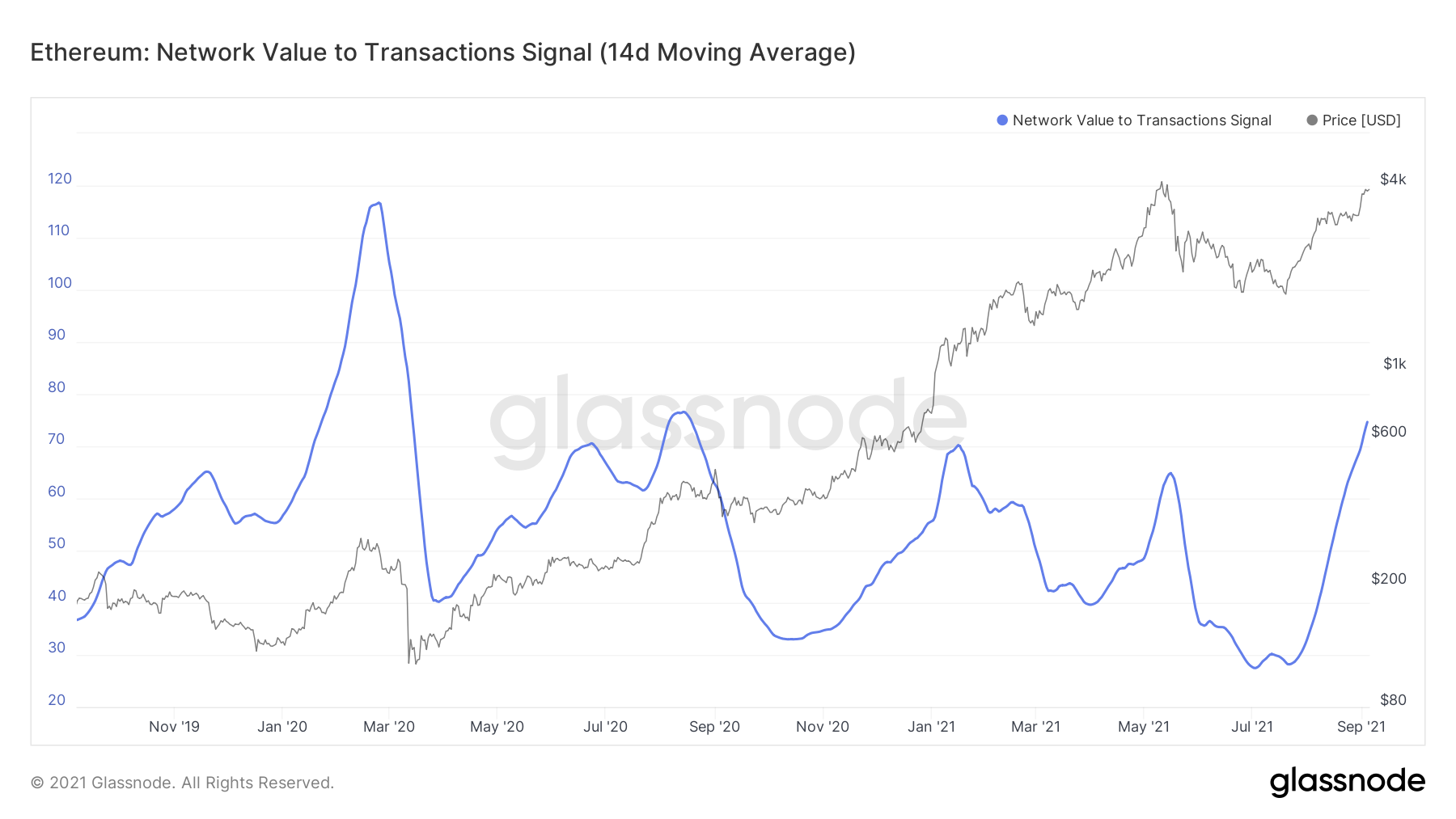

Highest network valuation in over a year

Ethereum’s NVT signal (14 day MA) recently reached a 17 month high, last seen in August 2020. A high NVT value suggests that the network valuation is outpacing its transaction volume. When NVT is high, the network value is well above the value being transferred on the network, while it may represent a potential bubble, in the case of Ethereum it represented legitimate growth stages, alongside strong price action.

Notably, over the past two years, whenever the NVTS saw a parabolic growth, Ethereum showed a sustained rally with massive price gains. A similar trend was observed towards the beginning of January 2020 when Ethereum rose by almost 140% in just a month.

Interestingly, this time too, a 140% rise from a low on July 20 will take the alt near $4300 which is around an ATH of $4,337.10. Thus, a strong NVTS trajectory with about 140% in gains could take ETH to its ATH and maybe above, it if the rise in NVTS continues.

However, a fall in Ethereum’s active addresses taking it to an all-time low of eight months is a worrying trend but a push in active addresses can push the rally further. A rise in active addresses, before ETH sees its ATH, would be crucial.

The future of ETH futures looks good

Apart from the high network value, other factors influencing ETH’s price are the open interest and daily volume of ETH futures. Based on data from Skew, ETH options volume was increasing during the last week. In fact, on September 1, Ethereum saw the highest peak in options volumes followed by another small peak two days later.

Further, Ethereum’s Open Interest in Perpetual Futures contracts reached a 13-month high of $589,275,968.65 on Okex. On other exchanges too, ETH futures’ aggregated open interest was high, with the total being close to its May ATH of 10.9 billion. At press time, the total Futures Aggregated Open Interest stood at 10.6 billion. Those looking for profits in Ethereum might find the derivatives market, an alluring opportunity.

ETH’s path to ATH

The top altcoin reaching its ATH will be critical to the rise of Defi, NFT marketplace tokens, and other altcoins. Further, ETH could increase the overall market capitalization of Defi with several projects following ETH closely in terms of price action and correlation. For now, ETH was around 30% away from its ATH. However, a push from spot traders and a rise in active addresses could ensure its journey upward.