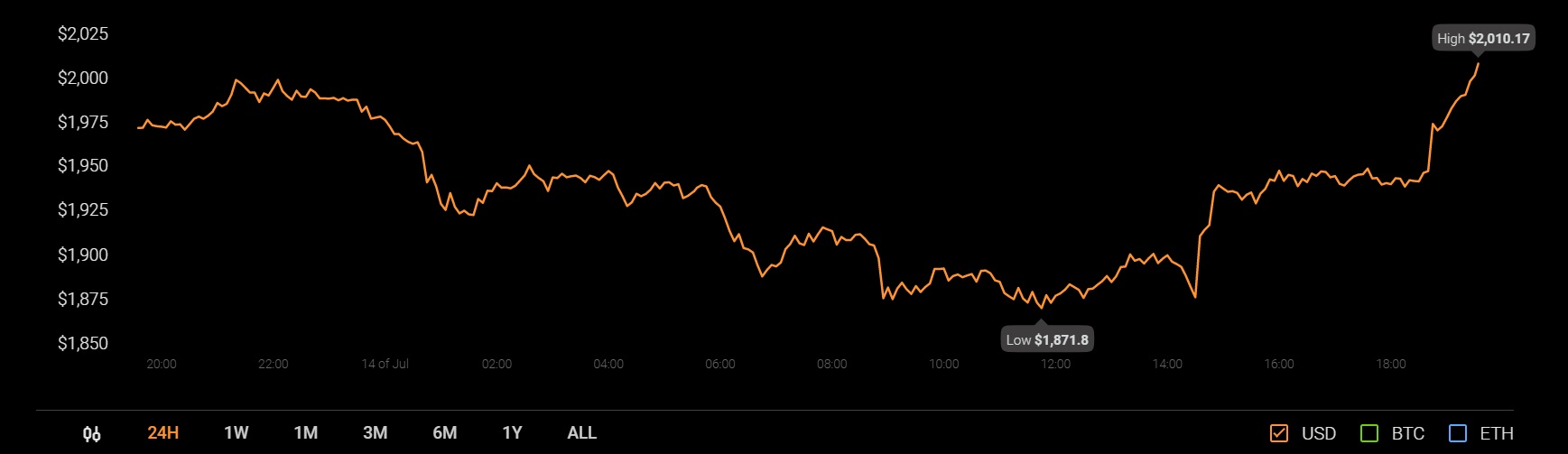

This early-year interest can still push Ethereum’s price to new levels

NFTs or Non-Fungible Tokens took the entire industry by storm when Beeple sold an NFT for $69 million in March 2021. With the bull run predominantly active at that time, Mike Winkelmann or Beeple claimed that he had identified NFTs as the next chapter in art history. However, the buzz has somewhat fizzled out over the past couple of months.

With Bitcoin and Ethereum free-falling alongside the rest of the market, NFTs are not being talked about anymore at the moment, and we are again possibly in a pre-NFT existence market. That is only half correct though.

Are NFTs here to stay?

Source: DappRadar

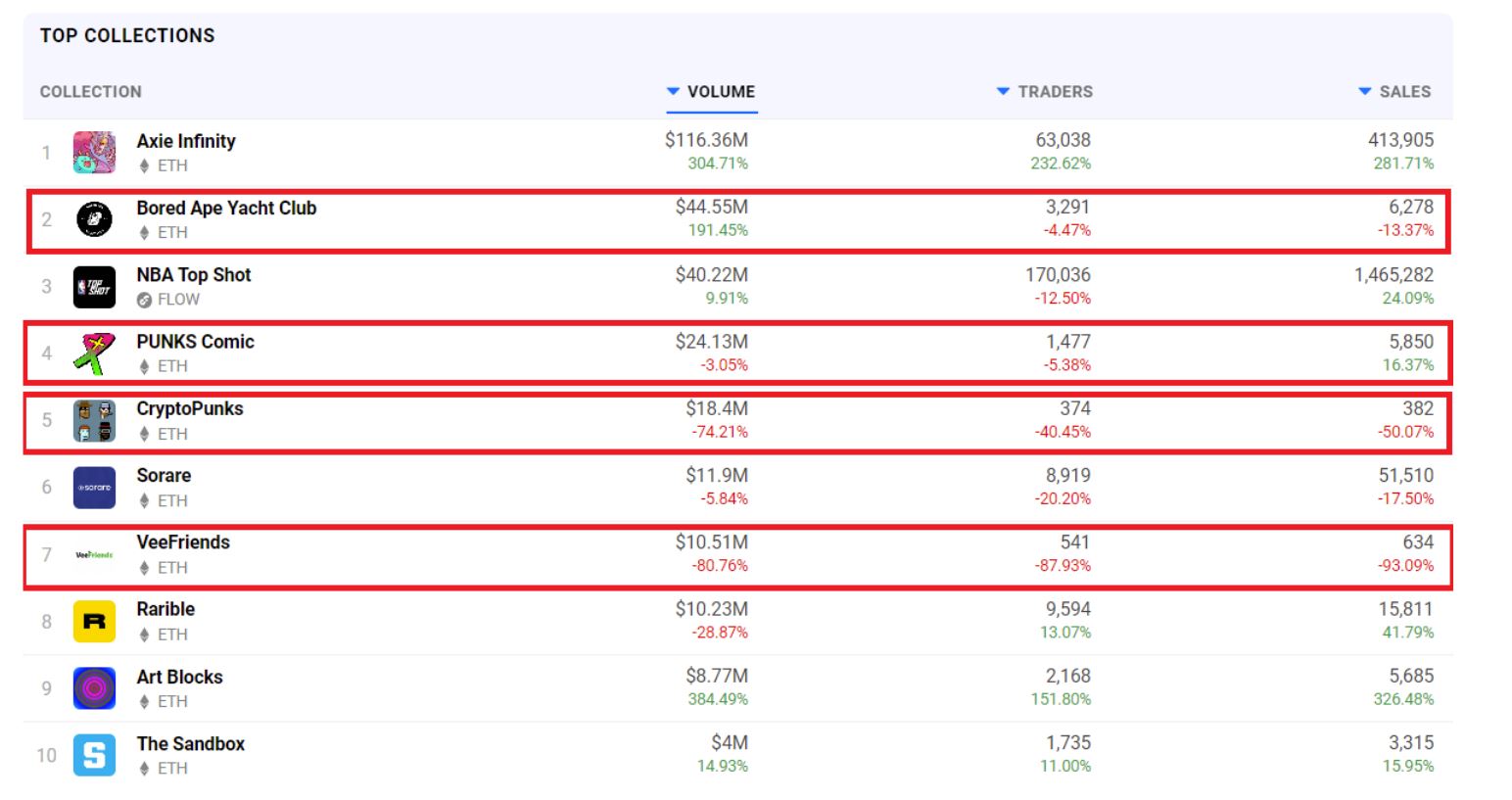

According to data, just like the DeFi craze, Google trends worldwide for NFTs have significantly dropped since the bearish market took over in May. NFT’s last major product, NBA Top Shot’s volume, declined quarter by quarter, dropping down by 66.87% in Q2 2021. Additionally, Ethereum’s collection that transacted over $95 million by the end of the last quarter plummeted to a mere $16 million in June. And yet, that wasn’t all.

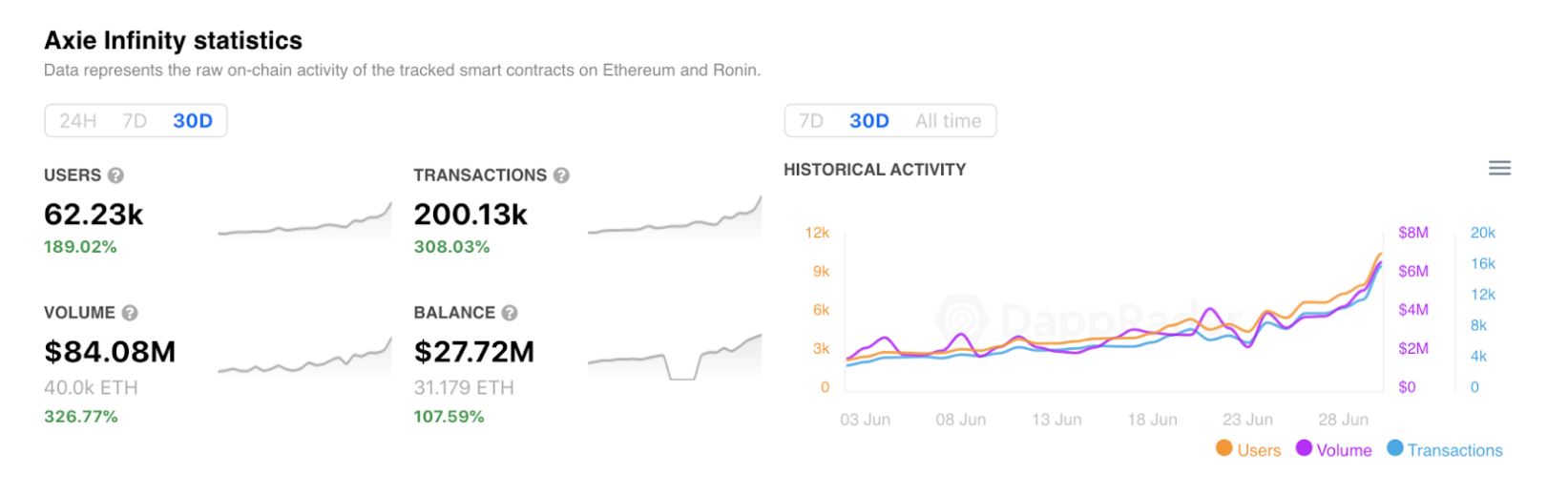

According to statistics from DappRadar, based on current NFTs sales, the number of unique wallets has increased by a whopping 111.46%, and the number of sales has spiked up as well. The rally was led by a Play-to-earned game called Axie Infinity, one which recorded more than 62,000 unique wallets in 30 days.

Now, one of the key success stories behind Axis Infinity is Ethereum’s sidechain Ronin, one which allows users to interact with the Axis universe gas-free.

And, it isn’t only Axis rising in the rankings. NFT-based games are leveling up as well, with the likes of Alien World seeing $356 million in transaction volumes over the past month.

Now, Ethereum’s own marketplace dropped by 47% in volume over Q1 on Q2, but solely on a monthly basis, it was up by 46.24% in traders and 5.32% in volumes.

The Case with Ethereum; fleeting but evident?

If the above chart is observed once again, it can be observed that most NFTs were paid through Ethereum besides NBA’s Top Shot. The space has come far ahead from its time with CryptoKitties, but the current appeal with NFTs is different, and it is not far-fetched to suggest that its activity can take Ethereum’s adoption to new heights as well. Hear me out.

DeFi in 2020 bought the industry closer to different financial outlooks and banking systems, which although remain only shaky standards, worked from a point of decentralization. Its impact eventually immersed into Ethereum, and the same could be taking place with NFTs.

NFTs can bring a new side to the industry, a new generation of individuals valuing the essence of digital art. With Ethereum, the supply side of the picture makes sense since all major digital art auctions are performed on Ethereum, not Bitcoin or any other crypto-assets. It means that Ethereum’s ERC20 tokens are suddenly the gold standard for tracking digital artwork ownership.

It is self-assuring that while the NBA’s Top Shot was paid by FLOW tokens, its blockchain links all $350 million of the NBA’s Top Shot NFT sales on the Ethereum network.

With NFTs possibly becoming relevant in the space, it can’t be ignored that just like DeFi, it is possibly going to create another drive for Ethereum’s value because ETH has moved first, and moved fast in its development. History suggests speed has often meant profitability.

Source: Coinstats