This Ethereum development could favor long-term investors, according to…

- New report suggests that Ethereum could be affected by sell pressure due to upcoming hardfork

- Number of large addresses on Ethereum continued to grow while top traders took long positions on ETH

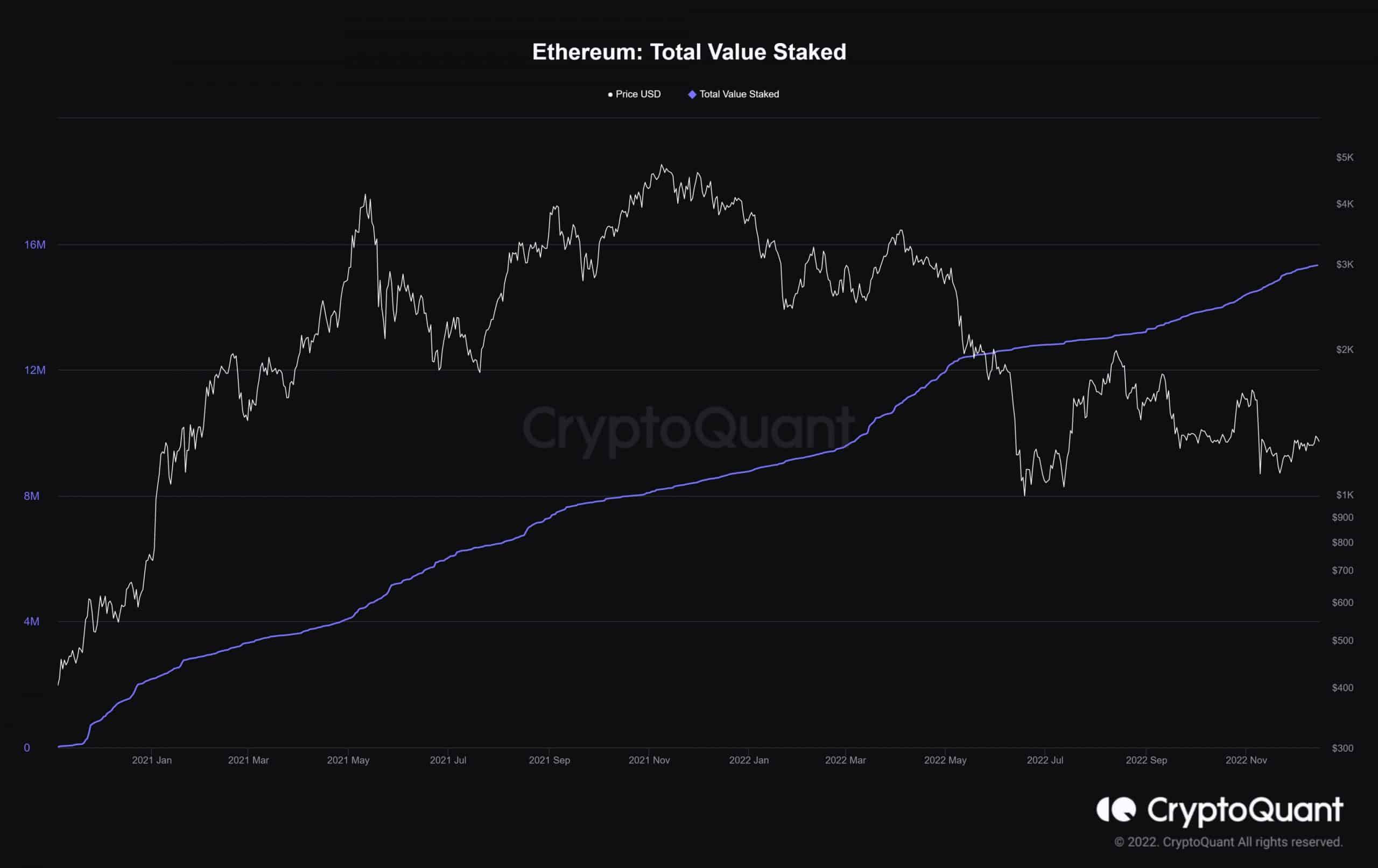

According to CryptoQuant, a crypto analytics firm, Ethereum [ETH] could face a mass selling event in the next few months. This event could be triggered by the Shanghai Hardfork that will occur in March 2023.

? $ETH Mass-Selling Event Is Coming?

1/ The #ETH2 Deposit has amassed, holding 12% of the total supply.

As the $ETH exchange reserve drops down to 15% of the total supply and continues to decrease,

What will happen on $ETH after the Shanghai Hard Fork??https://t.co/RrFQrLPeda pic.twitter.com/CrWhqSbxPn— CryptoQuant.com (@cryptoquant_com) December 16, 2022

Read Ethereum’s [ETH] Price Prediction 2023-2024

The Shanghai Hardfork will allow stakers and validators to withdraw their ETH from Ethereum’s beacon chain. According to data provided by CryptoQuant, 12% of the overall Ethereum supply could be withdrawn by stakers after the hardfork took place.

These stakers continued to grow. Their number increased by 4.25% in the last 30 days, according to Staking Rewards.

Events such as hardforks increase the volatility present in the market. As was observed during the Merge, Ethereum’s price plummeted after the event, according to data provided by CryptoQuant.

If the same were to happen after the Shanghai Hardfork, it would interfere with and change the supply and demand dynamics for ETH, which could lead to increased uncertainty.

6/ After the Merge, the supply began to decline; 0.1M?

The supply and demand dynamics will shift after the fork, $ETH price volatility is imminent.

Will #Shanghai trigger mass-selling?

Or is it an opportunity that provides more liquidity to buy more $ETHhttps://t.co/BeARRlcN4e pic.twitter.com/y09OdkC6z7— CryptoQuant.com (@cryptoquant_com) December 16, 2022

The current state of Ethereum

Despite the uncertainty that could ensue from the upcoming hardfork, large addresses continued to show faith in Ethereum.

Information gathered by Glassnode revealed that the number of addresses holding over 10 ETH increased, and reached an all-time high of 348,743 at press time.

However, the same sentiment wasn’t shared by retail investors. Additional data from Glassnode showcased that smaller investors were shying away from buying Ethereum. This was because the number of addresses holding 0.1 Ethereum reached an 18-month low of 5.13 million addresses.

? #Ethereum $ETH Number of Addresses Holding 0.1+ Coins just reached a 18-month low of 5,137,105

Previous 18-month low of 5,137,296 was observed on 12 December 2022

View metric:https://t.co/rW81qhwy4d pic.twitter.com/tQyhuPwkXE

— glassnode alerts (@glassnodealerts) December 16, 2022

‘Long’ing for ETH

Alongside large addresses, major traders also started showing interest in Ethereum.

The number of long positions made by top traders witnessed a massive spike over the past few days. As of press time, 65% of the overall traders were long on Ethereum.

It is yet to be determined whether the traders were right to have an optimistic outlook on Ethereum.

At the time of writing, ETH was trading at $1,181.19. Its price fell by 7.45% in the last 24 hours, while its volume increased by 89.88% during the same period, according to CoinMarketCap.