This fact makes Ethereum’s current rally different this way

Ethereum’s rally to $3000 has more volatility than observed last week. In the past 24 hours, the price was up over 9%. Despite this according to analysts, Ethereum continues to remain undervalued. With a high correlation with Bitcoin, Ethereum’s rally is expected to be a long and sustainable one this week.

Bitcoin hit $40000 after recovering from last weekend’s drop and the rally continues with an increase of 8% in market capitalization. In the case of Ethereum, the market capitalization is up nearly 10%. The 24-hour trade volume has dropped and this could be indicative of dropping Ethereum reserves across exchanges.

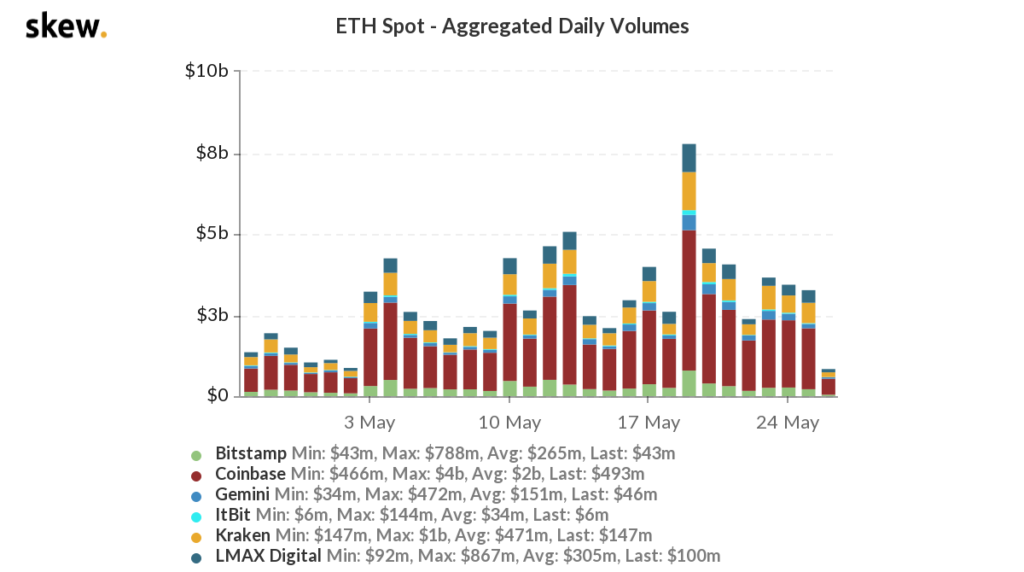

ETH Spot Daily Volume || Source: Skew

Based on data from ETH, the daily spot volume has dropped after hitting a peak last week, however, it now ranges below $4 Billion consistently. Despite that, the price has recovered and the volatility is back, based on the price trend.

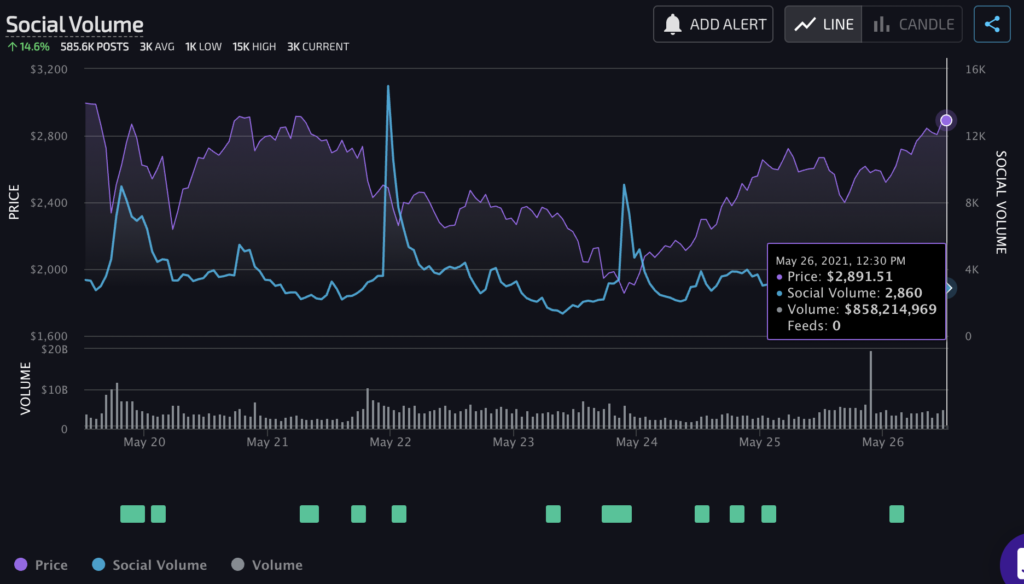

At the current price trend, 95% HODLers are profitable, this is up from 80% when the price was below at $2200 level. Additionally, the social volume is up 14% this week and the increase in social volume has had a direct impact on the price, resisting the selling pressure. The trend and the relationship between the social volume and price are evident from the following chart.

Source: Lunarcrush.com

The social volume hit a peak 3 times in a week, based on the above chart, the highest peak hit when the price was at the $2800 level. When compared to altcoins in the top 10, Ethereum has higher volatility and relatively high short-term ROI. This makes it lucrative for both long-term investors and retail traders. Besides, the increasing profitability of Ethereum HODLers is likely to change the HODLer composition and increase the % of HODLers holding on to Ethereum for over 12 months.

Ethereum has rallied several times this year since the beginning of 2021, however, this rally, a recovery from the dip is a sustainable once, since institutional demand has sustained. Grayscale’s ETH holdings are nearly at the same level, as they were when Ethereum’s price was at a peak of $4140 based on data from Bybt. The fact that institutional holdings have not tapered off, makes it likely that the current price rally will be a sustainable one.