This is what you’re missing about AAVE’s growth, price action

Impacted by Bitcoin falling into the $38.5k range again, most altcoins have had a pretty monotonous 24 hours. Such was the case with AAVE too. After witnessing a 1.4% drop over the day, the crypto was valued at $311.42 at press time. Additionally, its market cap stood at merely $4 billion, when looked at in relative terms.

Interestingly, AAVE has not been able to keep up with the profitability aspect of late. At press time, only 39.5% of the total addresses were in profit. However, at this juncture, it becomes essential to note that a significant number of market participants hold their AAVE tokens for less than a year.

According to ITB, the average HODLing period for AAVE is merely 4.5 months. Now, this clearly explains why the alt’s profitably has taken a hit.

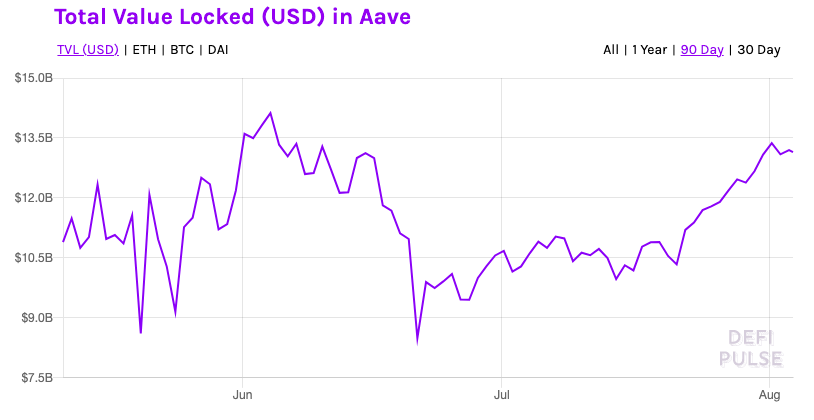

Despite the not-so-compelling numbers above, AAVE’s dominance in the DeFi space has intensified over the past few days. Its TVL has risen by an impressive $3 billion in the last 10 days alone. In fact, the press time value ($12.7 billion) stood pretty close to its ATH ($14.4 billion). By and large, AAVE’s recent TVL growth in the short run is a sign that more money is flowing into the platform. The same is a clear indication of its growth.

Has AAVE’s growth been consistent?

At the time of writing, AAVE was noting an unusual spike in its Perpetual Futures volume. What’s more, AAVE worth $597,374 USD was also seen to be traded in a matter of a few minutes. Curiously, following the same, the token’s price rose by 2.4% quickly too.

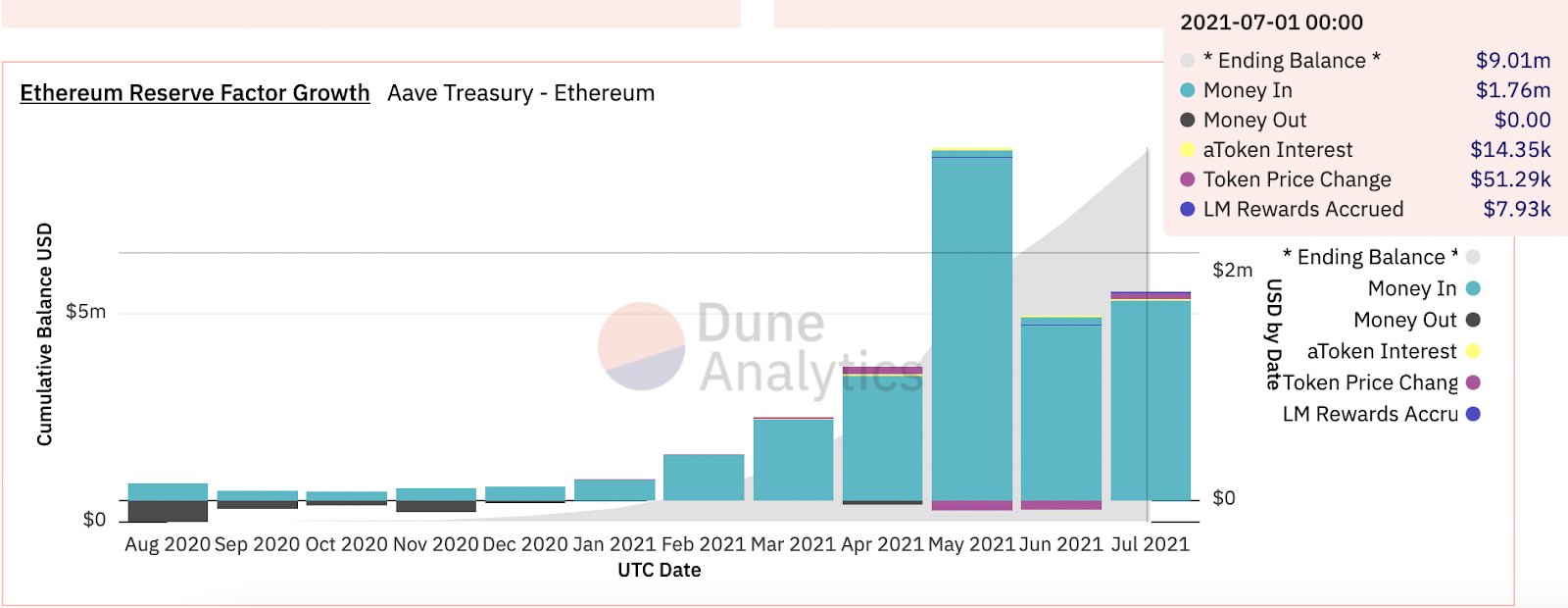

Now, Dune Analytics’ data pointed out yet another interesting growth trend. AAVE’s Reserve Factor on Ethereum touched the $9 million mark on 31 July, up by 3 times quarter-over-quarter and 55 times since the beginning of the year.

At this stage, a blind eye cannot be turned towards other L2 scaling platforms. For the past four months (April-July), AAVE’s Ethereum Reserve has earned more than $1 million in revenue, peaking at $3 million in revenue in May. As a matter of fact, the Polygon Reserve crossed the $1 million revenue mark in May and June, before shrinking to $670k in July.

Additionally, over the past few months, AAVE’s ETH reserve earned $41k in interest (0.7% of total revenue) while the Polygon Reserve earned just $11.8k (0.3% of total revenue). Despite the growing competition in the space, the aforementioned data proves that AAVE has managed to fare exceptionally well.

At the end of the day, the AAVE token derives its value based on how well the platform is doing. Looking at the market’s current state, it can be concluded that AAVE has already carved a niche for itself in the space and will continue to thrive in the long run.

![Uniswap [UNI] price prediction - Traders, expect THIS after altcoin's 14% hike!](https://ambcrypto.com/wp-content/uploads/2024/12/UNI-1-400x240.webp)