This is where Bitcoin ‘has an edge’ over stocks and real estate

Bitcoin is considered the most successful cryptocurrency. It continues to entice investors who previously viewed gold as the de-facto inflation hedge and portfolio insurance.

So is it a wise decision to add BTC to an investment portfolio?

Well, here’s what the current issue of the prestigious 178-year-old weekly magazine has to say about the same.

“Diversification is both observed and sensible; a rule of behavior which does not imply the superiority of diversification must be rejected both as a hypothesis and as a maxim.”

An expert at The Economist, reiterating the aforementioned quote by Nobel Prize winner Harry Markowitz’s Journal in 1990 opined that,

“…investor should maximize his or her returns relative to the risk (the volatility in returns) they are taking. It follows, naturally, that assets with high and dependable returns should feature heavily in a sensible portfolio.”

The article sheds light on the need for diversification stating, “diversification can reduce volatility without sacrificing returns.”

Bitcoin – a great portfolio diversification tool

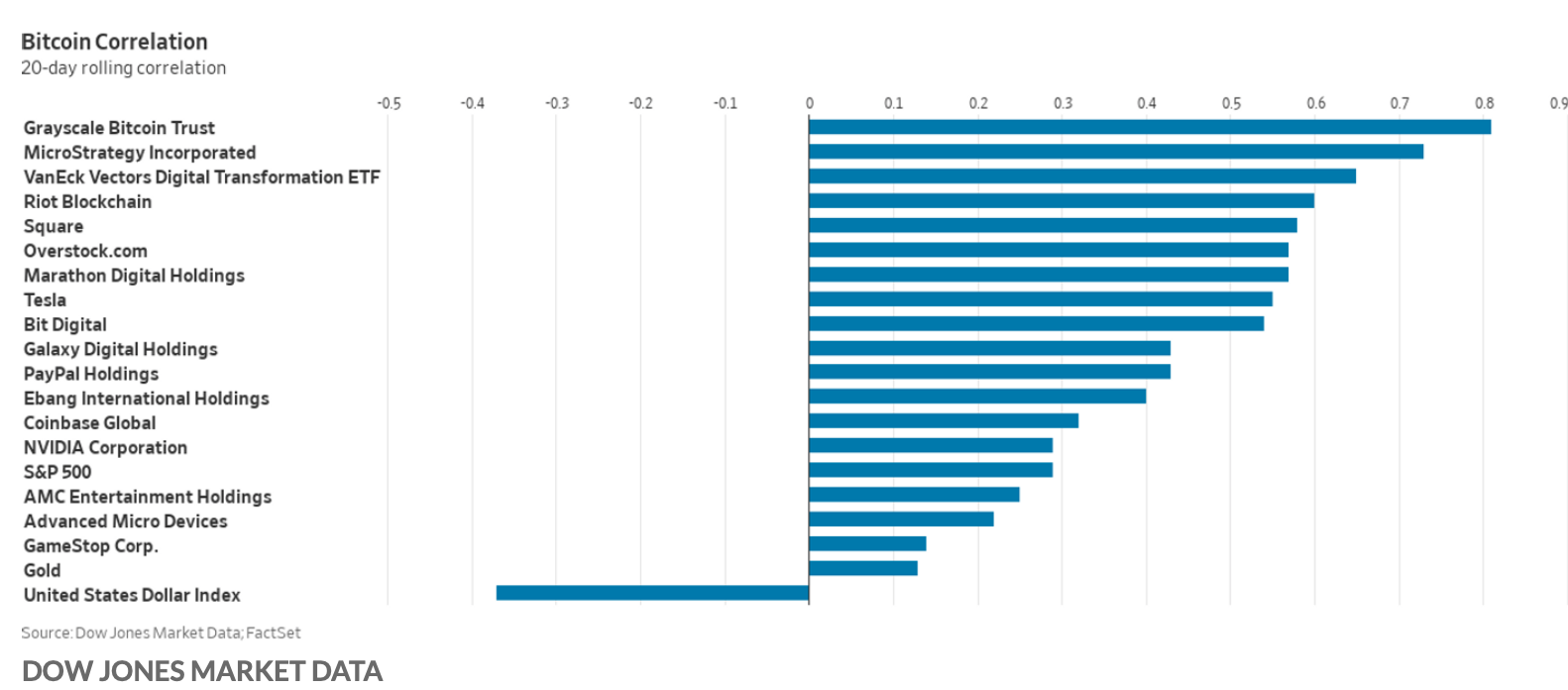

Asset classes in an investment portfolio should have the potential to provide high returns. Meanwhile have little or no correlation to each other. For example, although stocks and real estate can yield juicy returns, unfortunately, they are also highly correlated to each other.

“This is where Bitcoin has an edge. The cryptocurrency might be highly volatile, but during its short life, it also has had high average returns. Importantly, it also tends to move independently of other assets. Since 2018 the correlation between bitcoin and stocks of all geographies has been between 0.2-0.3. Over longer time horizons it is even weaker. Its correlation with real estate and bonds is similarly weak.

Ergo, this factor makes it an excellent potential source of diversification. The chart below sheds light on the same i.e. Bitcoin’s correlation with…

Source: Market Watch

In addition to this, the findings also showcased an important aspect to support the largest token. it noted that even throughout Bitcoin’s 2018-2019 bear market, a portfolio with 1% allocation to Bitcoin still offered a higher risk-reward option than one without it.

“…An optimal portfolio contained a Bitcoin allocation of 1-5%. This is not just because cryptocurrencies rocketed – even if one cherry-picks a particularly volatile couple of years for Bitcoin, say January 2018 to December 2019 (when it fell steeply), a portfolio with a 1% allocation to Bitcoin still displayed better risk-reward characteristics than one without it.”

The said allocation has been followed or advised before as well. Consider this, Ric Edelman, founder of Edelman Financial Engines while speaking to CNBC said, “allocating 1% of a portfolio toward bitcoin could give exposure to this asset class without damaging finances.” This interview was conducted in 2020. Fast forward to the current year, different crypto experts have increased their crypto allocations.