This is why LTC’s 2023 halving could bother eager miners and investors

- Litecoin’s halving event is approaching, and Oklink data predicts it will occur on August 2, 2023.

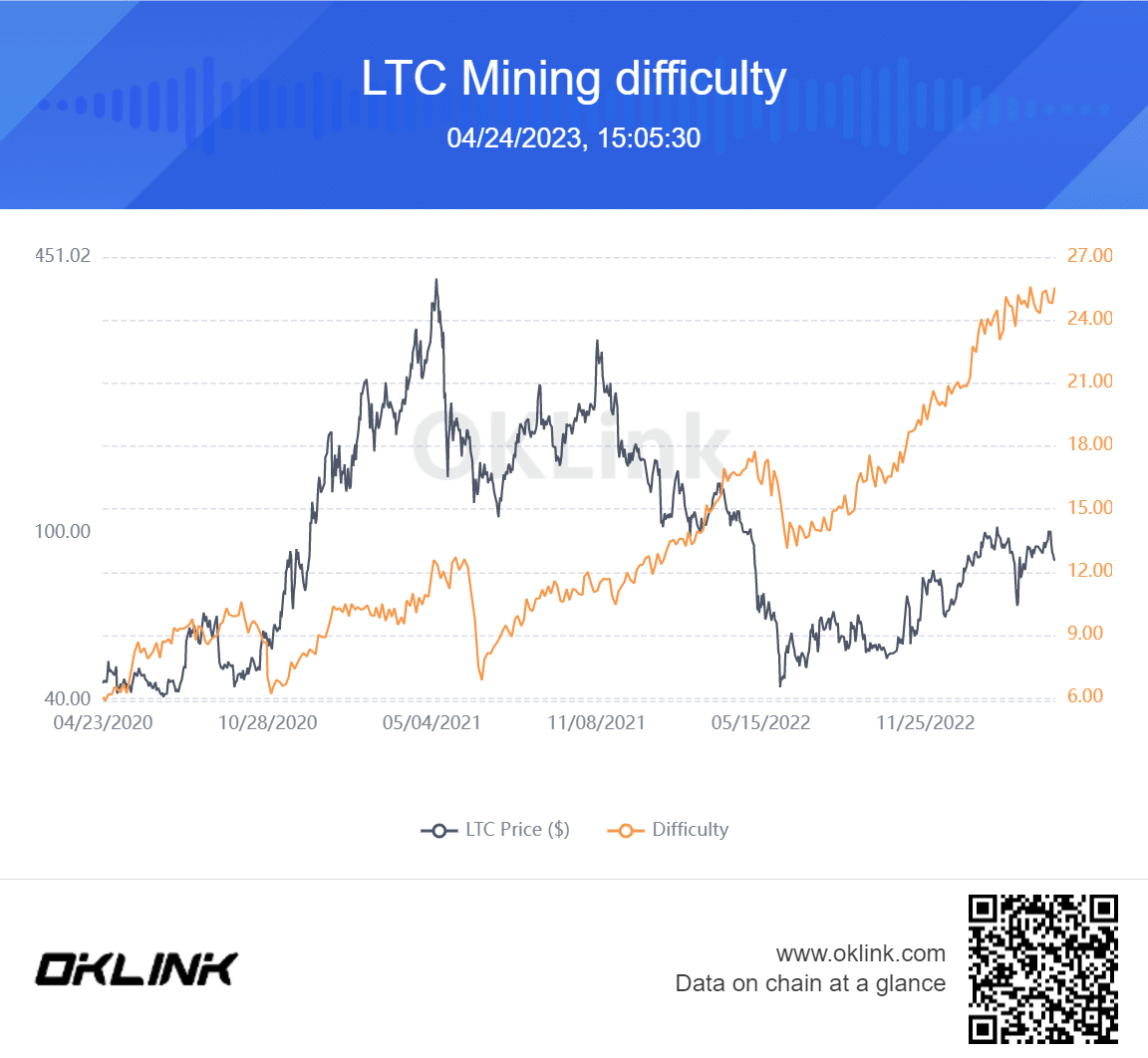

- The upcoming halving may affect LTC’s price, but the reaction is yet to be determined, while the mining difficulty is continuously rising.

Oklink’s data suggests that the Litecoin [LTC] halving will occur in the latter part of 2023. As such, it’s worth examining the current mining fee alongside the anticipated fee following the halving event.

Is your portfolio green? Check out the Litecoin Profit Calculator

Litecoin halving in 100 days

Oklink’s recent data on cryptocurrency halving and reduction events revealed that LTC’s next halving was imminent. The having is expected to take place on 2 August 2023 as per the website’s information.

The date was roughly 100 days away from the time of writing. Currently, 57,775 blocks remain until the halving, after which the block reward would be reduced from 12.5 to 6.25.

Launched in 2011, Litecoin is a decentralized digital currency that shares similarities with Bitcoin but has distinct features. One of its fundamental differences is its use of the Scrypt mining algorithm. This method allows for easier mining using consumer-grade hardware compared to Bitcoin.

What the Litecoin halving is, and when it started

The Litecoin halving is a cyclical event occurring after every 840,000 blocks mined on its blockchain, roughly every four years. During this event, the reward for miners validating a block on the network is reduced by half, meaning they receive only half the number of Litecoins for each block they mine.

The inaugural Litecoin halving occurred in August 2015, followed by the second halving in August 2019.

Current LTC mining difficulty

The mining difficulty in blockchain networks, such as Bitcoin and Litecoin, is regulated using a target value called the difficulty target. This 256-bit number denotes the highest possible value a block hash must meet to be deemed valid.

Furthermore, the difficulty target is lowered to increase the level of complexity in obtaining a valid hash as additional computational power is incorporated into the network.

The mining difficulty chart revealed a consistent upward trend since the beginning of the year, with occasional minor declines. As of this writing, the mining difficulty stood at approximately 25.5, representing the second-highest level reached this year.

– Realistic or not, here’s LTC’s market cap in BTC’s terms

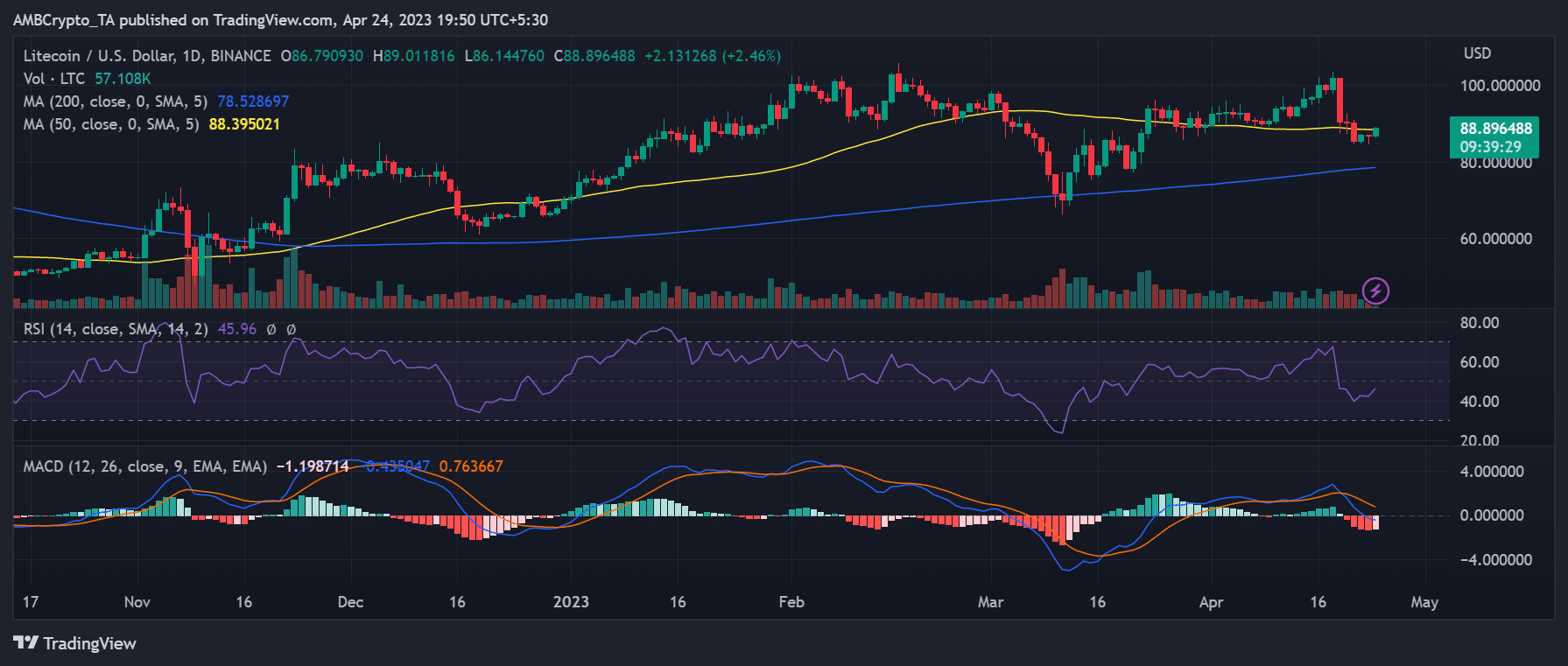

LTC’s price movement

As of this writing, LTC was trading at approximately $89, showing a gain of almost 3% from the previous period. However, the coin experienced losses in the recent trading periods, with a significant decline of over 11% on 19 April.

It’s worth mentioning that the previous LTC halving did not elicit any significant price response. Thus, it is only a matter of time till we can see the impact on LTC’s price.

Source: TradingView