This points to a strong likelihood of organic growth-based rally for Loopring

Loopring, after shedding close to 40% over the last 10 days, seemed to be continuing an unprecedented run yet again. Even though the alt traded close to its ATH price of $3.8 noting over 40% weekly gains, its recent choppy price action brought forth speculations about the coin’s rally.

Rumors and price rise

The altcoin had rallied on high positive social sentiment amid partnership rumors that gave way to higher gains. To many in the space, the alt’s rally seemed to be driven largely by speculations around rumors such as “Loopring partnering with GameStop in its NFTs.”

Further, another interesting rumor on LRC’s subreddit regarding the coin’s supply-demand dynamics seemed to be stirring the positive waves for price. According to the rumor circulating on Reddit, “Coinbase has run out of LRC and is being very slow with the processing of LRC-related transactions because of the issue.” This is bound to cause a supply shock in days to come thereby propelling LRC’s price to new ATHs.

But does this hold any truth?

Well, the availability of LRC on exchanges (or % supply on exchanges) has been oscillating between 30%-32% of total supply for about two weeks now. In fact, with no major shifts in the number, it seems like the supply shock narrative was rather weak.

Nonetheless, with LRC’s price rallying it seemed like all this worked out in the favor of the coin. So, the question remains- for how long could LRC rally like this?

Can an organic rally take place soon?

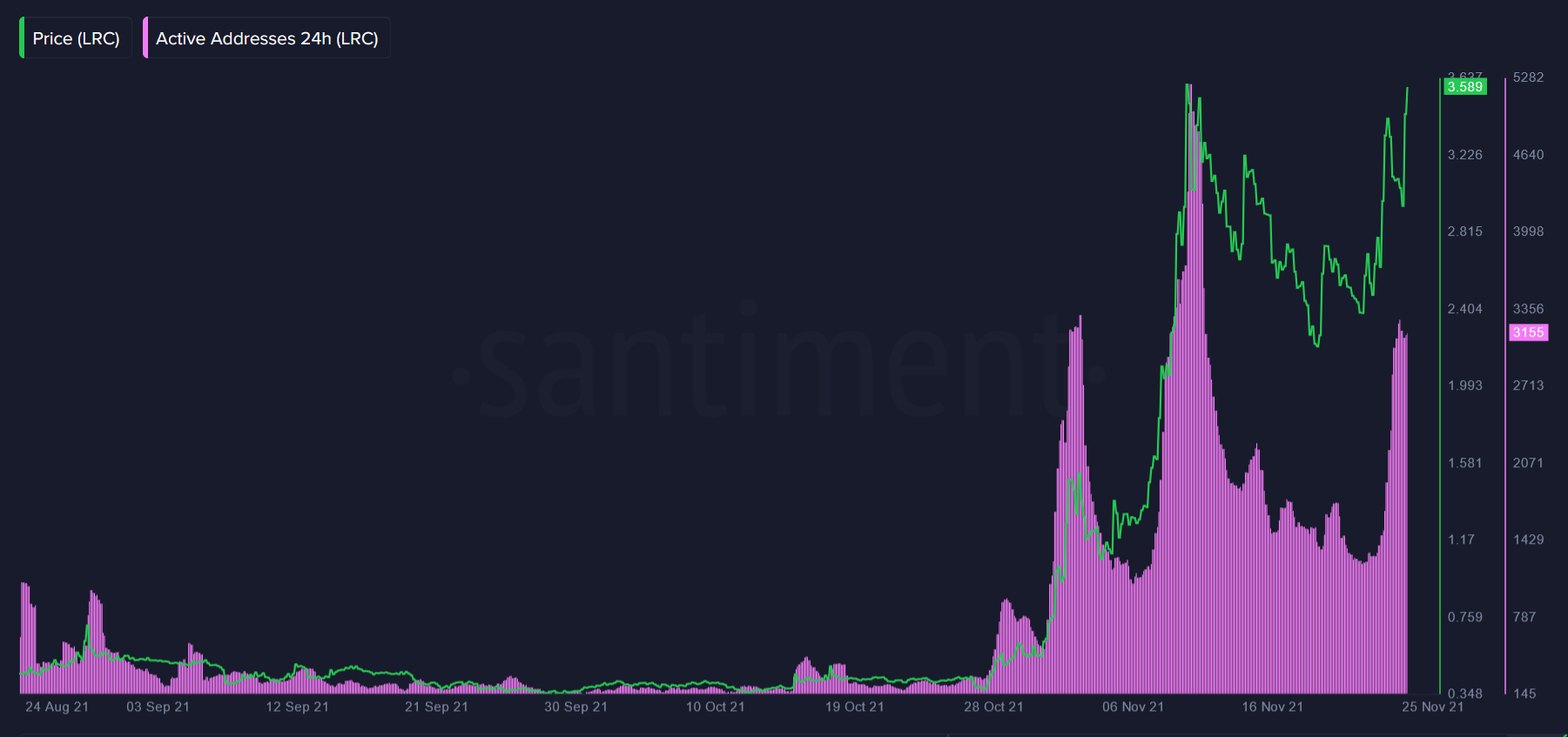

The amount of unique addresses sending or receiving LRC has soared by 150% in the last 36 hours. Thus, pointing to increased interest in Loopring on-chain activity.

In addition to that, the number of addresses interacting with LRC for the first time saw a parabolic rise, peaking at 1706 over the last day. That’s more first-time addresses over the last 24 hours than most ERC-20 coins do in a week, as a Santiment report highlighted.

However, there has also been a strong uptick in LRC-related deposit addresses. This tends to signal an increase in profit taking by holders and short-term sell-offs. So, it seemed like part of the increase in on-chain activity could in fact be new sell-side pressure rather than organic growth.

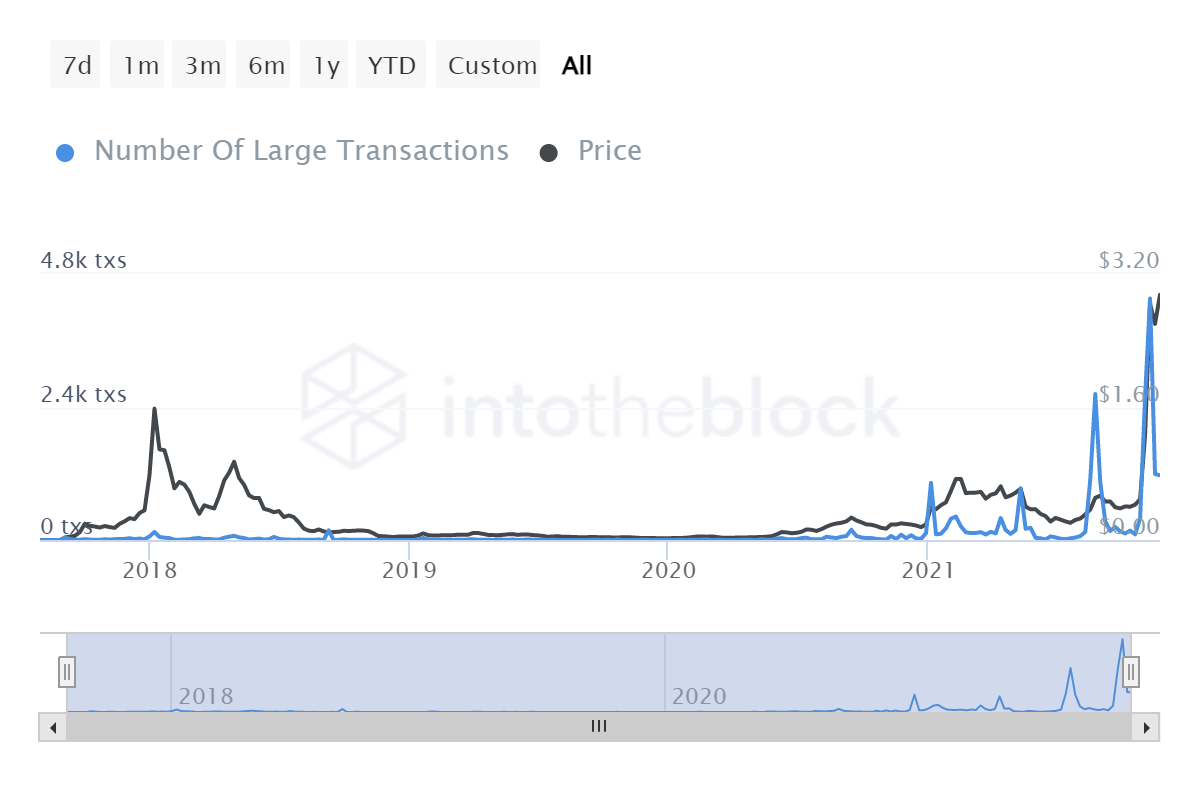

Additionally, the number of larger transactions and large transaction volumes after rising in early November saw a dip and have maintained lower values since then. Further, this could be indicative of institutional investors or bigger players staying away from the scene.

At the time of writing, the coin, after reaching $3.77 had started to lose ground, over the smaller time frame. While price seemed to wither, if the coin’s active addresses remain in the higher levels, the coin could see a rally based on true organic growth soon enough.