This unlikely factor supported Bitcoin, Ethereum Options in August

After the devastating May crash, August 2021 marked the first month of actual recovery for Bitcoin and Ethereum, as both assets were able to recapture important resistance levels. Over the past few weeks, Bitcoin initially managed to take a position above $42,000, and was now consolidating above the $50k mark. Ethereum re-tested $4000 earlier, and was only about $400 away from its ATH.

The optimism in the market has brought back futures premiums in the industry, as both BTC and ETH recorded strong derivatives volumes. However, despite a drawdown, ETH options continued to register a higher amount of engagement over the past month.

Bitcoin, Ethereum Options, and the DVOL break?

Before considering options data, looking at the Deribit Implied Volatility Index or DVOL suggested that it currently ranged around 90 for BTC and 110 for ETH. Alongside that, at-the-money volatility term structure was also less than 70%, which means that currently, price movements are expected to be timid.

With both Bitcoin and Ethereum cautiously moving up, and sideways in the market, expectations have aligned with its trajectory as well.

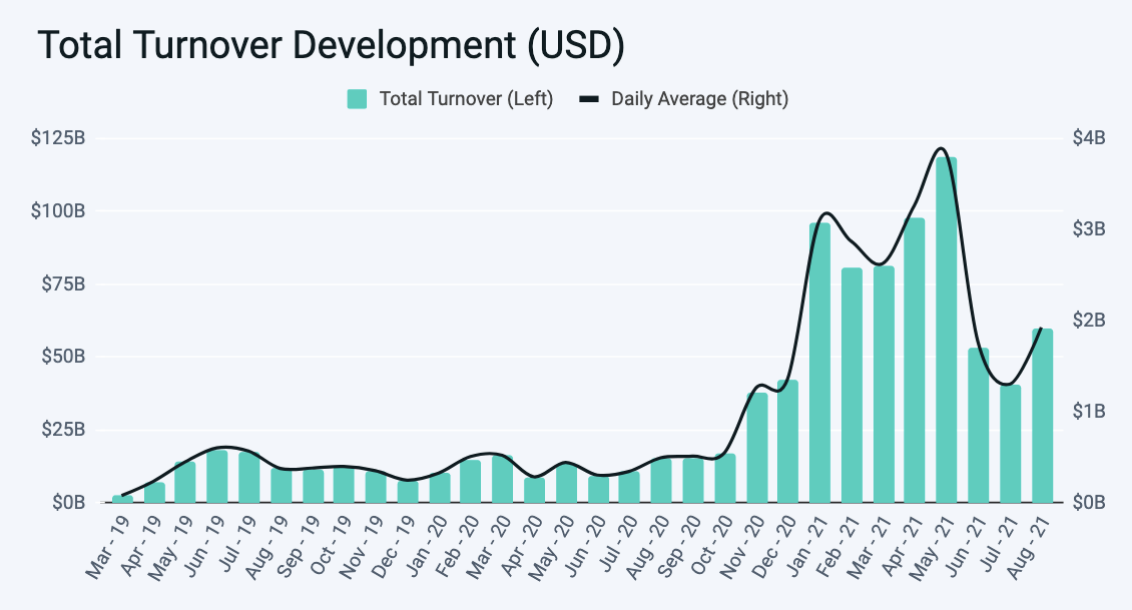

Now, according to data, the total turnover in the month of August was around ~$60 billion, which was approximately 48% higher than in July 2021. The daily average notional turnover was $1.9 billion. It is still under its peak from May 2021.

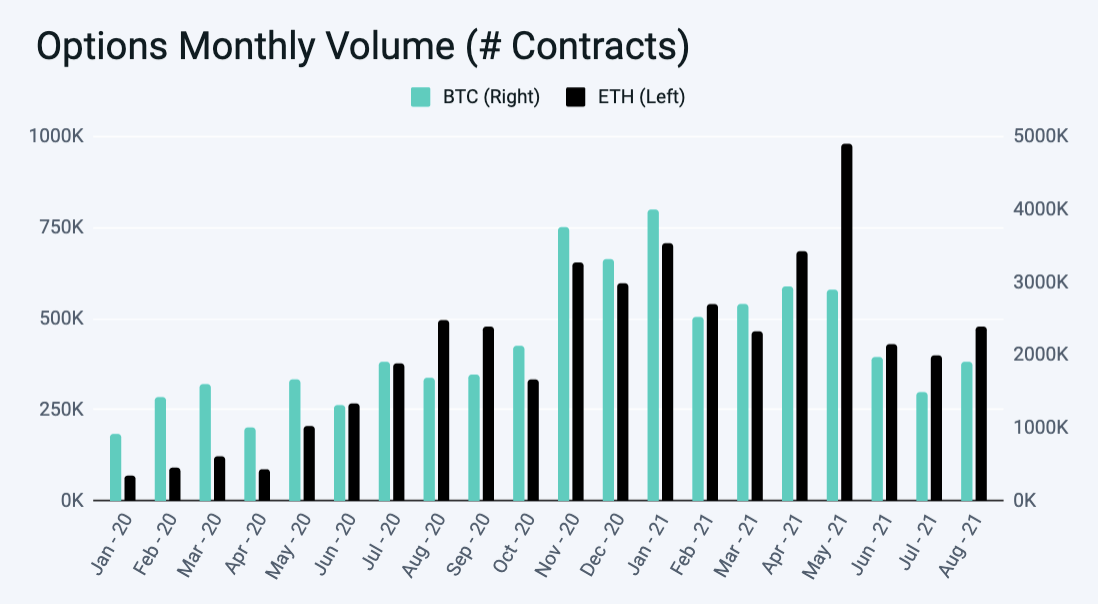

In terms of options turnover, 382,406 BTC and 1,400,732 ETH options contracts were traded in August 2021, which were up by 29% and 21% respectively, since July 2021.

Now, as observed, irrespective of the larger trend, Ethereum Options has consistently registered more engagement than Bitcoin Options, since January 2021 and as per data, NFTs played a major role in it.

The NFTs and Institutions concoction for ETH

For the larger market, NFTs were a source of interest over the past few weeks but for the derivatives market, it was a green signal for institutional traders to demonstrate that bullish behavior. During the month of August, Deribit increased its options market share to 94.7% of the total OI in Ethereum Options.

Additionally, 536k ETH options contracts got traded through block trades, achieving a 22% notional turnover share of the total ETH options contracts traded on Deribit. 86% of the total ETH block turnover was in call options and only 14% in put options.

Hence, without being a part of the futures market, NFTs had an impact on futures traders as well, as the sentiment carried over in the derivatives network.