Three reasons why an Altseason may be around the corner

Altseason is a crypto-market cycle phase investors absolutely love. This is a period where altcoins tend to rally, offering gains in the multiples. However, an altseason has a lot of components working together and each of these parts needs to be in the right place to kick-start an altseason.

It all comes together

The cycle for cryptocurrencies, like stock markets, comprises of a bull run and a bear run. However, these distinctions get blurred when taking a nuanced approach. For example, the typical bull run includes Bitcoin and altcoins rallying together. However, in actuality, when BTC starts pumping heavily, altcoins take a backseat and only rally when the big crypto cools down for the next leg-up.

However, as the bull run matures, both asset classes rally in tandem.

The leading factor behind an altseason is capital rotation from investors trying to maximize their profits. Now that Bitcoin has established its presence and moved past the $45,000-hurdle, there is a good chance altcoins will rally. In fact, many altcoins are already rallying by >20% in a single day.

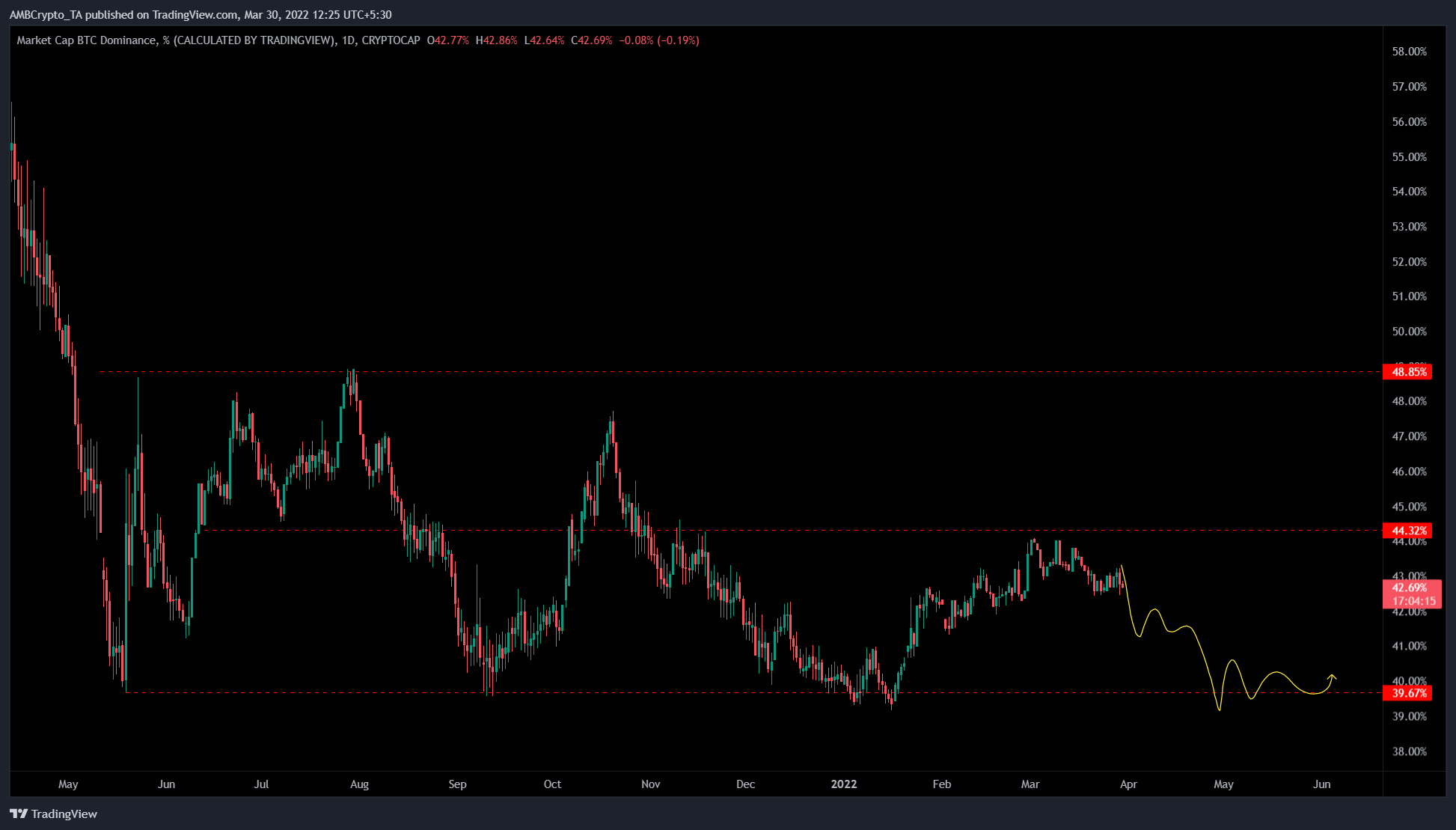

Another observation is that the dominance of Bitcoin reduces during an altseason. Currently, the dominance of BTC is hovering around 42% after a rejection at 44%. From the looks of it, this retracement will extend, pushing BTC dominance to 39% or 40%.

Such a southbound move is a sign that capital is flowing from BTC to altcoins.

Bitcoin and altcoins have a say

Another factor that backs the assertion that an altseason is starting is Bitcoin’s price. Although there is a good chance BTC might hit $53,000, there is no proof or supporting arguments that indicate that the rally will extend beyond this level.

As seen in the chart attached below, Bitcoin’s price has three major areas of support –

- $52,000 to $53,486

- $42,076 to $44,654

- $35,000 to $37,033.

The first area is a major hurdle and clearing it is unlikely. The second one is the immediate support level and the third area is the last line of defense. Breaching the last support area could trigger a crash to $30,000 or lower.

The recent run-up shattered the $45,000 resistance barrier and has also moved above the yearly open, suggesting a resurgence of buyers. However, due to the presence of overhead barriers, Bitcoin’s price action will be limited. Also, it likely to bracket between these areas.

Finally, the altcoin index also suggested that flipping the 4,146 hurdle will eliminate any and all immediate hurdles, allowing altcoins to rally.

Thanks to Bitcoin’s sideways movement, the reduction in its dominance, and the altcoin index’s current reading, the altseason seems more than likely to kick-start itself. All in all, the three aspects reveal the possibility of an altseason and work perfectly well in helping each other.