Tough week for BNB as price decline sparks record liquidations – What now?

- BNB remained in the $400 price range.

- The RSI showed that BNB was still in a strong bear trend.

Binance Coin [BNB] has experienced a notable downturn of late, mirroring the broader market’s decline, with its price falling for six consecutive days.

This prolonged decline resulted in one of the highest liquidation volumes seen for BNB, signaling a significant level of market distress among its holders.

Binance crashes below key zones

BNB’s downturn started from the 31st of July with an initial drop of over 2%. With the decline, the price fell to around $576.

This marked the beginning of a sustained period of decline, spanning six consecutive days during which BNB lost over 26% of its value.

The most substantial single-day drop occurred on the 5th of August, with a 6.48% decline that reduced its price to approximately $464.

This sequence of losses pushed BNB’s Relative Strength Index (RSI) below 30. However, recent data suggested a slight recovery, with BNB up over 3% at press time, elevating its price to the $478 range.

Correspondingly, its RSI has slightly increased, moving just above 30. Despite this minor rebound, the data indicates that the bearish trend for BNB remains strong.

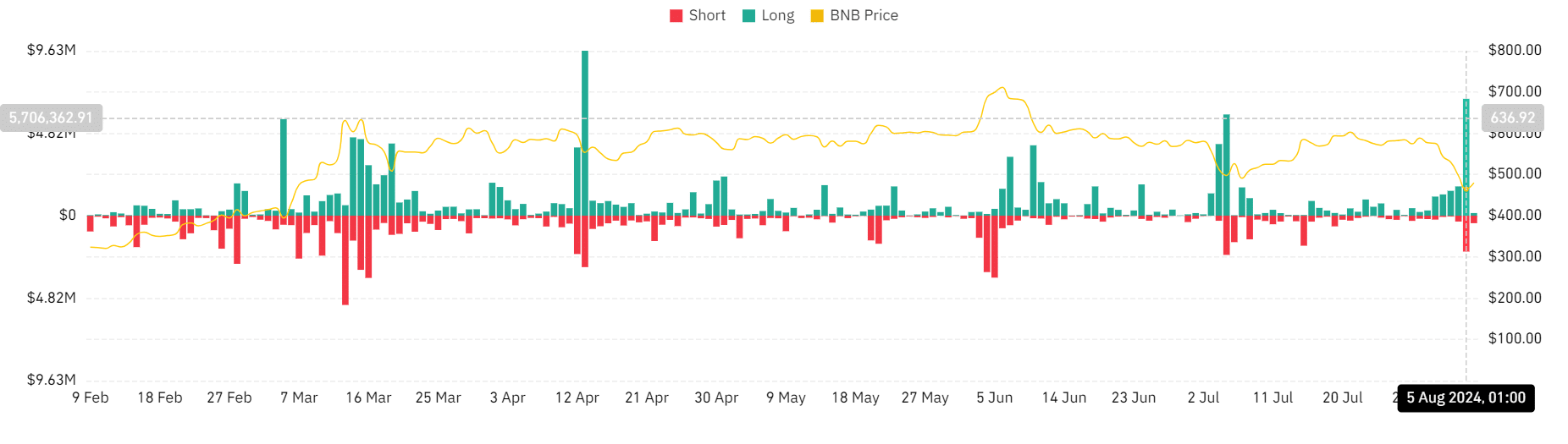

Binance Coin sees record liquidations

The recent downturn in BNB’s price has triggered a significant spike in liquidations among traders, per data from Coinglass. The BNB total liquidation volume escalated by nearly $9 million during this period.

This marked the highest liquidation volume recorded since April.

A closer examination of the data revealed that long positions were particularly hard hit, accounting for over $6.8 million of the total liquidations. This suggested that many traders anticipated a price increase or stability.

In contrast, short liquidations, which occur when traders bet against the market, amounted to around $2.1 million.

BNB descends into negative sentiments

The press time state of BNB’s Funding Rate, standing at -0.0170% at press time, provided a clear indicator of prevailing market sentiment, which appeared to be predominantly bearish.

Read Binance Coin’s [BNB] Price Prediction 2024-25

This negative Funding Rate implied that sellers controlled market dynamics. So, the cost to maintain long positions exceeded that for shorts, essentially rewarding traders who held short positions.

Despite the recent minor BNB price recovery, the persistently negative Funding Rate indicated that this bounce had not been sufficient to shift overall trader sentiment from bearish to bullish.