Traders can expect Chainlink, Polkadot’s prices to move in this direction

The prices of most top altcoins have been rallying over the last couple of days. In fact, if their weekly RoIs are taken into account, a significant number of them boasted returns of 20% to 25%. However, Chainlink and Polkadot, two of the market’s most prominent alts, registered surges of 40% each in the aforementioned timeframe.

Now, the crypto-market is definitely not new to such short-term upticks. Nonetheless, the sole question that matters at the moment is whether or not these two alts will continue their uptrend.

LINK’s Price Divergence

After remaining in the bearish zone for almost the entire month of July, LINK’s Price DAA Divergence finally stepped into the bullish zone on the 27th. This metric tracks the relationship between the alt’s price and the number of daily addresses interacting with it.

Since the beginning of this year, this indicator has flashed bullish signs only during the end of every month. The same carried forward to the initial few days of the subsequent month, and then translated into a bearish sign. Furthermore, the past six bullish divergences did not prolong themselves for more than 4 days.

However, at the time of writing, this indicator was in the bullish zone for the sixth consecutive day.

According to the attached chart, LINK’s valuation has risen by $1 to $4 every time a bullish signal flashed this year. As a matter of fact, the alt’s price has already risen by $5 this time. Looking at the way things have unfolded for LINK this time, it can be claimed that the ongoing rally might end up sustaining itself for a couple of days, at least.

Additionally, it is noteworthy that LINK’s price has not always reacted immediately during such transitionary phases. Hence, traders can expect the value of this alt to hike a little more over the coming week.

What does this V-shaped recovery mean?

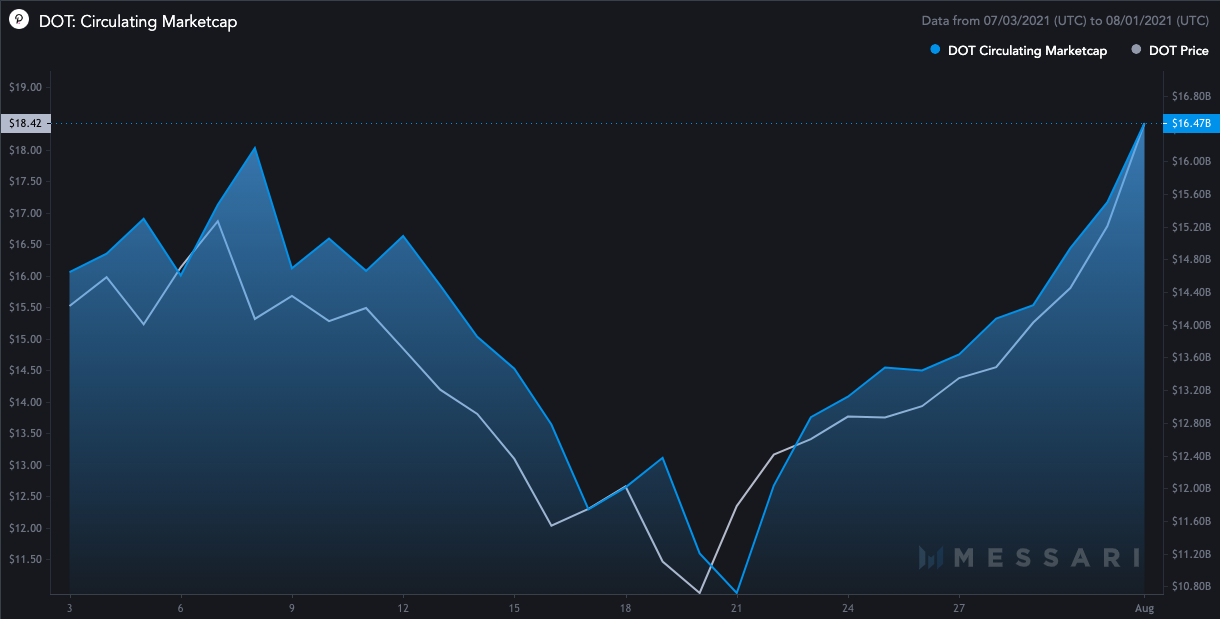

As can be seen from the chart, DOT’s circulating market cap has started making a V-shaped recovery. On 21 July, the cumulative value of the circulating supply stood at $10.72 billion, while the same, at press time, had a value of $16.47 billion. Additionally, as seen on Messari’s chart, the press time level was essentially DOT’s one-month high.

Notably, the more the number of tokens that float in the market, the better it is for the price. Hence, this metric needs to continue in the same direction to sustain DOT’s rally.

Development activity and active addresses

The number of active addresses for both DOT and LINK has also been on the rise of late. DOT’s active addresses hit a one-month low (18k) on 10 July. However, its recovery was pretty impressive as it stood at 25k at press time. LINK’s active addresses too, over the same timeframe, rose from 4169 to 4888.

Furthermore, the ecosystem-centric developments have been gradually pacing with time on both networks. Here, it should be noted that this factor doesn’t necessarily have a say in the near-term price action. However, looking at the state of this metric, it can be asserted that the long-term future of both these alts does not look bleak.

Considering the projections of the aforementioned indicators, it can be concluded that both these alts would be able to sustain their price rally for a week, at least.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)