Traders can make 25% on Bitcoin remaining market neutral, here’s how

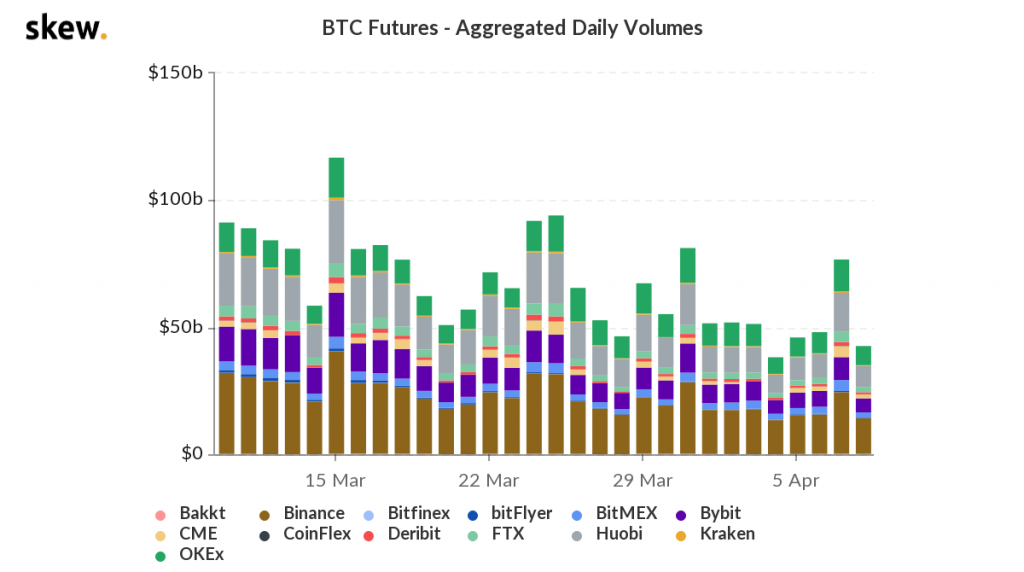

With Bitcoin’s price back under $60000, and increased investment inflow to altcoins and top DeFi tokens. It may be the best time for retail traders to direct their investment to HODLing Bitcoin in the long term and getting yields while remaining neutral in the market. Currently, the aggregate trade volume in Bitcoin futures is relatively low when compared to the trade volume in the first three weeks of March 2021.

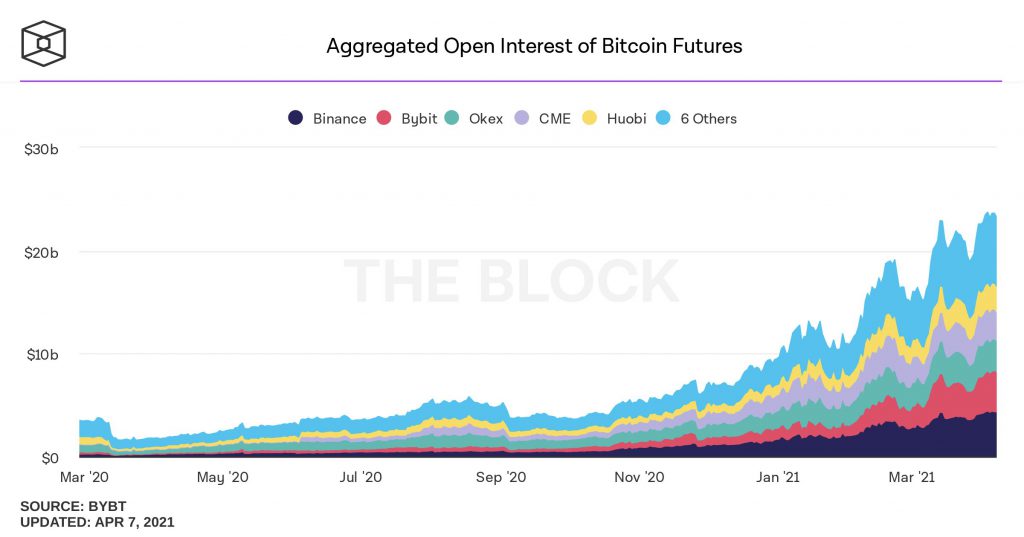

The aggregate Open Interest on Bitcoin Futures is now sitting at $23 Billion, and climbing steadily, unlike the trade volume. The open interest is part of a predictive reflexive loop that feeds the price of Bitcoin in the long run, in the market cycle. The fast growing Bitcoin derivatives market vs trillions of fiat dollars is offering real income even at low to neutral risk.

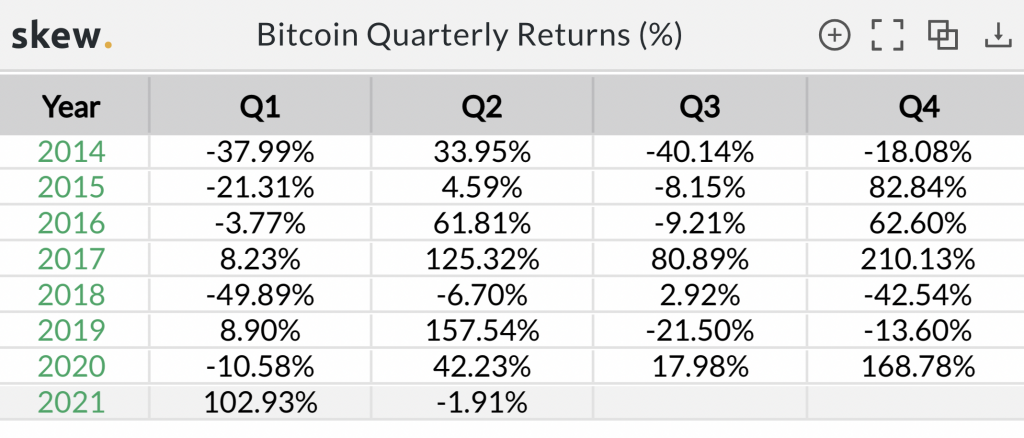

Bitcoin Quarterly Returns || Source: Skew

Based on the above chart, after four profitable quarters, Bitcoin’s returns were negative leading traders to tread lightly over the next few months. Based on the trend, returns for HODLers were positive for three quarters in a row, however, as of now, the trend has changed and the returns are negative 1.91%.

When Bitcoin is overleveraged, the price takes a bearish turn based on the trend. Traders are expected to go short on Bitcoin, only if they are over collateralized, and the current market is letting traders collect 25% annualized yield while being market neutral at the same time. 25% yield while remaining market neutral is the same as making 25% with the lowest risk possible, for retail traders. The expanding Bitcoin derivative market has pulled capital from legacy fixed income.

For retail traders to predict the impact of Bitcoin’s price action on derivatives exchanges, it is important to consider the rising aggregate open interest in Bitcoin futures, in the chart shown above. The interest has increased consistently since the drop in the last week of March 2021 and it is at its peak, since March 2020. This corresponds to the breakout in price past the $60000 level, and a steady increase in the following weeks would point towards an upcoming rally. The asset is not consolidating in the following week, not based on derivatives exchange metrics. However, making 25% returns on a Bitcoin portfolio is sure to attract more leverage and traders to the asset, increasing demand in the short-term and boosting the price rally.