TRON ranks second in TVL, but this is where the network’s dominance is faltering

- TRON’s TVL declined, but active addresses and revenue increased.

- The network witnessed positive trader sentiment alongside USDD’s decline in pool balance and transfer volume.

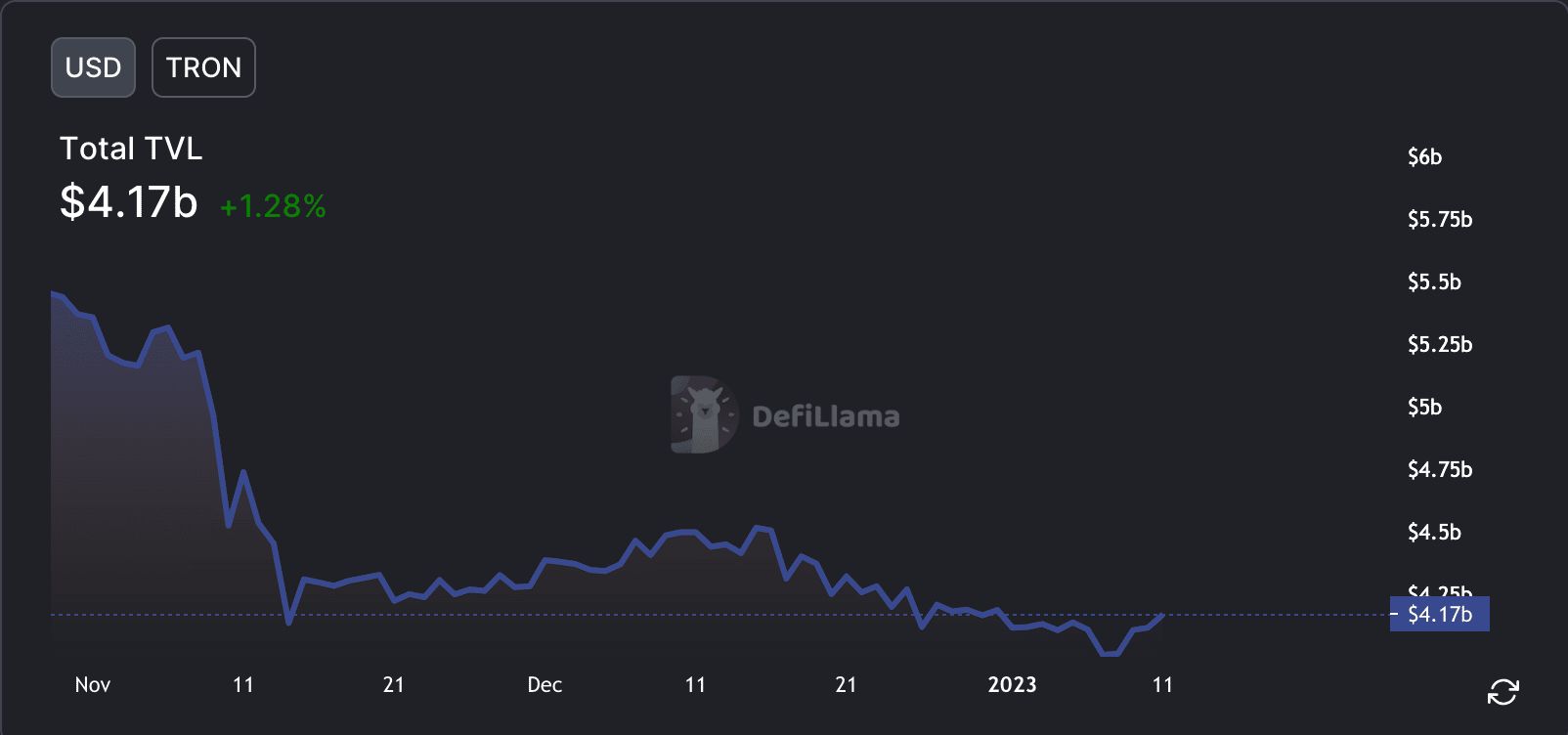

On 10 January, TRON [TRX] tweeted that it ranked number 2 in terms of total value locked (TVL) in the cryptocurrency market. However, despite this accomplishment, data showed that the TVL on TRON declined materially over the past few months.

This raised a question on whether TRON would maintain its rank in the cryptocurrency market and bounce back from the decline.

Are your TRX holdings flashing green? Check the TRON profit calculator

The TRON – dApp angle

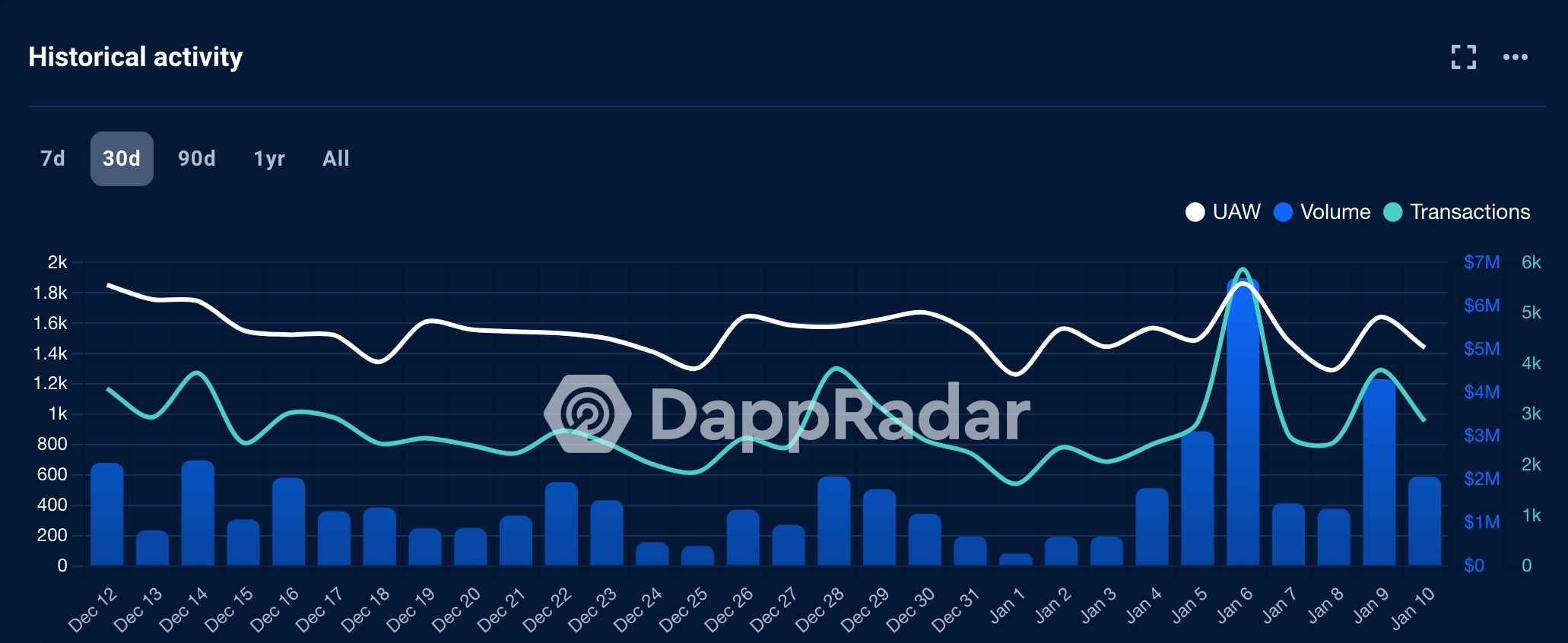

One potential reason for TRON‘s declining TVL could be a decrease in the platform’s dApp activity. According to DappRadar, popular dApps such as SunSwap, JustLend, and Transit Swap saw a decline in unique active wallets.

For example, SunSwap’s unique active wallets decreased by 13.61%, while JustLend and Transit Swap saw declines of 14.93% and 8.93%, respectively.

SunSwap’s volume fell by 37.9% during this period as well. Thus, the decline in the number of active users could be a sign that buyers were losing interest in these dApps. Therefore, lessening the overall value locked on the platform.

Despite the declining TVL, data from TronScan showed that the revenue collected by TRON actually increased from $509,937 to $637,520 over the last month. This could be because of the increase in the number of active addresses on the network, which was a sign of an increasing number of users. According to data provided by Messari, the number of active addresses increased by 4.47% over the last week.

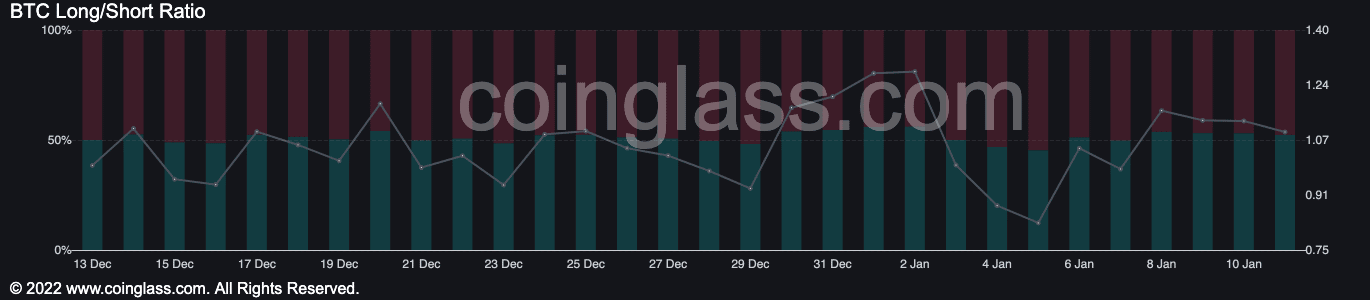

This could be one reason why the sentiment of traders for TRON was positive. 52.3% of all positions on TRON were long, based on information provided by Coinglass. Thus, traders believed that TRON’s price had the potential to rise in the future.

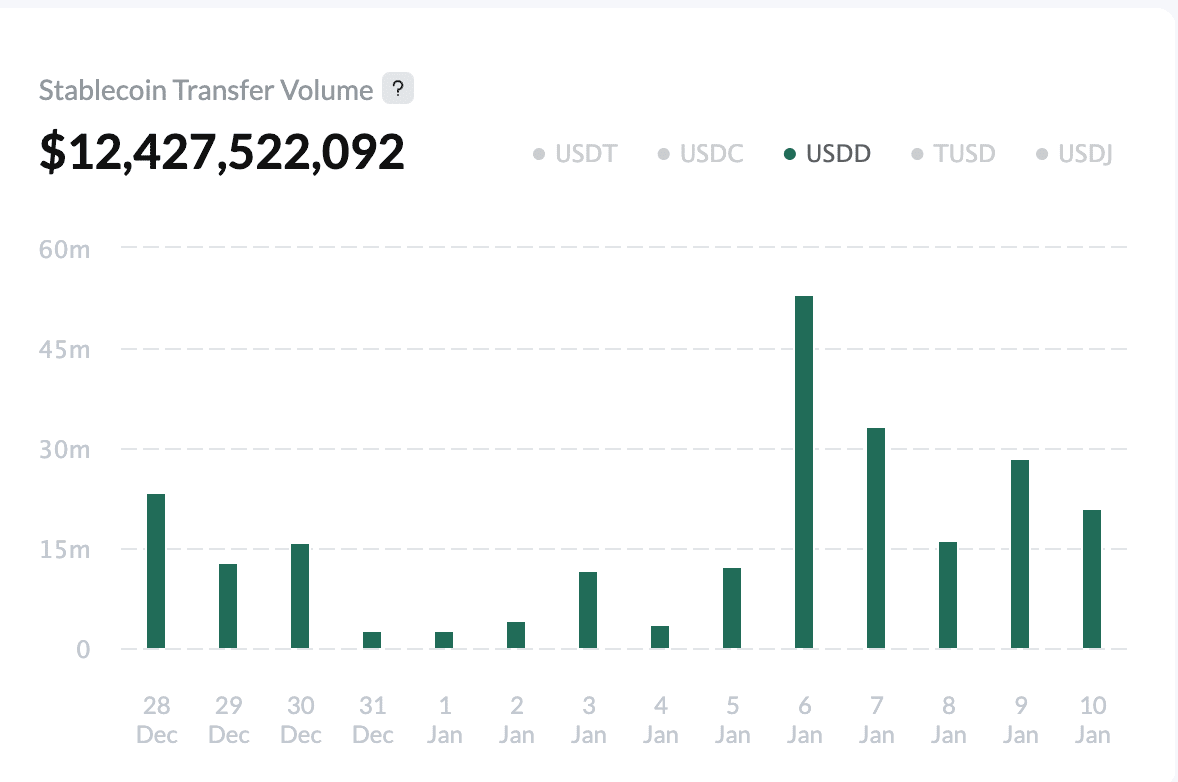

Another important aspect of TRON was USDD, the ecosystem’s stablecoin. According to data provided by TronScan, USDD’s transfer volume decreased. The decline in usage of the USDD stablecoin could there be a sign that fewer traders are using USDD to trade on decentralized exchanges.

While the declining TVL and dApp activity could be a concern for TRON, the increasing revenue and positive trader sentiment may suggest that the platform was still experiencing overall growth at press time.