TRON traders facing obstacles at $0.07161 can look to book gains here

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- TRX’s market structure was bullish but TRX faced a key resistance level.

- So far, the coin has faced three price rejections at $0.07161.

Tron [TRX] hiked by 43% in the past few weeks. It rose from $0.05000 but has consistently faced price rejections at the $0.07161 level.

It is worth noting that the resistance has been hit thrice. But BTC was struggling to reclaim the $25K zone, which could make the $0.07161 obstacle persist.

Read Tron’s [TRX] Price Prediction 2023-24

The $0.07161 resistance level: Can bulls clear it?

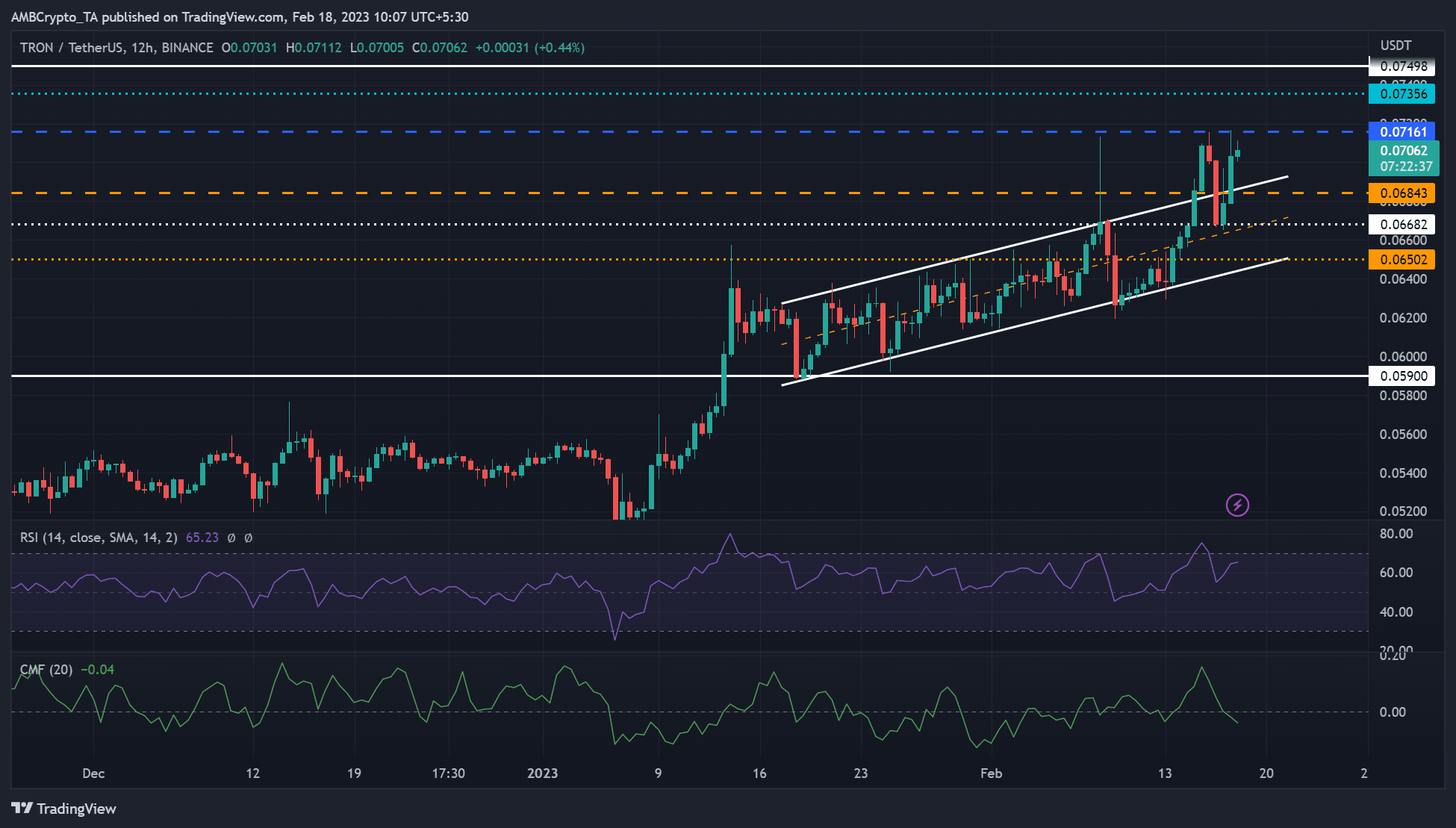

TRX’s uptrend in January has continued in February, as shown by the ascending channel. So far, the three times TRX has faced price rejection at the $0.07161 level, a correction followed. The trend could repeat if BTC fails to reclaim the $25K, setting bears to devalue TRX.

Sellers could benefit from short-selling opportunities at $0.06843 or $0.06682 if BTC fails to close above $25K and TRX’s obstacle persists. But the drop could be checked by the channel’s mid-point (brown, dashed).

Is your portfolio green? Check out the TRX Profit Calculator

But a break above $0.07161 would give bulls more leverage to seek extra gains at $0.07356 or $0.07498. But the upswing will invalidate the above bearish bias. The upswing could be accelerated if BTC reclaims the $25K level.

The Relative Strength Index’s (RSI) value was 65, a bullish structure, but the CMF (Chaikin Money Flow) moved southwards, showing the market was increasingly becoming skewed towards the bears. Thus, bulls should be cautious of the $0.07161 level.

TRX’s sentiment surpassed its January level; it fell sharply afterward

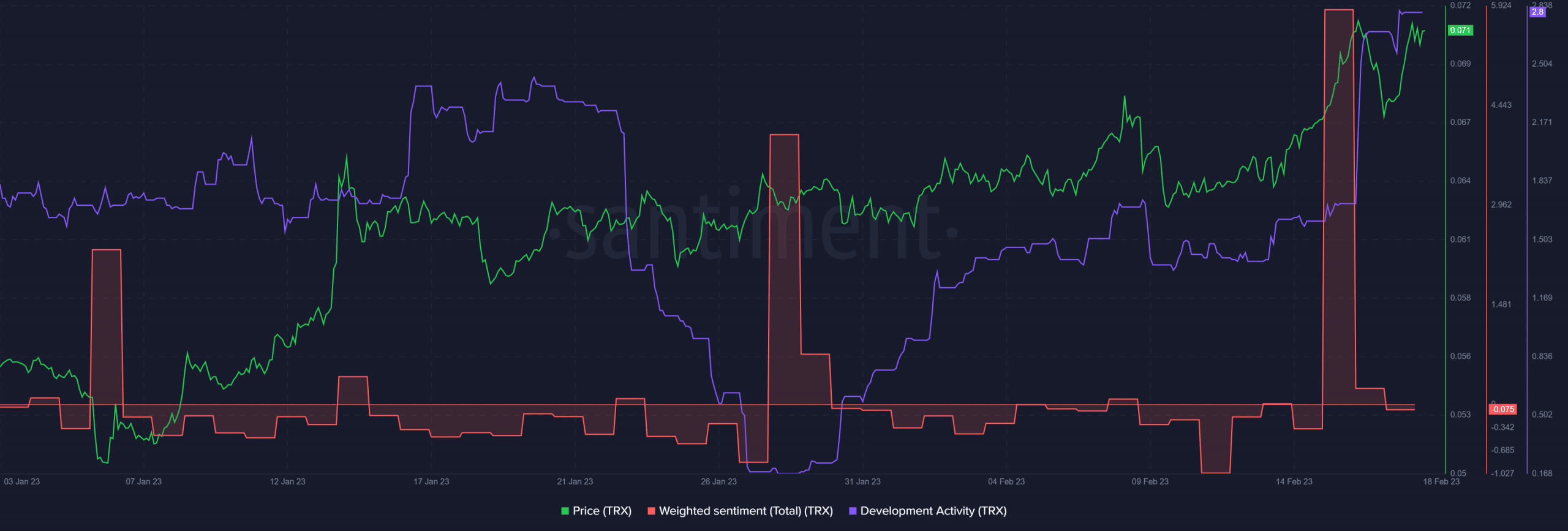

According to Santiment, TRX’s sentiment surpassed its January level, only to fall sharply afterward. It underlines investors’ fears after TRX’s sharp drop on Friday (17 February). Nevertheless, the recovery after that hasn’t improved investors’ outlook on the asset.

But the increasing development activity could change trading sentiment in the long run and boost TRX’s value.

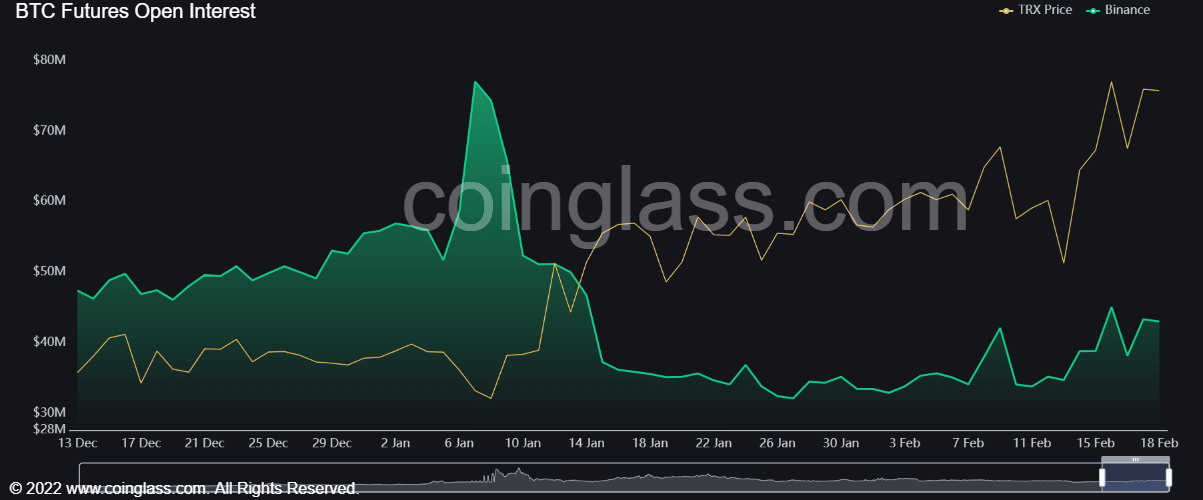

Notably, TRX’s open interest (OI) rose from 11 February but somewhat stagnated at press time before breaking above the $0.07161 resistance.

If OI drops further and the negative weighted sentiment persists, it could denote the asset’s bearish outlook. It could tip bears to inflict a price correction.