Tron [TRX] faces double blockage: Can shorting yield gains

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

– TRX was bullish on the four-hour chart.

– Sentiment dropped; the funding rate was positive.

Since mid-March, Tron [TRX] has struggled to surpass the supply zone near $0.06800. At press time, the price action faced both the supply zone and a descending trendline – two obstacles that could undermine bulls’ further uptrend momentum.

Read Tron’s [TRX] Price Prediction 2023-24

Any pullback due to the blockage could offer shorting opportunities, especially if Bitcoin [BTC] continues to hover below $30k in the next few hours/days.

Will sellers gain leverage?

On the four-hour chart, RSI hovered above the 50-mark, confirming increased buying pressure. Similarly, the stochastic RSI entered the overbought zone, highlighting bullish sentiment besides making TRX ripe for price reversal.

Moreover, the ADX (Average Directional Index) continued to drop – reiterating a likely consolidation or pullback.

A breach below the 50-EMA ($0.06598) and 200-MA ($0.06549) will show an increasingly weakening market – a perfect condition for shorting the asset at current levels. But the drop may slow to $0.06490 or the recent swing low of $0.06200.

A session close above the descending trendline ($0.06659) and supply area ($0.06800) will invalidate the above thesis. Such an upswing, especially if BTC retests $31k, could tip near-term bulls to target the next resistance levels at $0.06903 and $0.07044.

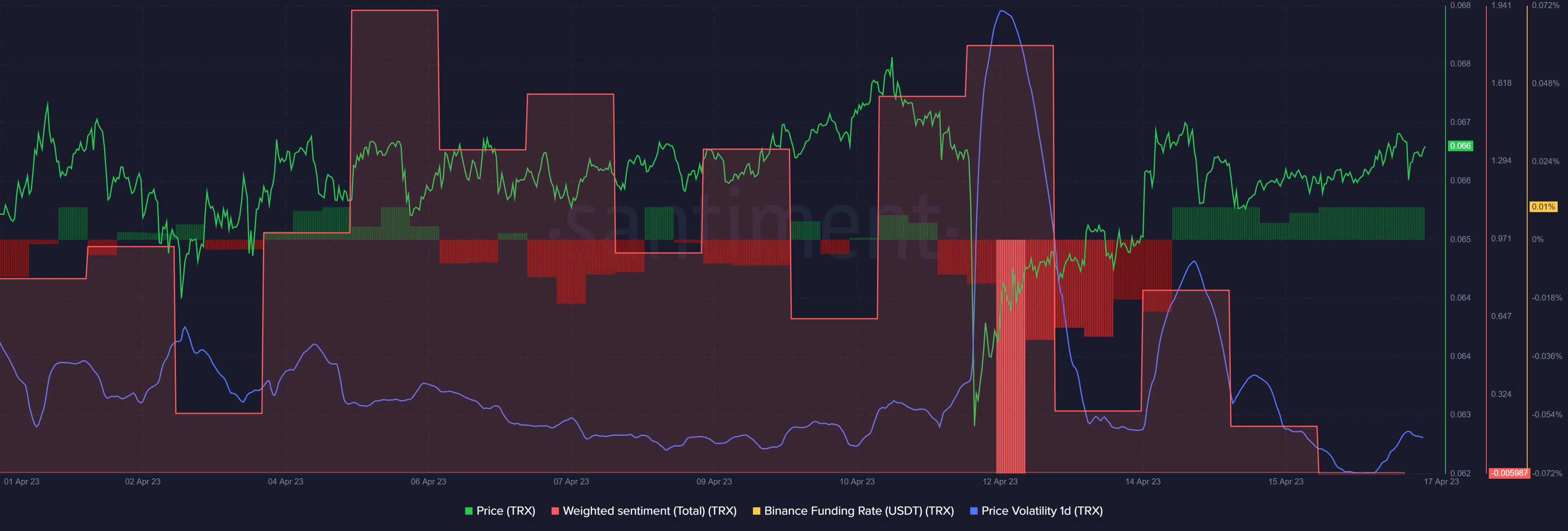

Sentiment drops to neutral: funding rates improve

Is your portfolio green? Check TRX Profit Calculator

TRX saw a drop in demand in derivatives mid-last week (12 April), as shown by the funding rate (red bars). But it later improved into the weekend and remained positive (green bars), reiterating the bullish sentiment.

But the sentiment dropped to a neutral level in the same period, while daily price volatility eased. It shows investors were neither bullish nor bearish on the asset, making the price steady – a likely consolidation could be in play in the short term.