UNI and how Uniswap’s Q2 saw some ‘outperformance’ on this front

Was the second quarter this year as bad as it is made out to be? Maybe for major cryptocurrencies, but maybe not for some others in the crypto-market. In fact, Uniswap managed to “outperform” crypto-asset prices in Q2, as per a recent report.

Messari’s “State of Uniswap Q2 2022” touched upon the major performance aspects of Uniswap.

The global crypto-market cap diminished by more than $1.3 trillion during Q2. On the contrary, Uniswap has been able to note some improvements over the course.

Let’s dive in

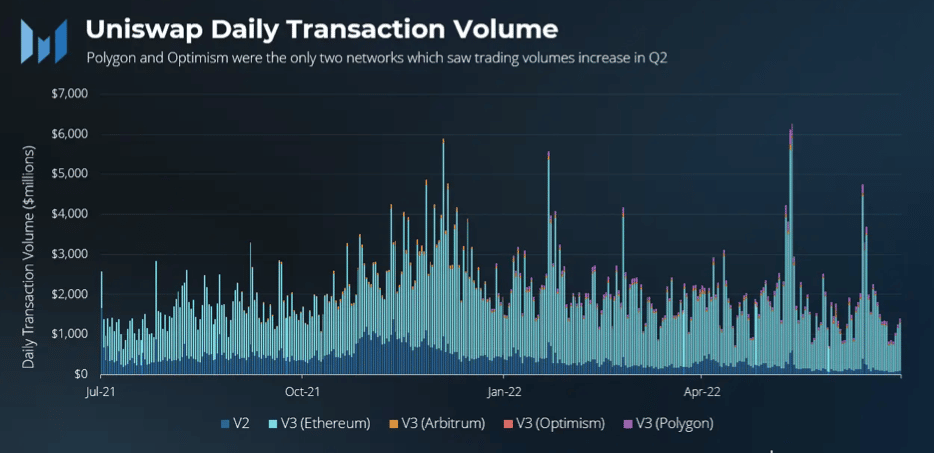

The trading volume on Uniswap dipped by only 8.7%, when compared to Q1 2022. This is evident across major DEXs as volatility supplements volume during such periods. After careful inspection, only Polygon and Optimism showed an increase in trading volume during the quarter.

Messari also noted that arbitrage bots represent up to 75% of trading volume when users flush out. This is considered a healthy sign among DEXs.

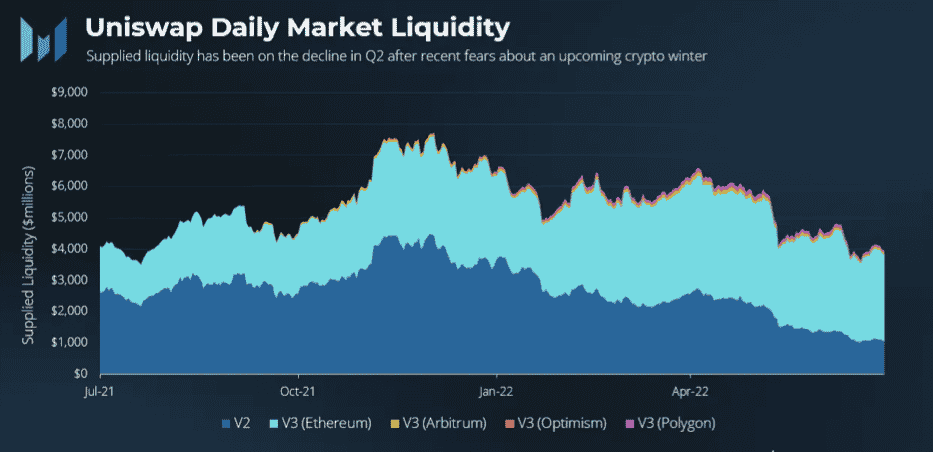

Understandably, supplied liquidity went down from the headwinds in the market. It fell by 37.1% across Q2, but still outperformed crypto-asset prices. According to Messari,

“This benchmark is important since liquidity on the DEX is heavily impacted by the price of the underlying tokens.”

Liquidity across Uniswap held up well despite ETH falling by over 70% over the quarter. The liquidity on Uniswap is also aided by the inclusion of stablecoins which are also prominent during bear markets.

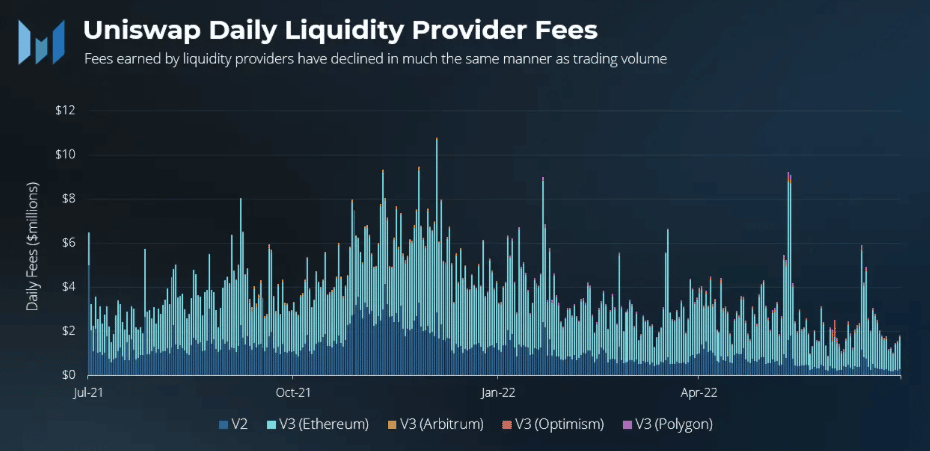

A drop in trading volume led to diminishing fees on Uniswap. Fees across all networks were down by 21.9%, when compared to the previous quarter. However, some protocols managed to register extreme results.

Optimism saw fees hike by 146.9% from $1.4 million to $3.5 million over the last 90 days. However, the most significant decline took place on Arbitrum as fees fell by 35.9%, down to $3.6 million.

A UNI victory?

One of the most significant recent developments is the integration of Decentralized Exchanges (DEX) with Coinbase’s platform. This integration has started to allow more exposure to DEXs than ever before. Uniswap has started to seemingly reap the benefits of this alliance. This is evident in the price action of UNI itself.

UNI bulls have been in full swing this week and have registered a near 30% surge. UNI was trading at $6.27, at press time, after a 1.2% uptick in 24 hours. This followed a mild surge in volume as it rose by 17.25%.

With strong foundations and a Coinbase alliance in-store now, Uniswap can and must build on that.