Uniswap investors should know that UNI might be about to experience…

Imagine buying Uniswap’s native crypto UNI in December 2020, just before it embarked on a strong rally up until May 2021. Such a chance has presented itself once again courtesy of the latest crypto market crash.

UNI recently dropped as low as $3.35 on 14 June pushing into price levels that it previously tested in December 2020. This is the same price level at which UNI traded before it embarked on a robust rally in the first half of 2021. Uniswap leveraged robust growth during this period and became one of the top decentralized exchanges.

Can UNI pull off another strong run?

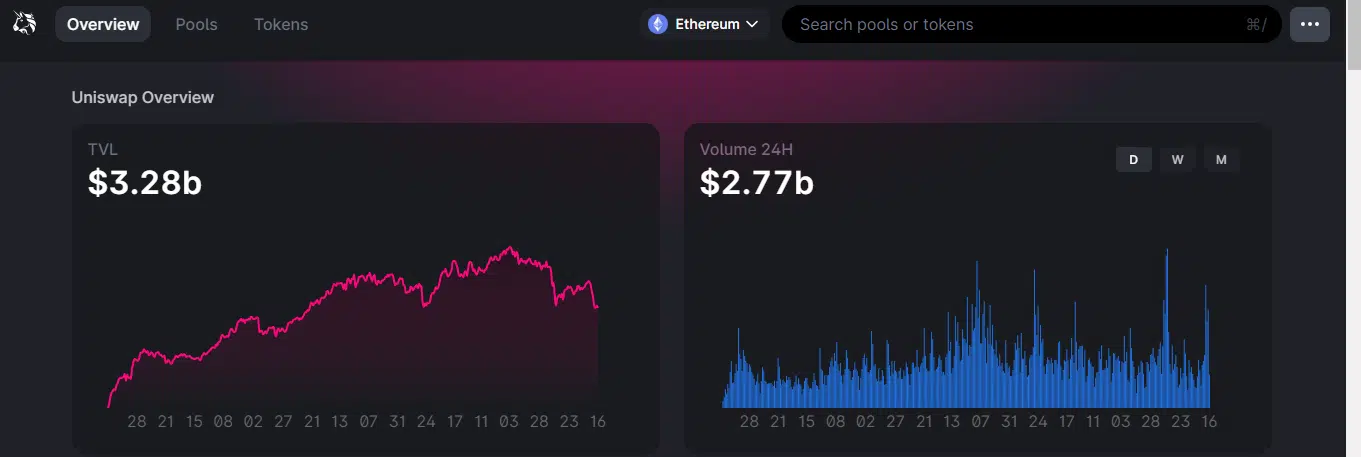

Uniswap experienced significant growth since 2020 in terms of utility and trading volumes. It had a total of $3.28 billion in total value locked and $2.77 billion in daily trading volume at press time. This kind of growth means UNI has strong fundamentals on which one can rely in the long term.

UNI’s current price action is a reflection of the overall crypto market conditions rather than Uniswap’s performance. The current price drop is, therefore, an opportunity for investors to make entries at discounted prices. UNI traded at $3.90 at press time after a roughly 8% uptick from its latest low.

UNI’s slight uptick was fueled by significant accumulation as indicated by MFI after falling into the oversold zone. Its DMI’s -DI indicator registered a slight drop in the last two days, signifying decreased selling pressure.

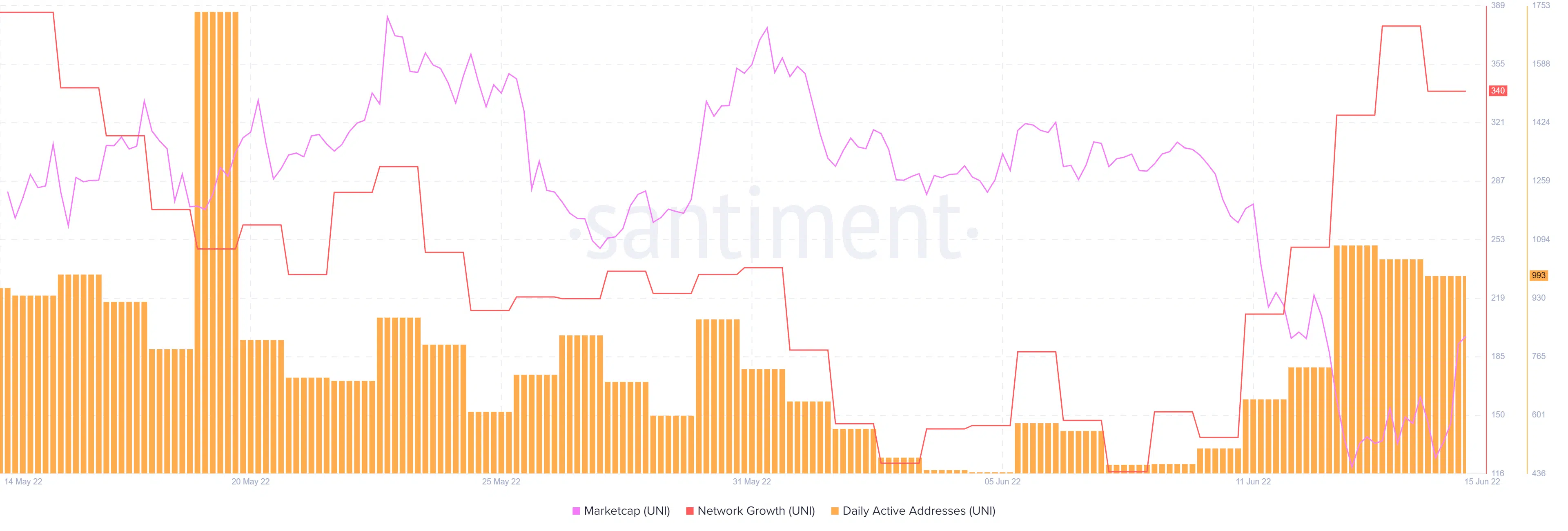

UNI’s oversold nature suggests that the price might be about to experience some more upside. Its on-chain metrics highlight similar observations. For example, its market capitalization metric bottomed out at around $2.5 billion on 13 June.

The number of UNI’s daily active addresses has also grown as prices dropped lower, indicating healthy accumulation. Its daily active addresses metric grew from 462 addresses on 8 June to 993 daily active addresses by 15 June. UNI’s network growth metric bottomed out at 145 on 5 June and it grew to 340 by 15 June.

Uniswap maintains strong growth despite UNI’s extended downside. The price drop presents an opportunity for investors to average in at a healthy discount. However, there is still a probability that the price may experience more downside in the future.