Uniswap, Polygon, and assessing how their ‘couple goals’ are faring

They just met, but everyone’s already talking about how great they look together. This isn’t your average celebrity couple, no, but rather Polygon and Uniswap. Here’s what you need to know about their compatibility so far.

#CoupleGoals or no?

Uniswap was deployed on Polygon in December 2021. However, roughly a few weeks later, the DeFi protocol has been quickly chewing up Polygon’s share of the market. From around 20% in one week to nearly 30% in two weeks, Uniswap was holding about 45% of the market share on Polygon at press time, according to the OurNetwork newsletter.

Looking at the total value locked [TVL], one sees a sharp rise in February 2022 to reach a value of $139.3 million on 18 February.

Source: DeFi Llama

Analyst Derek Walkush noted,

“Uniswap’s TVL on Polygon jumped 2x+ over the past two weeks and is currently tracking around $140m. This growth still lags its peers, with QuickSwap and Sushiswap TVL tracking around ~$800m and ~$280m, respectively.”

Poly’s time to party?

Uniswap isn’t the only one benefiting from this relationship. In fact, Polygon saw 2.36 million unique addresses over the previous month. Polygon also appears to be a hit with gamers as seven titles clocked in more than 10,000 monthly active users. Sunflower Farmers was just one example of this, even if its hype led to imbalanced revenues.

However, when looking at Polygon’s biggest dApps by users, QuickSwap, Sunflower Farmers, and SushiSwap came far ahead of Uniswap, which had 16.6k users last week.

Should anyone object to this UNI-on…

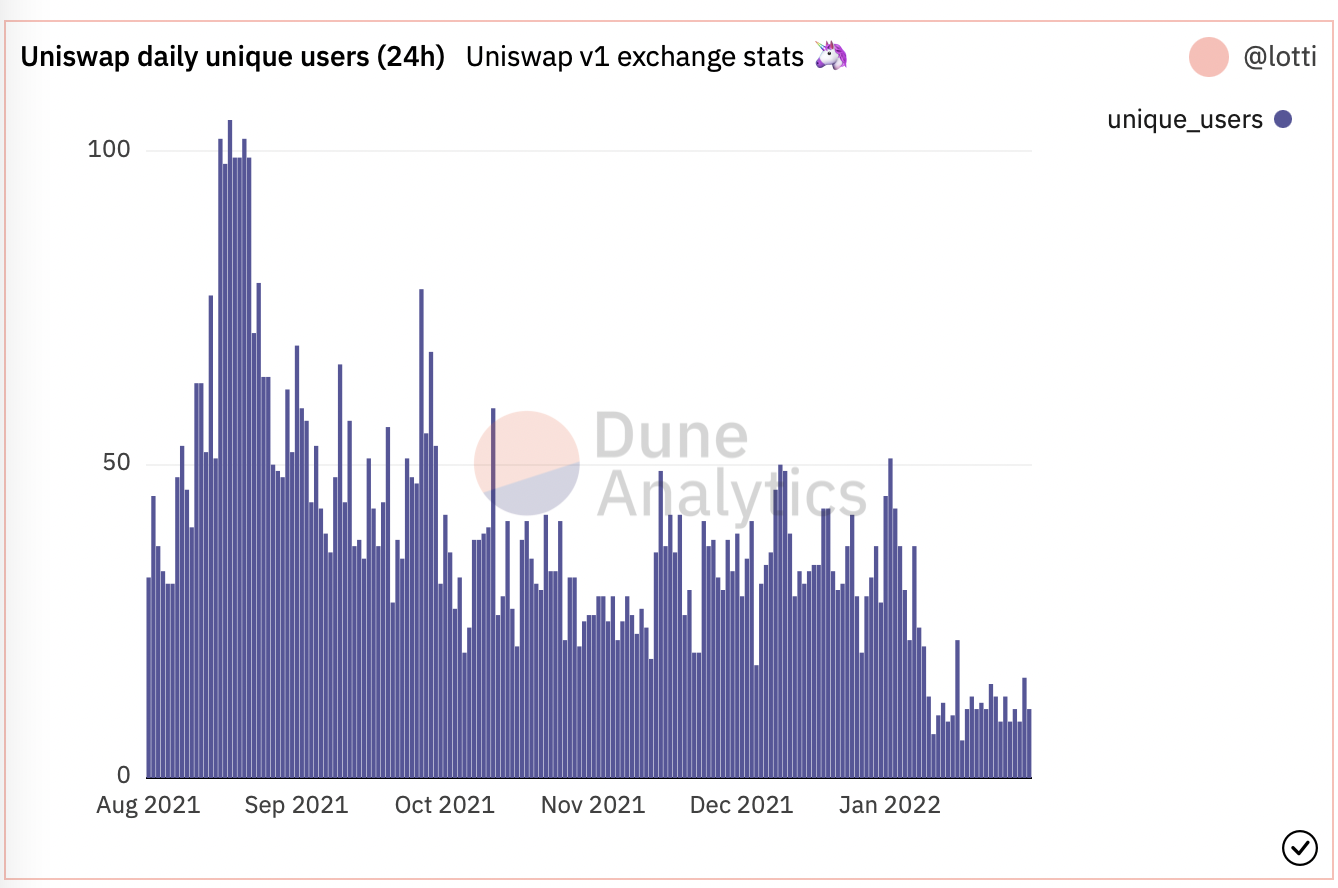

But, it’s not all roses and chocolate for Polygon and Uniswap. Individually, there’s work to be done. Uniswap’s daily unique users have been steadily falling since August 2021. There was an especially sharp drop in 2022, and 19 February only saw 16 unique users. Not exactly a winning formula.

Source: Dune Analytics

Furthermore, since 1 February, Uniswap has seen losses of around $485 million. This was apparently so serious that even Uniswap whales decided to hang back. Additionally, the network’s growth hit a 17-month low.

As a MATIC of fact…

At press time, Polygon’s MATIC was changing hands at $1.53. This was after falling by 2.55% over the last 24 hours, and by 10.81% in the last seven days.