Uniswap sees sharp decrease in fees per core developer; is UNI in trouble

- Uniswap’s fees per core developer declined from $150 to $10 million

- The fall in UNI’s price could be a reason, and the fee switch might have further impacts

The “fees per developer” indicator for Uniswap [UNI], the top decentralized exchange (DEX) platform on Ethereum according to Total Value Locked (TVL), has been falling dramatically lately. Could the number of working developers be decreasing at the same rate?

Read Uniswap’s [UNI] Price Prediction 2023-2024

Uniswap declines in fees per core developer

At the height of the bull market in 2021, Uniswap earned approximately $150 million in “fees per core developer,” according to data published by Token Terminal on 11 December.

At the peak of the bull market last year, @Uniswap had a 'fees per core developer' figure of ~$150M ?

At the moment, the figure is ~$10M

With the fee switch activated, 'revenue per core developer' could be ~10-15% of the above pic.twitter.com/jOwWctEwo0

— Token Terminal (@tokenterminal) December 11, 2022

In today’s market, however, the same statistic dropped to roughly $10 million. This meant that in a few short months, the base developer cost decreased by more than half.

The “fees per core developer” metric measures how much revenue is made per core developer of a given coin. This measure might be beneficial for investors who are interested in evaluating the financial health of a particular cryptocurrency project. Furthermore, it can also help know the amount of devotion and dedication of the development team.

A high “fees per core developer” ratio may indicate a strong and well-supported project. In contrast, a low ratio may indicate that the project was struggling to earn enough cash to fund its development crew.

Possible reasons for the decline

The devaluation of UNI was a major factor that affected Uniswap‘s decreasing developer’s fee. All cryptocurrency prices have taken a hit in the present market, and UNI was no different. Due to the fact that developer fees were originally priced in UNI, a decline in value would translate into less amount of money in USD.

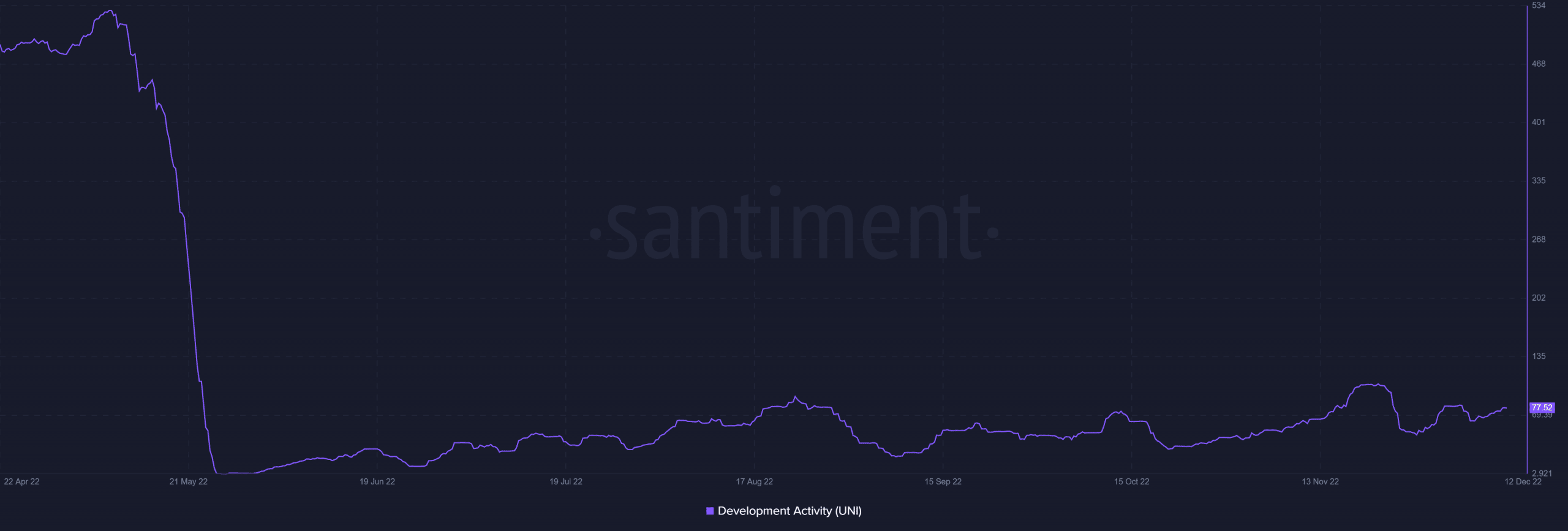

According to the Uniswap development activity metric, the project’s activity dropped significantly around May, from over 500 to under three. As of the time of writing, the development activity had reached 78.05 and was showing signs of continuing to rise.

The governing body of Uniswap will vote on whether to test a “fee switch” on a subset of pools in the next few days. In July 2022, a proposal was put up with the intention of charging fees on a limited number of Uniswap liquidity pools.

The code permits a minimum fee of 10% to be assessed against the chosen pools. Users who are directly using the protocol to swap will not be affected by the fee move. Rather, a small portion of the present payments made to liquidity providers will be kept.

If the fee switch proposal is approved and activated, the current fee for core developers might be reduced to between 10 and 15 percent of its present level.

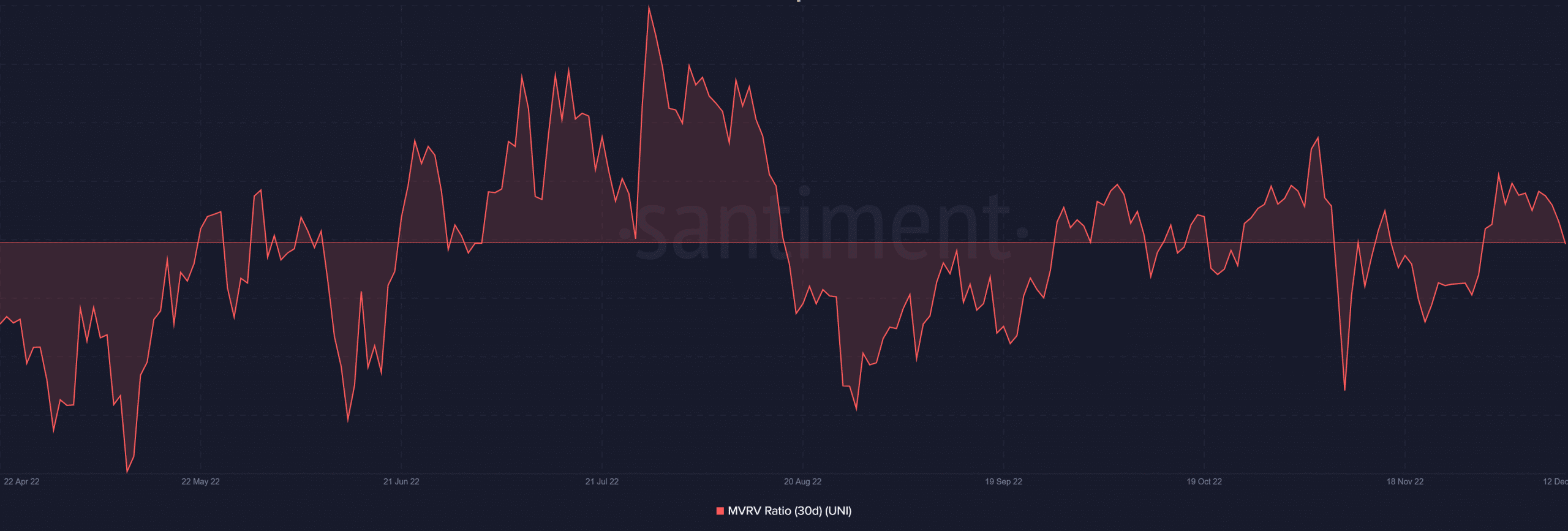

Analyzing UNI’s MVRV and active addresses

According to a review of the Market Value to Realized Value (MVRV) indicator during the last 30 days, UNI holders were at a loss at the time of writing. With the MVRV ratio at 0.2, UNI had only lost less than 1% of its value over the previous 30 days.

A review of the active address metric for the last 30 days revealed that UNI had witnessed a record number of addresses. The number peaked at over 46,000 but dropped to about 42,000 as of the time of this writing.

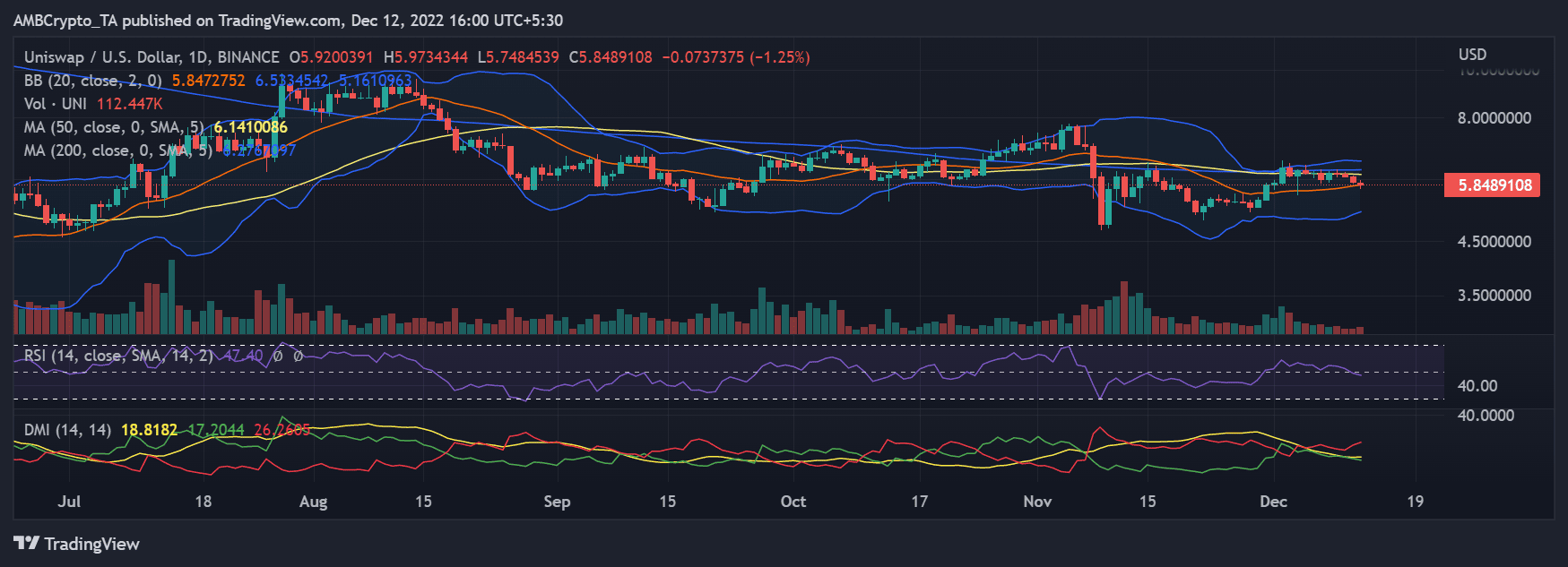

UNI in a daily timeframe

In the daily timeframe, it could be noticed that UNI’s rally, which began in late November, witnessed a pause. At the time of writing, the asset was changing hands at a price of about $5.8.

The Relative Strength Index (RSI) also indicated a change to a negative trend. As the volume indicator indicated that sellers were in control, the RSI line was below the zero line.