Uniswap shows possibility of a bearish scenario if it loses this level

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- Uniswap forms a bearish reversal pattern

- 4-hour session close below support bodes ill for buyers

Uniswap has performed well in the markets in recent weeks. It posted gains of nearly 26%, measured from the lows in late September to the swing high it made the previous day.

In doing so, it formed a bearish reversal pattern, even though it retained bullish momentum. This could change over the next few days.

Here’s AMBCrypto’s Price Prediction for Uniswap [UNI] in 2022

Bitcoin was unable to climb above $20.4k yet again. If BTC fell below $19k, it could accelerate the losses for altcoins across the market. There were two important levels that short-term Uniswap bulls would have their eyes on.

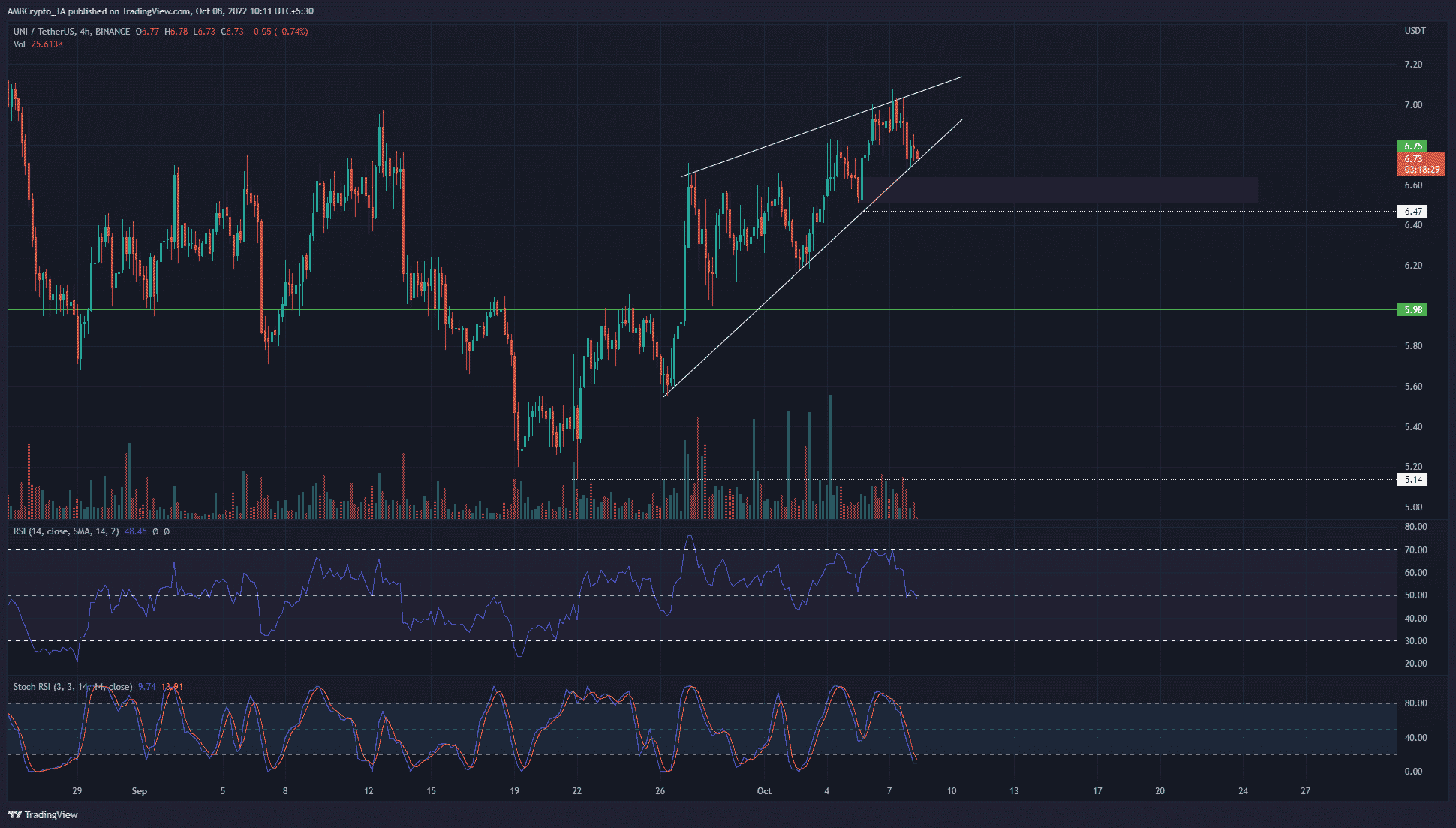

A rising wedge spotted, losses could be imminent

On the 4-hour chart, a rising wedge pattern (white) was spotted. In the past few days, UNI had managed to hold on to the $6.75 support level.

However, at the time of writing, it looked set to slip below. The wedge’s lower trendline support as well as the horizontal support at $6.75 could be broken in the coming hours.

The RSI stood at 48.46 at press time. If it dropped below 45 in the next few hours, the indication would be a flip in momentum in favor of the sellers. The Stochastic RSI was at oversold territory as well.

In the event that the $6.75 was lost as support, a bearish scenario can develop if the price further fell below the $6.47 level. This would flip the 4-hour structure to bearish. The highlighted region around $6.6 could serve as a resistance zone and facilitate a drop for UNI as far south as $6-$6.2.

On the other hand, the $6.5-$6.6 has been a significant level on lower timeframes. If Bitcoin can defend the $19k region over the next few hours and begin to reverse, UNI could see a bounce from $6.6 as well.

Funding rate swerves toward neutral

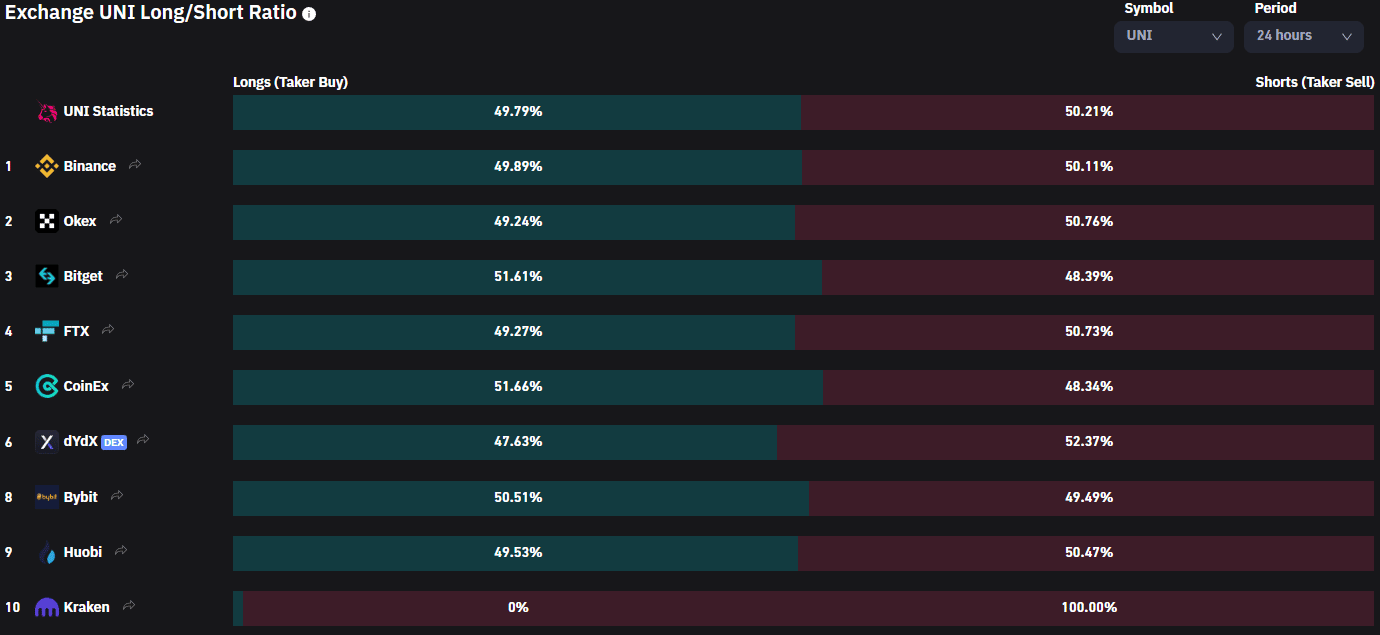

Source: Coinglass

The Long/Short ratio on Coinglass showed a very slight advantage to the sellers on the futures market. A look into the funding rate page showed that Uniswap has been bullish in the past 24 hours as it had a positive funding rate.

However, this fact has changed in the past few hours as the lower timeframe market participants flipped their bias to bearish.

A move below $6.6 could spark a fall to $6.2, especially if Bitcoin continued to fall.

A 4-hour session close below $6.47 would flip the structure to bearish. Traders can look for short entries near $6.5-$6.6. Alternatively, a surge back above $7 and its subsequent retest as support could offer a buying opportunity.

![Solana [SOL]](https://ambcrypto.com/wp-content/uploads/2025/08/Solana-SOL-1-400x240.webp)