Uniswap [UNI] rejected at bearish order block, bulls fight to defend $5.2 level

![Uniswap [UNI] rejected at bearish order block, bulls fight to defend $5.2 level](https://ambcrypto.com/wp-content/uploads/2023/05/AMBCrypto_BullsVBears_UNI_1200x900.png.webp)

- Bulls unable to push past resistance at Value Area Low.

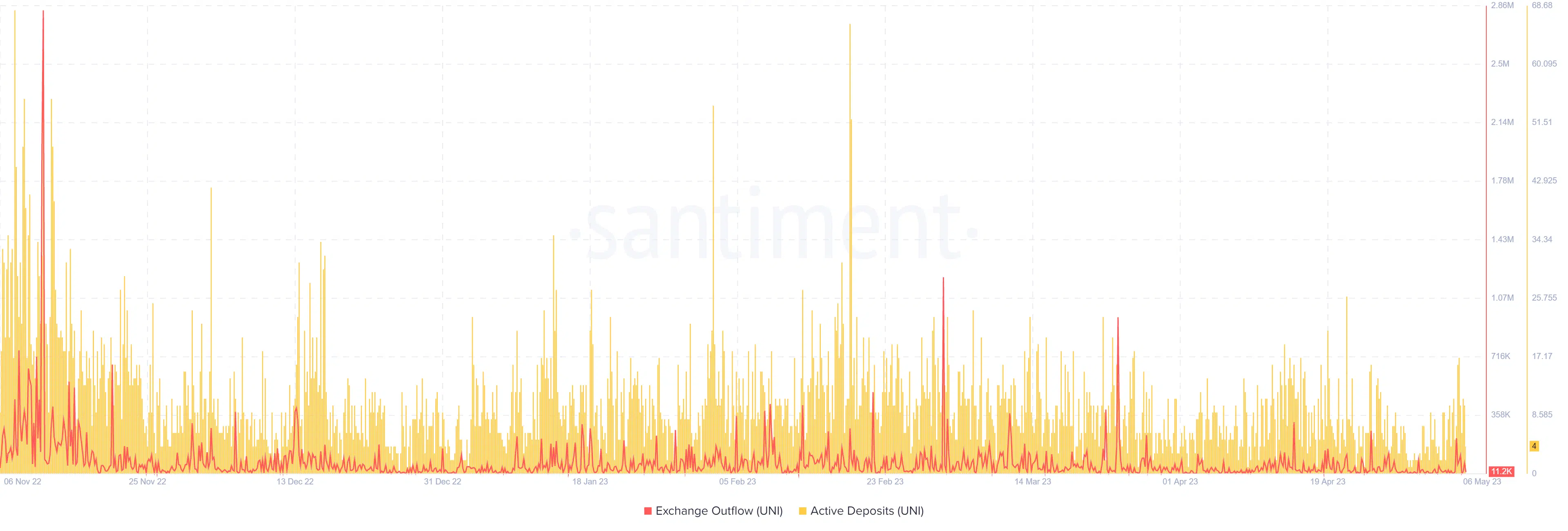

- Active deposits on exchanges increased to suggest more selling pressure.

Uniswap [UNI] posted gains of 3.1% within the past 24 hours to signal a possible bullish reversal. However, this did little to sway the overall market sentiment, as UNI’s structure at press time remained bearish.

Read Uniswap [UNI] Price Prediction 2023-24

UNI’s short-term recovery might be boosted with Bitcoin [BTC] holding onto the $29k price area.

Bullish recovery stalled

UNI’s price has been on the decline since 19 April. The bearish order block at the $6.3 price area halted the bullish momentum with price crashing below the $5.7 support level.

Bulls were able to stall the bearish momentum with a rally from the $5.2 support level. However, the bullish rally failed to push past the $5.6 – $5.7 area.

A look at the Visible Range Volume Profile tool on the four-hour timeframe showed that the Value Area High (VAH) and Value Area Low (VAL) were at $6.4 and $5.6, respectively. Buyers met resistance at the VAL ($5.6) with a bearish order block under it serving as the catalyst for price rejection.

The RSI crept above the neutral 50 and the OBV recorded a slight uptick. However, both experienced a sharp decline afterward, which suggested that the bullish rally was waning.

A four-hour candle close above the VAL could offer UNI bulls further buying opportunities. Alternatively, bearish momentum could force a retest of the $5.2 support level.

Is your portfolio green? Check UNI Profit Calculator

Market sentiment aligned with sellers

Data from Santiment over the past 24 hours showed an increase in active deposits while exchange outflow was low. This suggested the presence of active sellers still looking to short UNI.

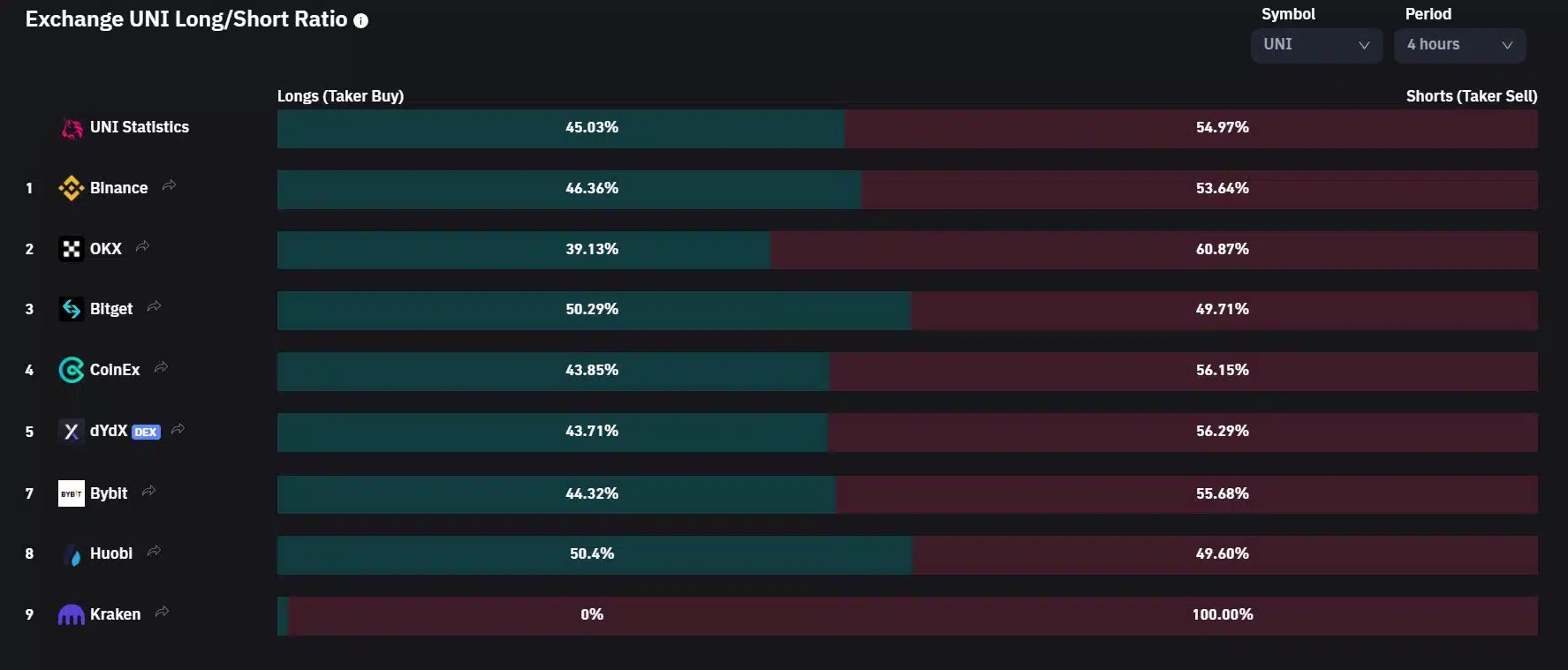

This sentiment was corroborated by the long/short ratio data from Coinglass, with shorts retaining a 54.9% dominance. While the overall market sentiment remained bearish, bulls can look to initiate another price rally with a daily candle close above $5.6.