USDC outperforms USDT? Key insights on Stablecoin market domination

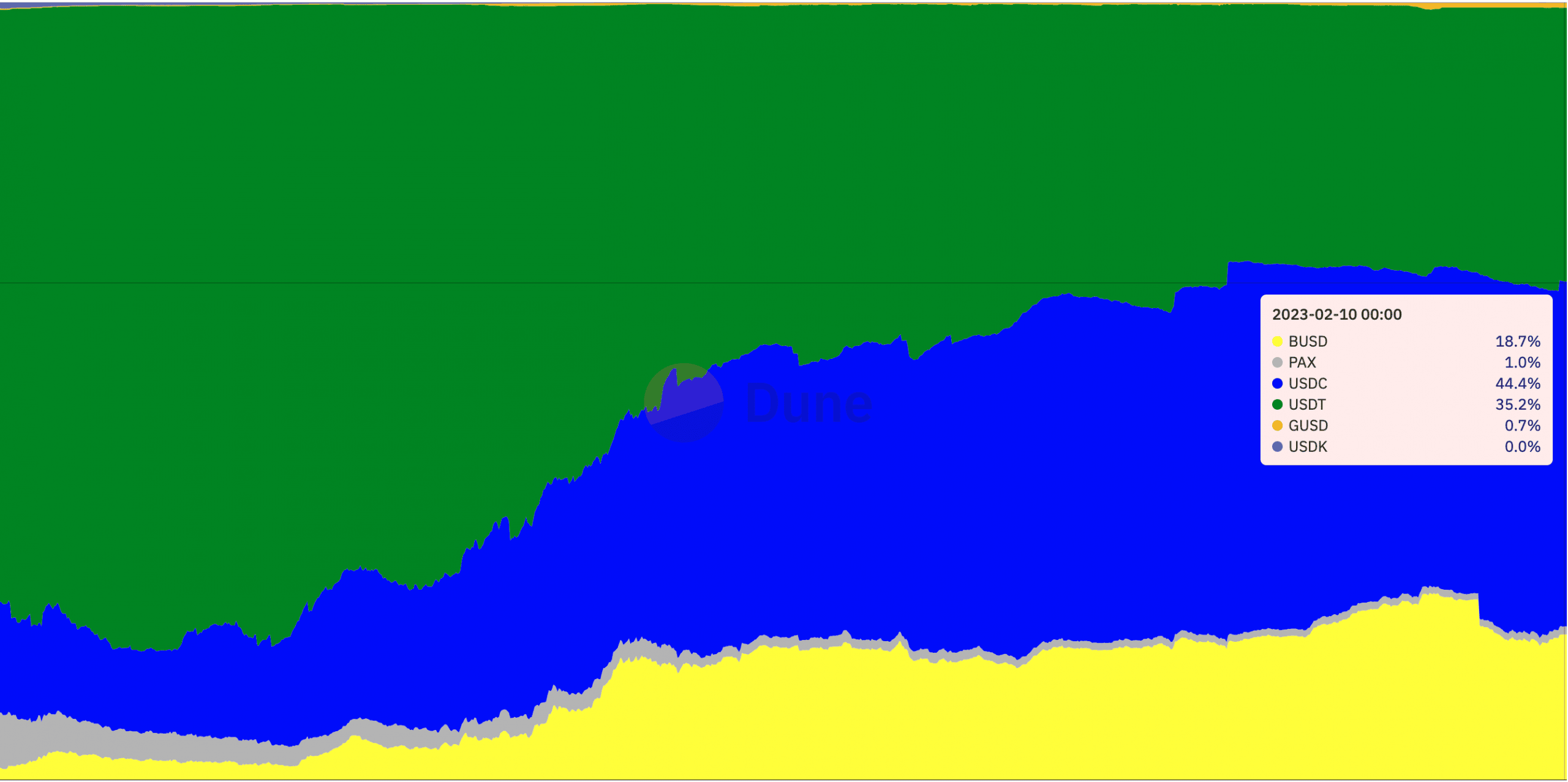

- USDC captures 44% of the stablecoin market share, outperforming USDT.

- Coinbase users convert large amounts of USDC into fiat.

Stablecoins have been gaining popularity in recent years, as they offer exposure to cryptocurrency without the volatility that is typically associated with it.

While Tether (USDT) has long been the dominant stablecoin in terms of market cap, USDC has been gaining ground in other areas.

According to data provided by Dune Analytics, USDC’s market share grew considerably over the past year. Over time, it ended up outperforming other stablecoins and managed to attain the top spot.

At press time, USDC captured 44.4% of the overall stablecoin market. USDT and BUSD captured 35.2% and 18.7%, respectively.

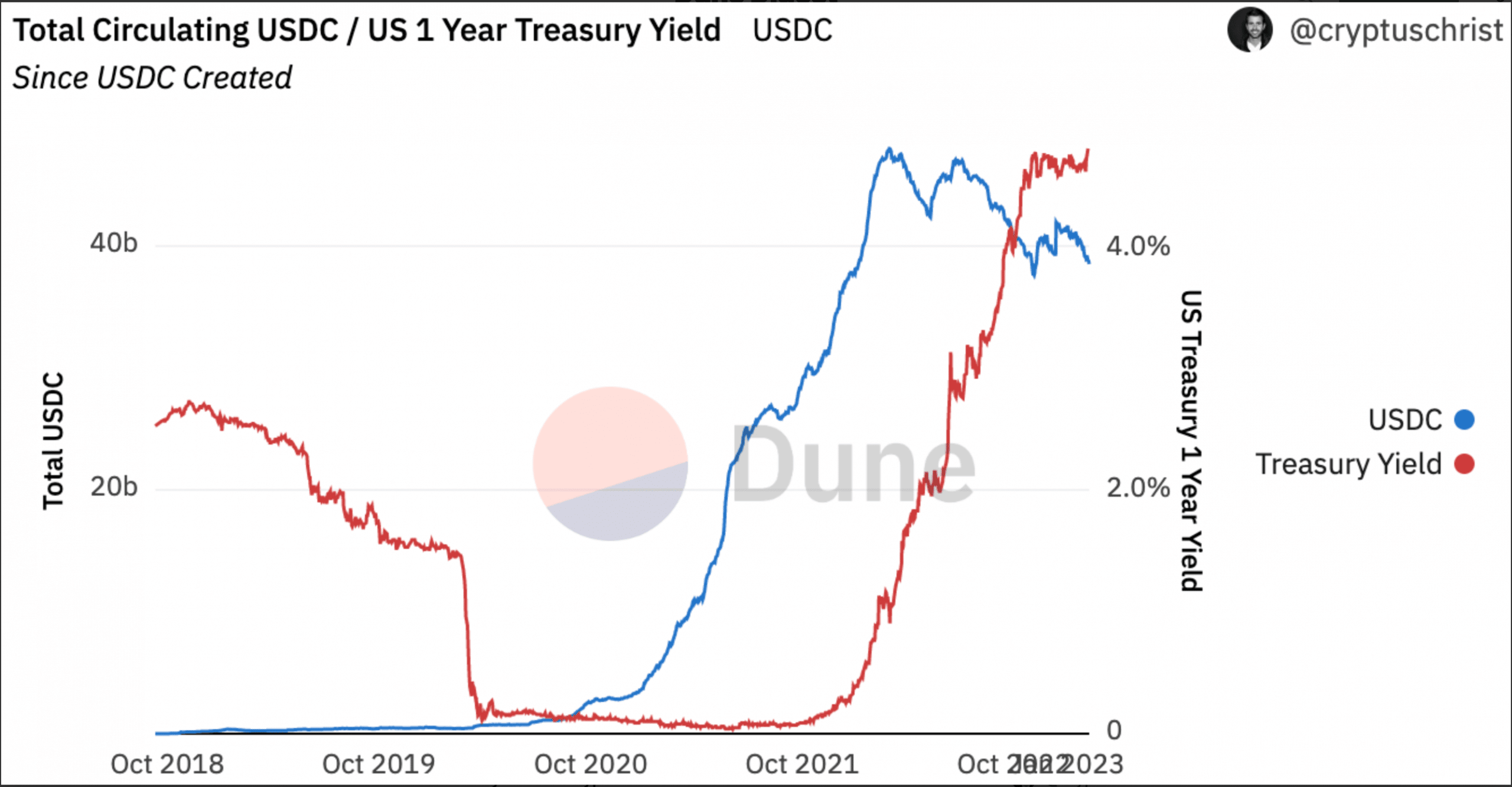

One of the reasons behind USDC witnessing growth could be its increasing yield. USDC’s yield growth paralleled that of the US 1-year treasury yield.

Furthermore, the growing number of USDC holders played an important role in helping the stablecoin capture a huge portion of the market.

According to Dune Analytics data, the number of USDC holders crossed more than 1.5 million over the past few months.

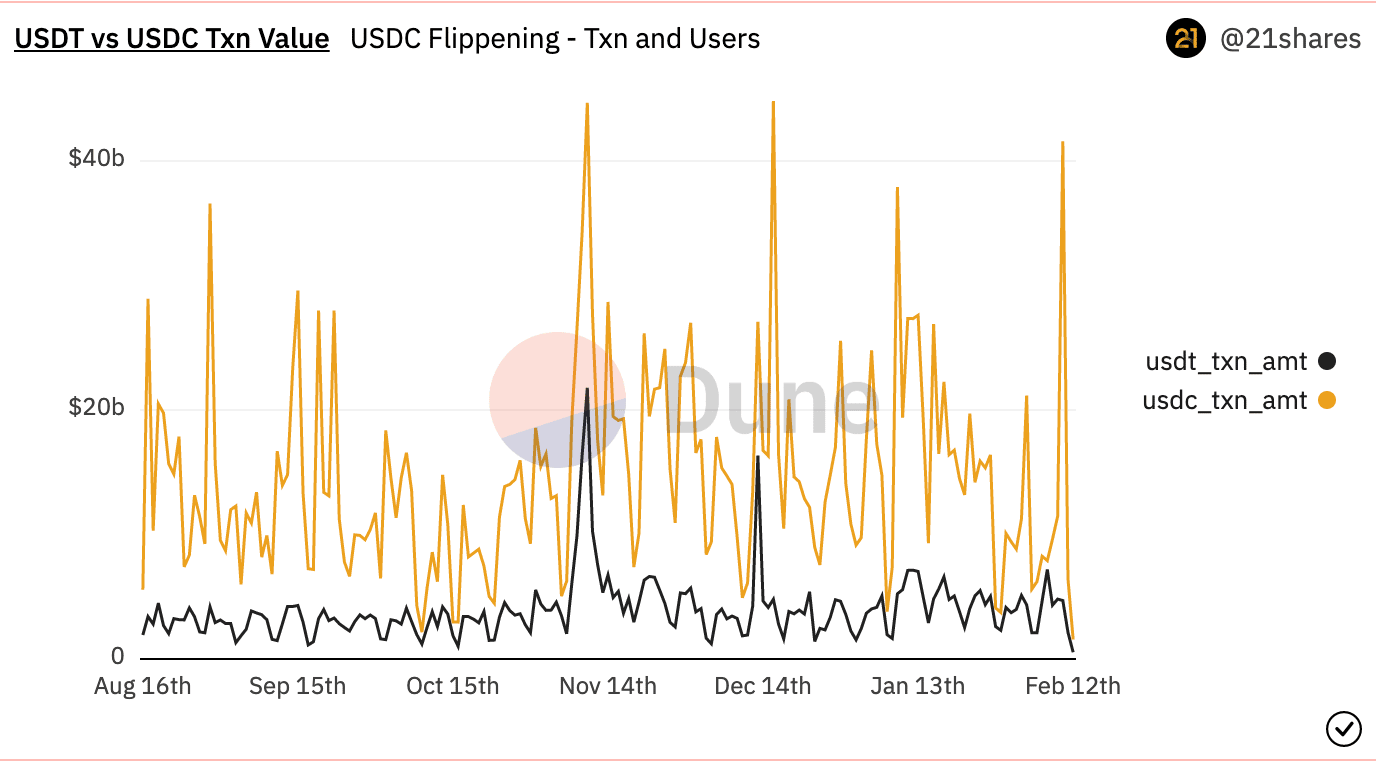

Subsequently, the number of transactions being made on USDC also increased compared to USDT. This suggested that more people were using USDC to transact, and it was becoming the preferred stablecoin for certain use cases.

Some setbacks

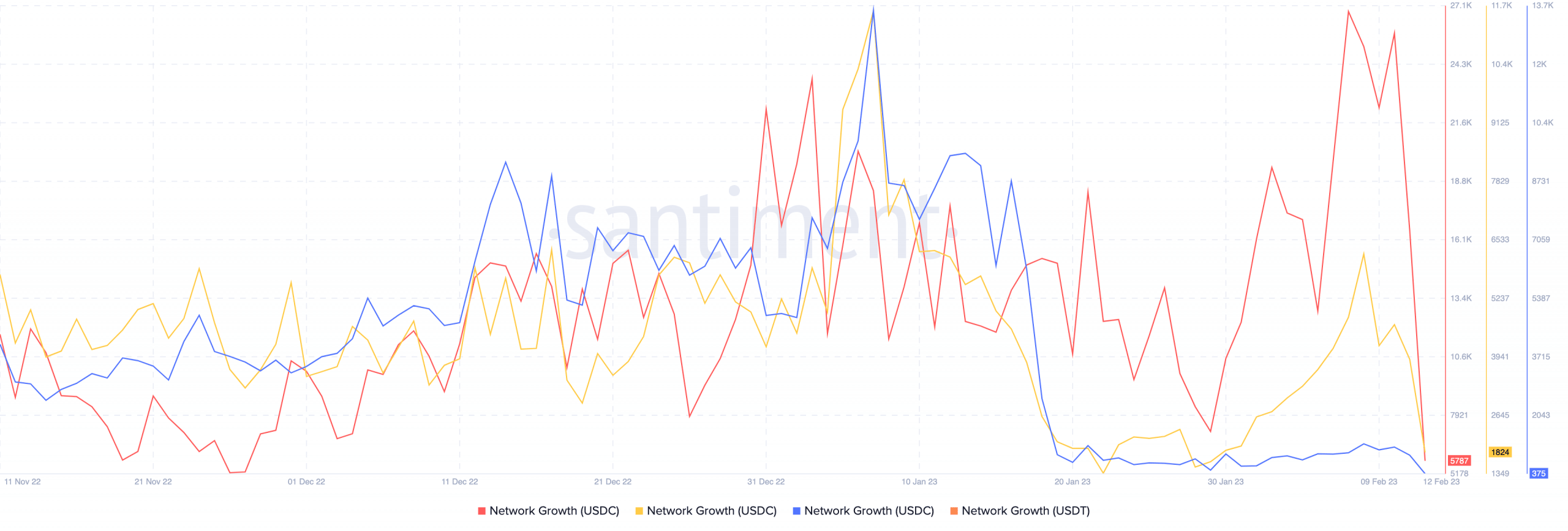

However, the network growth of USDC declined significantly over multiple networks. This meant that the number of new addresses using USDC fell considerably. This could be due to competition from other stablecoins, or simply due to saturation in the market.

Another negative factor that affected the stablecoin was the behavior of multiple addresses on Coinbase. According to recent developments, about $5 billion worth of USDC was converted into fiat over the last few days.

This panic selling could be due to the actions of U.S. regulators. Recently, the Securities and Exchange Commission charged cryptocurrency exchange platform Kraken for its crypto staking-as-a-service product.

However, this scenario did not impact USDC’s current dominance, although there may be some repercussions for the stablecoin in the future.