USDC’s loss was CEXs’ gain? Well, the real story is…

- CEXs registered a massive surge in usage and balance after USDC’s de-peg

- Sustained interest in various CEX tokens also recorded a hike

Despite the adverse effects of the USDC situation on various aspects of the cryptocurrency sector, centralized exchanges were able to reap significant gains during this time.

Realistic or not, here’s BNB market cap in BTC’s terms

CEXs reap rewards

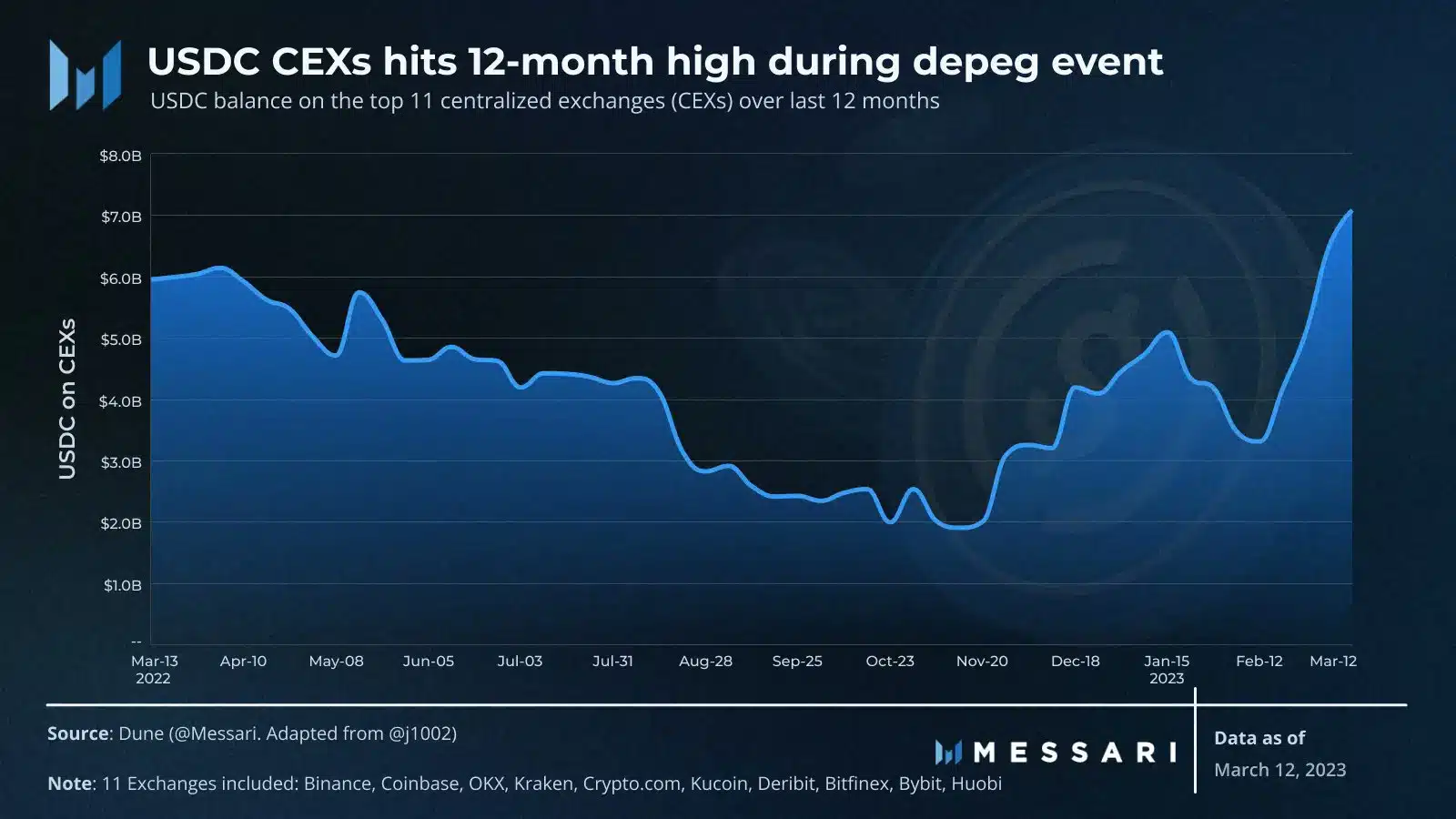

According to data provided by Messari, activity on CEXs hit a 12-month high due to USDC’s de-pegging event. Exchanges such as Binance, OKX, and Kraken all recorded an uptick in activity over this period.

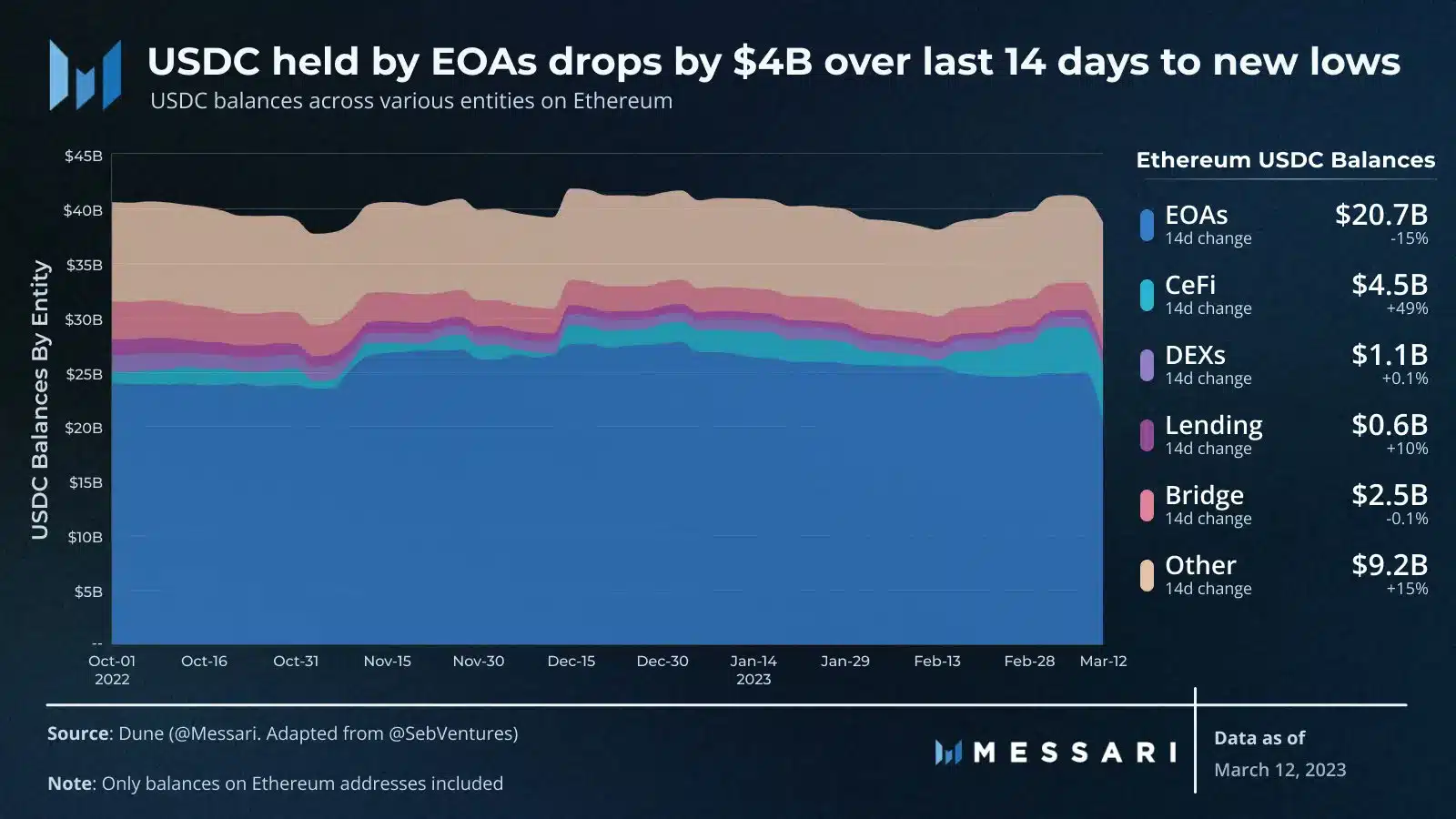

One of the reasons for the high activity was the drop in Externally Owned Addresses on Ethereum. Externally Owned Addresses (EOAs) are user-controlled accounts on the Ethereum blockchain that are owned and controlled by individual users. Unlike contract accounts, which are controlled by code, EOAs are controlled by their private keys and can only be accessed by their respective owners.

Most of the USDC ecosystem was integrated with the Ethereum blockchain. As the USDC stablecoin deviated from its peg, the EOAs dropped by $4 billion in value. However, centralized exchanges (CEXs) managed to accommodate this excess supply and registered a significant 49% hike in their balance as a result.

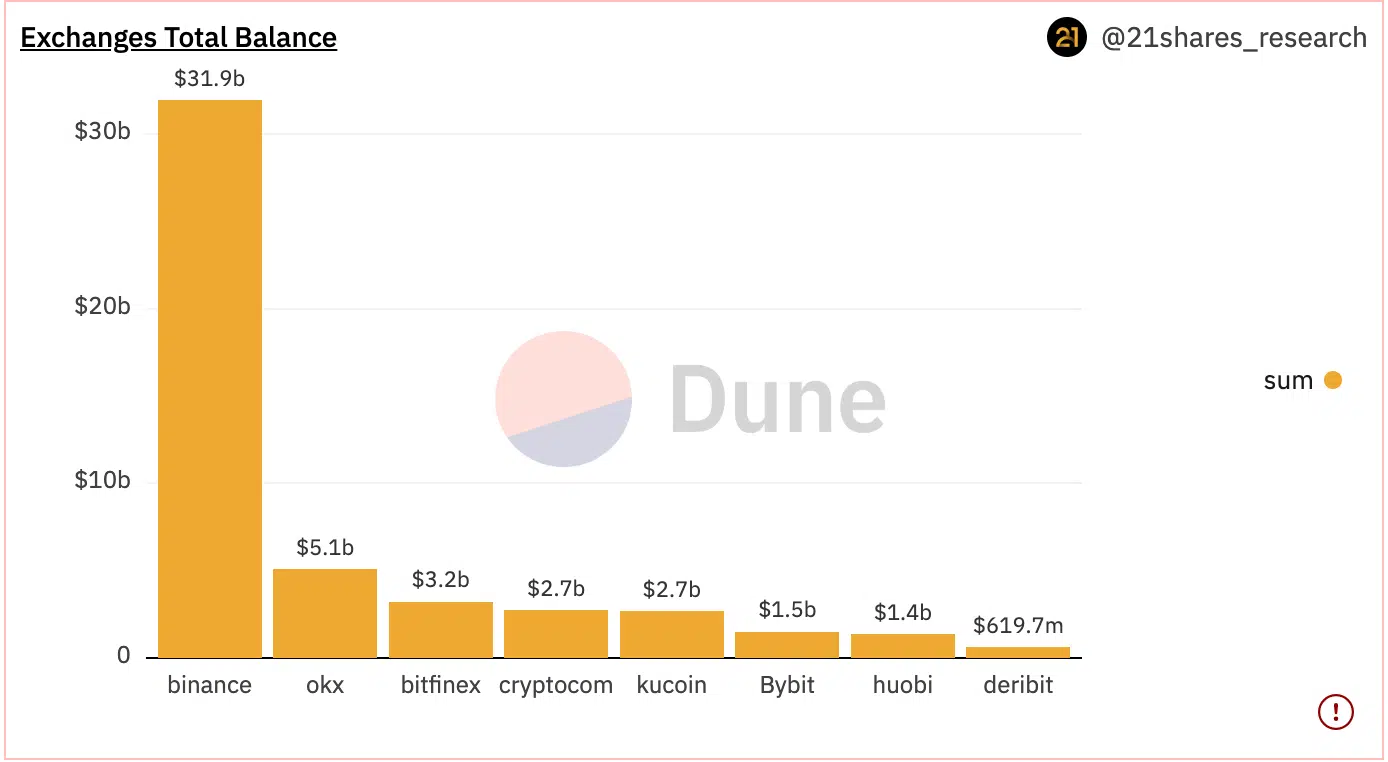

At the time of writing, Binance was leading in terms of exchange balance, with $31.9 billion on its platform. In comparison, OKX and Bitfinex came in second and third place with $5.1 billion and $3.2 billion, respectively.

Momentum on the way?

Following the FTX incident, numerous long-term users found it difficult to have faith in other centralized exchanges. Overcoming this mistrust was a major challenge for these exchanges. Nonetheless, the implementation of proof of reserves helped to establish some degree of trust and data transparency for customers using centralized exchanges.

Read OKB’s Price Prediction 2023-2024

Binance, KuCoin, and OKX have all provided proof of reserves for their customers to see. Proof of reserves showcase the overall percentage distribution of all the assets that have been stored by these exchanges. A majority of these exchanges currently have high amounts of ETH and USDT held as reserves.

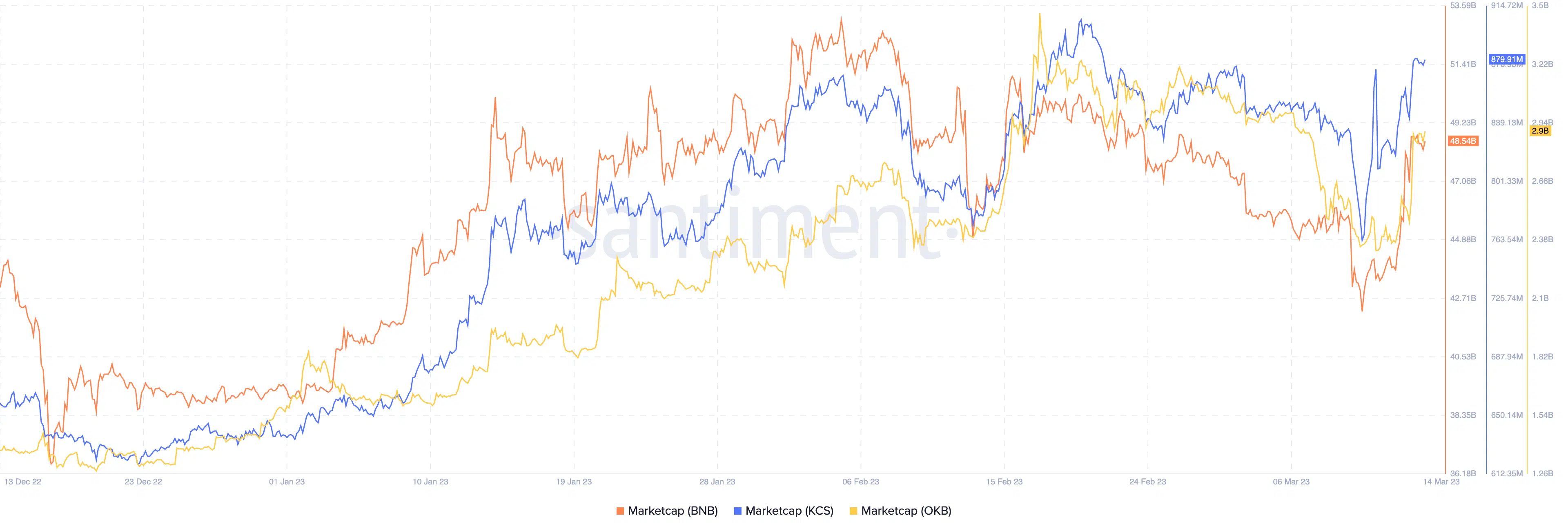

The fall of USDC, coupled with the trust gained by CEXs by showing their reserves, helped generate interest in their tokens as well. In fact, over the last few days, the market caps of BNB, OKB, and KCS have all increased.