USDD’s growth in Q2 2023 highlights this about the state of the stabelcoin

- USDD fairs well despite a rough start thanks to Tron’s growth.

- USDD managed to maintain over 130,000 users over the last quarter.

We have been evaluating Tron from a bird’s eye view but have you ever wondered what has been happening under the hood? Perhaps a look at USDD, a fast-paced stablecoin native to Tron, may offer some insights.

USDD achieved significant growth in the last 12 months. This was a noteworthy observation considering that it survived some rough terrain slightly over a year ago. The UST collapse in 2022 sowed a dark cloud of uncertainty and distrust over the crypto market. As a result, we saw Tron commit to more investments aimed at overcollateralizing USDD to secure its peg.

But just how far has it grown since the shocking events of 2022? Messari recently released an analysis evaluating USDD’s performance in Q2 2023. The analysis revealed that the stablecoin enjoyed lower volatility as well as improved stability. This allowed it to maintain its dollar peg.

1/ How did @usddio perform in Q2 of 2023?

During the second quarter, the @trondao-native stablecoin showed improved stability and returned to its peg, resulting in reduced volatility while trading.@john_tv_locke explores key insights and developments below. ? pic.twitter.com/xg4kSke2sk

— Messari (@MessariCrypto) July 18, 2023

Some of the key takeaways from the report include the announcement that USDD maintained over 130,000 holders during the quarter. However, this marked a significant quarterly decline since its inception.

What has been driving USDD utility?

According to the Messari analysis, DeFi protocols, especially lending protocols account for over 40% of USDD utility within the Tron ecosystem. The report revealed that SunCurve and SunSwap, two of the top DEXes on Tron controlled roughly 10% of circulating USDD. The amount of borrowed liquidity in Q2 amounted to 5 million USDD while the liquidity deposited to lending protocols amounted to 220 million.

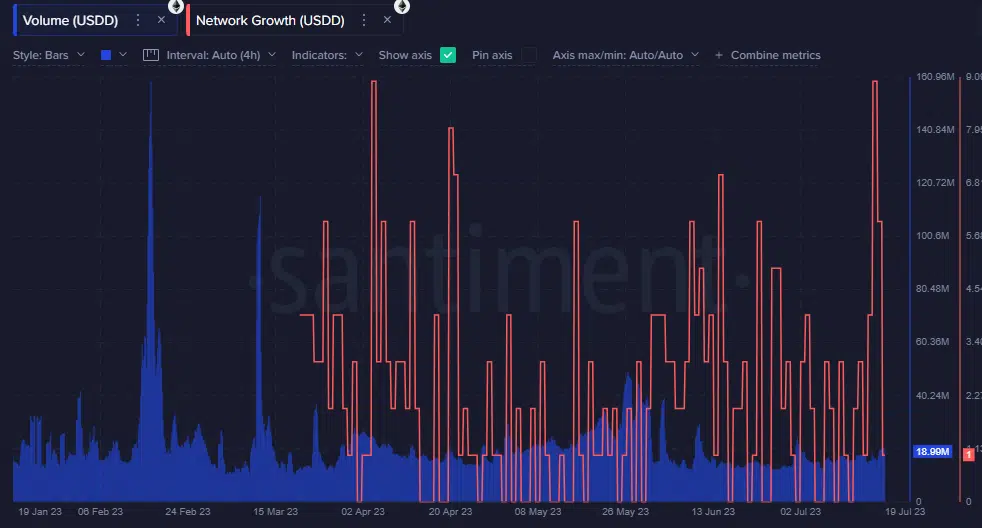

USDD managed to maintain healthy on-chain performance during the last six months. For example, its volume on the Ethereum network soared as high as 159.37 million USDD at its peak in February. USDD volume on Ethereum had a record low of just above 10 million. Its network growth maintained healthy activity during the same period.

As for the situation on the BNB chain, volume peaked just below 50 million USDD during the same six-month duration. Its lowest volume during the same period fell to roughly 11.0 million USDD. Meanwhile, network growth has been more pronounced during the last four weeks compared to the previous months since the start of 2023.

In conclusion, it is clear that USDD owes its rapid growth to the Tron network’s robust growth during the last few months. It will likely continue on the same trajectory as the Tron network expands.

Nevertheless, 2022 stablecoin woes have certainly left a mark on the market. Can Tron avoid a repeat of what we saw during the UST crash? Time will tell.