USDT, Binance, and whale transactions- Making sense of the development

If you were to host a crypto Met Gala, the theme this season would probably be ‘FUD.’ After all, looking at the year ending in March, the Consumer Price Index increased by 8.5%. This, along with supply chain issues due to the Russia-Ukraine War and sanctions, have triggered an increase in the price of basic groceries and fuel across the globe.

It was around then that one of the world’s richest men – Binance CEO Changpeng Zhao – posted a rather ominous tweet.

When the titanic sinks, little floats near it get dragged down too. But the floats will eventually come back up, if they are untethered.

— CZ ? Binance (@cz_binance) April 12, 2022

Loose lips sink ships

Well, there’s no need to be coy. Many decided that the reference to “untethered” floats was Zhao’s way of taking a hit at the stablecoin Tether [USDT]. With FUD building up around inflation and the purchasing power of the [fiat] dollar, it makes sense that some investors might be worried about the value of their stablecoin investments.

Let’s take a look at what the metrics have to say.

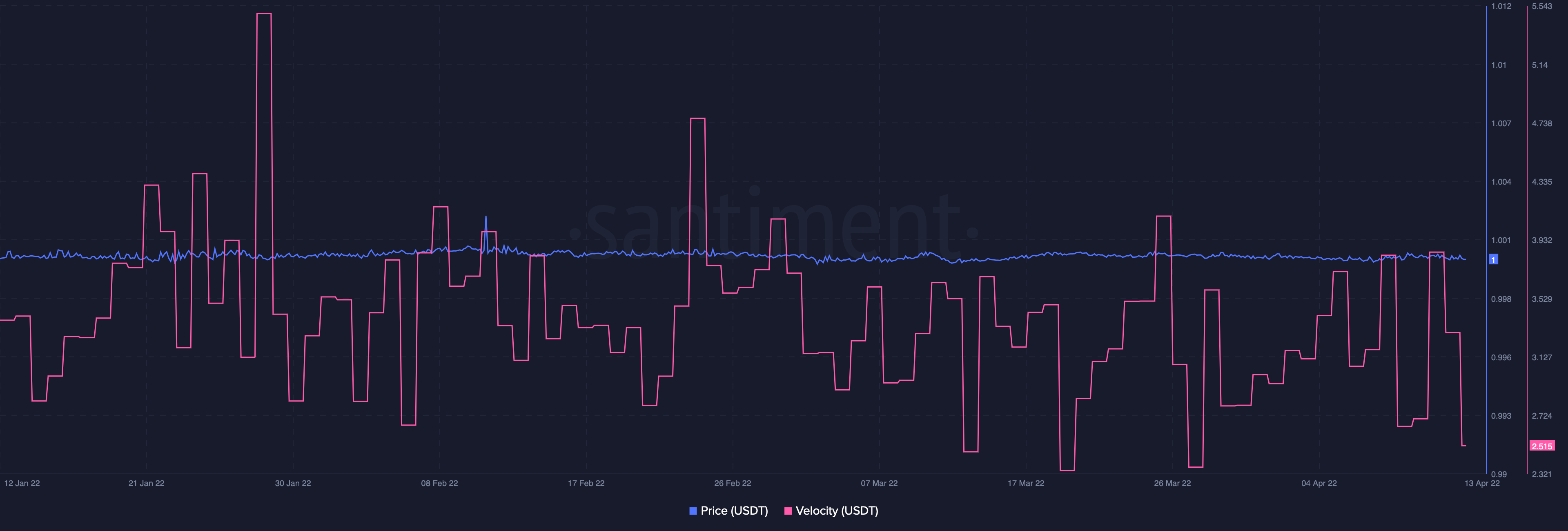

Around the time Zhao posted his tweet, USDT velocity was in the midst of a spike and was over 3.0. However, later on 12 April, it plunged down to 2.515. This shows a drop-off in activity. However, it could also be related to market conditions, such as crypto traders selling their alts.

Source: Santiment

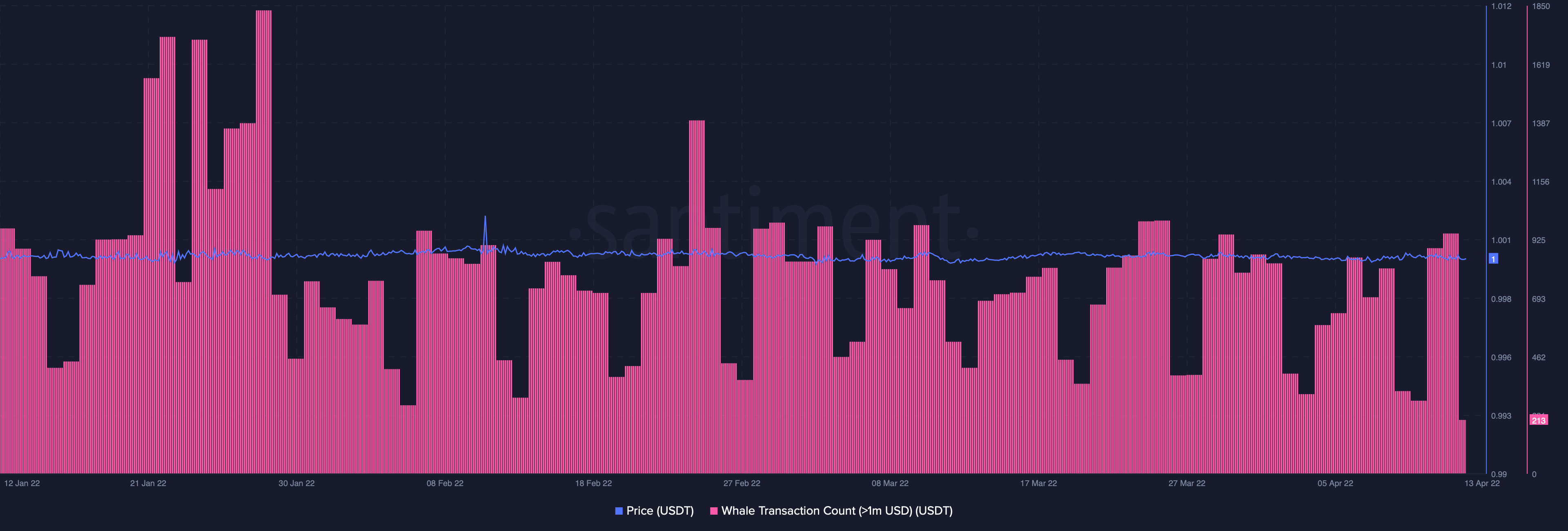

Despite what velocity says, however, crypto whale transactions worth more than $1 million have been spiking since about 10 April. However, it remains to be seen whether this will continue in the coming days or taper off due to inflation FUD.

Source: Santiment

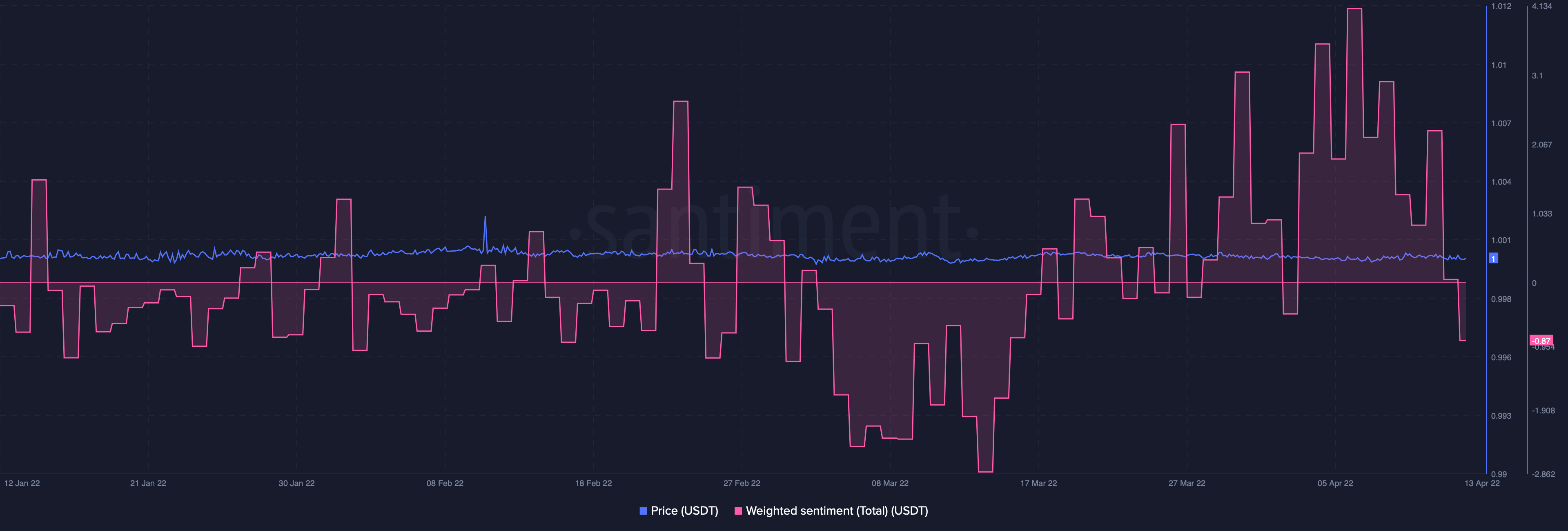

That said, the recent news updates have been hard on stablecoin users. So, what does the data signal here? According to Santiment, weighted sentiment has been mostly above zero since mid-March 2022. However, around 12 April, this metric plunged into negative territory and was -0.87 at the time of writing.

Source: Santiment

Draw me like one of your alt coins

These findings bring us to the question of how investors will deal with the dollar and inflation FUD in the future. Will Zhao’s tweet prompt traders to use stablecoins backed by assets other than dollars, such as TerraUSD [UST]? Or will investors gravitate to alts instead?

However, this in no way means Tether’s reign is over. In fact, the Luna Foundation Guard – the non-profit linked to Terra [LUNA] – published its reserve breakdown. Out of a total of $2.26 billion in crypto assets, $151.33 million was held in USDT.