If you’re a VET holder, watch out for VeChain in Europe

- VeChain bets on venture capital to drive growth and development in Europe.

- VET bulls finally get a chance to flex as sell pressure dies down.

The amount of venture capital flowing into blockchain projects has been gaining traction in the European market. The VeChain network might be among the top networks to capitalize on available opportunities.

Read Vechain’s [VET] price prediction 2023-24

Venture capital entering the blockchain segment is a good indicator that institutional investors are confident enough to explore growth opportunities. VeChain’s latest update revealed that the network was optimistic about attracting venture capital in the European market.

It highlighted a favorable regulatory environment as one of the key factors encouraging growing VC participation.

Our position as a leading #blockchain platform based in Europe's regulatory environment ensures #vechain will greatly benefit from the enhanced clarity of established #crypto rules.

We're proud and excited to be playing a critical role in building tomorrow's economy.… https://t.co/WMGvC9s6pc

— vechain (@vechainofficial) May 17, 2023

The VeChain network further hoped to secure a sizable piece of the venture capital pie since it was one of the top blockchains in the European region. The network’s statement was in response to a recent Orion M. Depp analysis assessing the amount of VC investments in crypto for the last four quarters.

The analysis also revealed that venture capital funding flowing into European blockchain projects grew substantially between Q1 22 and Q1 23.

What does venture capital investment mean for VET?

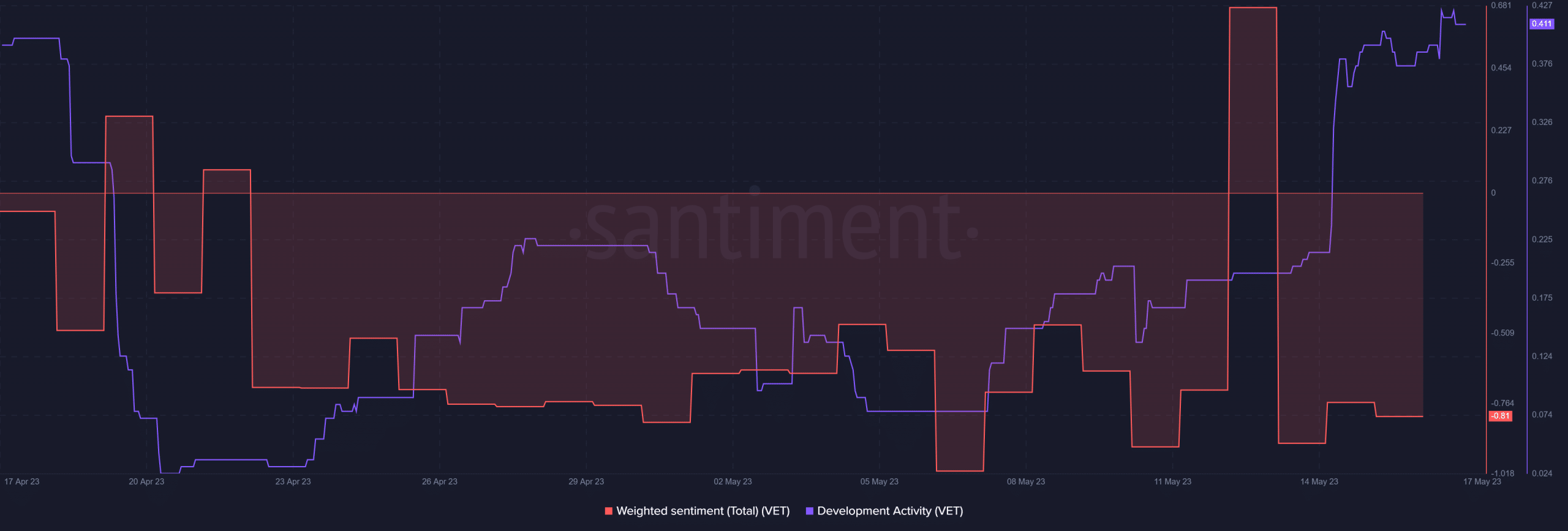

Traders would likely gain more confidence in holding VeChain’s native crypto VET if the network attracted robust VC inflows. Such investments would likely encourage more network development. Speaking of, VeChain experienced a strong resurgence of development activity in the last three weeks after a previous slowdown.

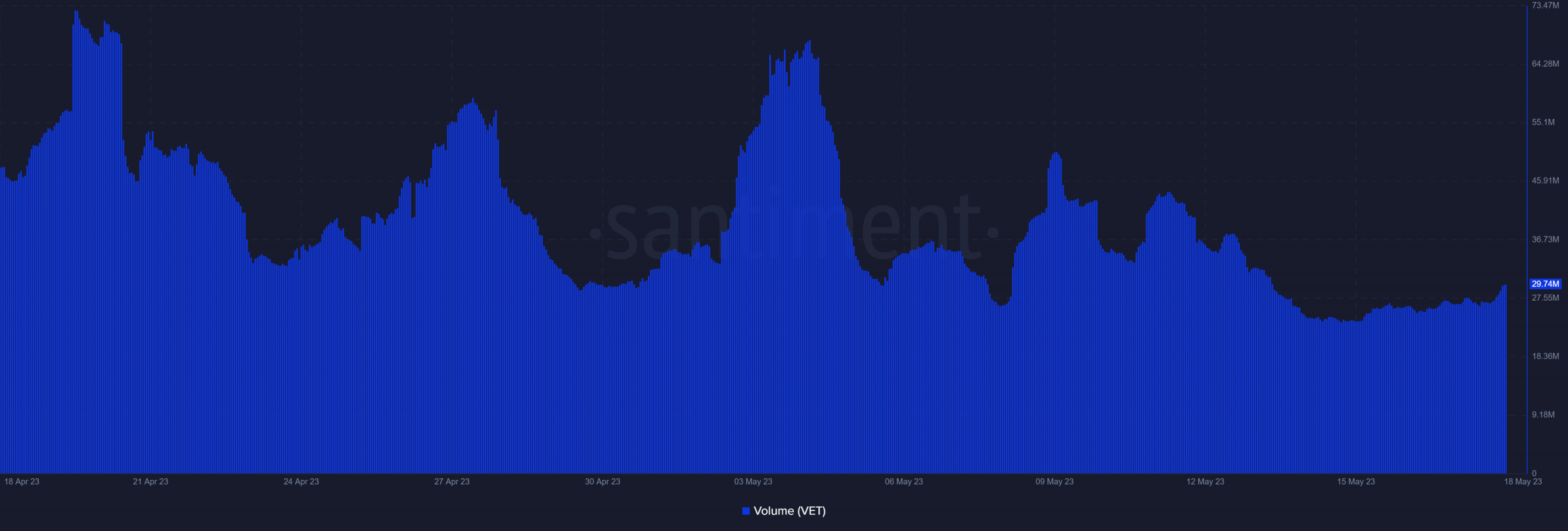

VeChain’s development activity just soared to its highest level in the last four weeks. Despite this, investor sentiment still remained low. The same could be said about VET’s on-chain volume which was still struggling to recover from its lowest monthly levels.

Perhaps the question that most traders are wondering about is whether VeChain’s unique position to leverage VCs may aid VET’s price action. Well, the short-term possibility was that the statement may support more investor confidence and trigger some demand. That may already be in place considering the cryptocurrency’s latest performance.

Is your portfolio green? Check out the VeChain Profit Calculator

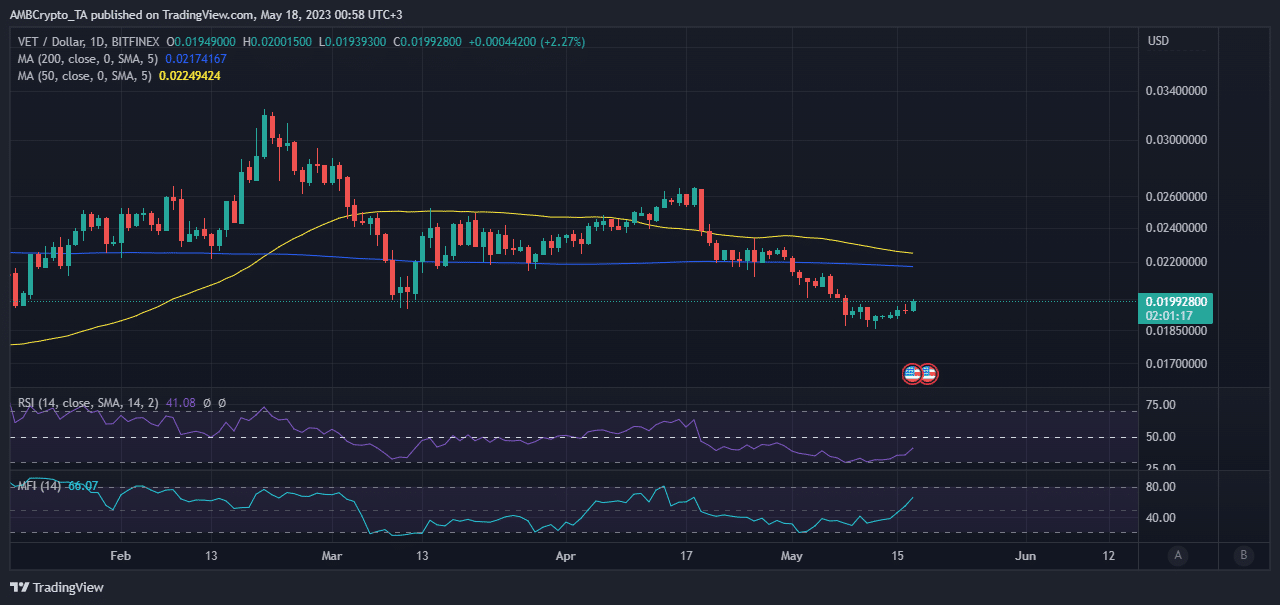

VET bears have been dominating since around 18 April, facilitating a 29% pullback. However, they lost momentum a week ago, allowing for some upside. Its $0.019 press time price represented a 7.29% upside from its current three-month low.

VET’s MFI didn’t indicate that there had been significant accumulation at recent lows. Nevertheless, the subsequent upside has been limited, perhaps due to the lack of strong volumes. Despite this outcome, VET’s long-term outlook might have just gotten a lot better with the prospects of VC funding.