VeChain [VET] fixated on the $0.02695 target – Is it feasible?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

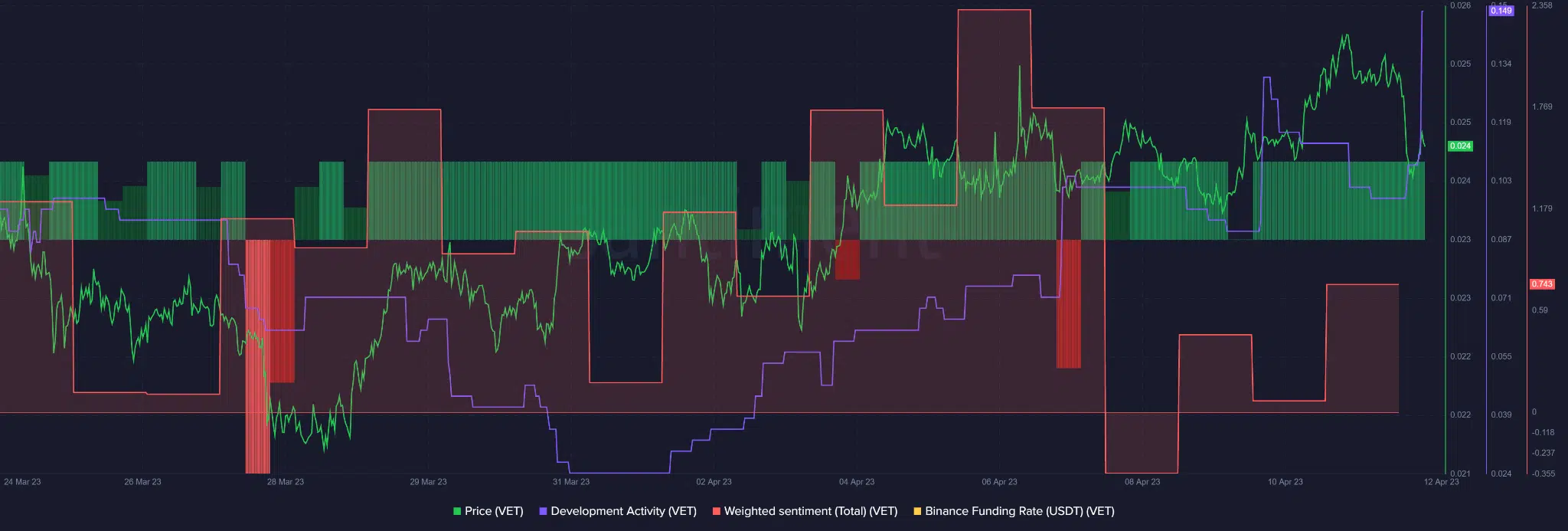

VeChain [VET] has steadily appreciated since the end of March – chalking an ascending channel. It rose from $0.01938 but hit the stiff resistance level of $0.02496. The above resistance level has blocked VET’s further uptrend momentum in the second half of March.

Read VeChain [VET] Price Prediction 2023-24

Bitcoin [BTC] broke out and crossed $30K. Despite the expected US Consumer Price Index (CPI) data on 12 April, BTC continued consolidating narrowly above $30K – reinforcing the overall bullish sentiment. Any surge above $30K could set VET to overcome its key obstacle.

Can bulls clear the $0.02496 obstacle?

At press time, VET had dropped to the ascending channel’s lower boundary of $0.02393. The above level doubles as a confluence area with the $.02379 support. As such, sellers may be cautious at this confluence area as bulls could gain entry into the market, especially if BTC surges beyond $30K.

If BTC maintains above $30K regardless of the US CPI data highlights, VET could clear the hurdle at $0.02496. A close above $0.02496 and an uptrend confirmation may set VET to target at $0.02695 resistance level or the range of $0.02695 – $0.02870.

A session close below the confluence area, particularly $0.02379, will invalidate the above bullish thesis. Such a move could attract more selling pressure, especially if BTC drops below $30K. The $0.02200 support could slow the drop.

The Relative Strength Index (RSI) has been predominantly above the 50-mark – signaling increased buying pressure in the past few days. However, a cross below the 50 mark could confirm sellers’ leverage. Moreover, the Average Directional Index (ADX) chalked a ‘peak,’ which suggested that the uptrend momentum eased.

Funding rate and sentiment improved

How much is 1,10,100 VETs worth today?

VeChain’s development activity has been rising since the beginning of April. At press time, it sharply increased – an indication of a consistent building. The trend can boost investor confidence in VET, as shown by the improved weighted sentiment.

In addition, the funding rates have remained positive in the past few days – a bullish sentiment that could favor bulls. However, the recovery and subsequent uptrend may be delayed if BTC drops below $30K.